It's probably time to look back at the last month and the launch of my own ETF.

This first monthly update is still boring, but should provide the basis for the following ones.

Benchmark comparison with the MSCI World looks positive for the few stocks:

As only a few stocks are currently included, and $AMZN (+3.08%) The MSCI World is the largest position at 31.95%, so this is of course not yet meaningful.

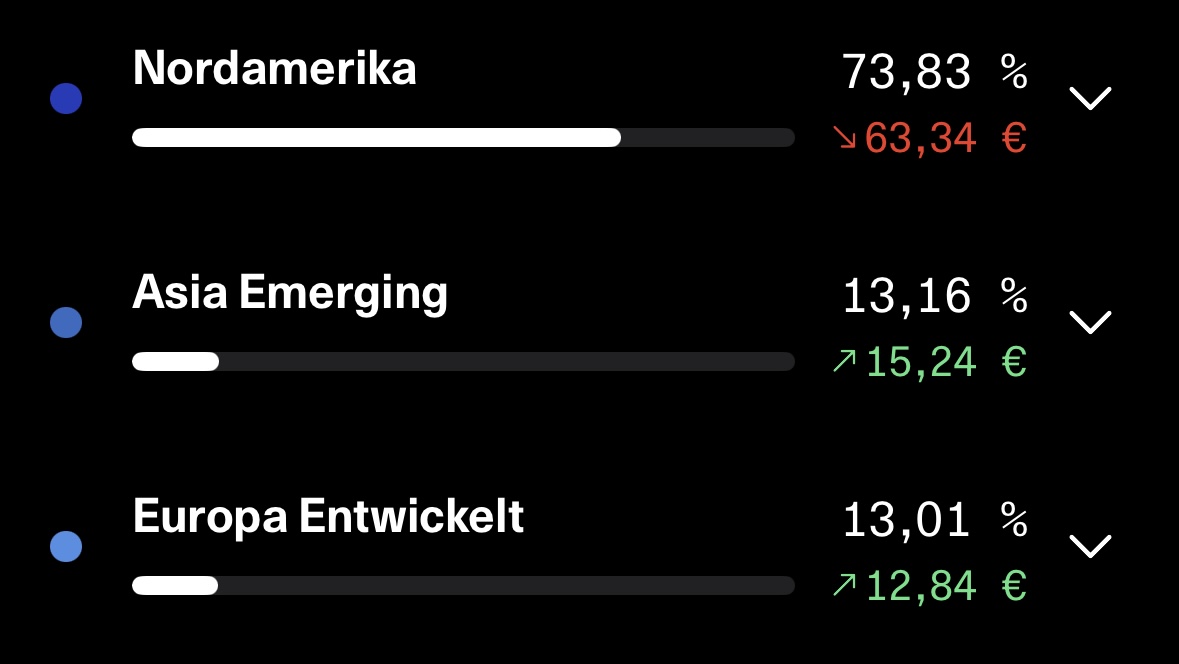

Allocation by region is as follows. The aim is to get below 70% US exposure in the long term.

You can see what my current savings plans and valuations look like in the picture. These will also be executed tomorrow. $NOVO B (-7.16%)

$ASML (+1.25%)

$V (+3.23%)

$MELI (+1.01%) will therefore be added to the portfolio.

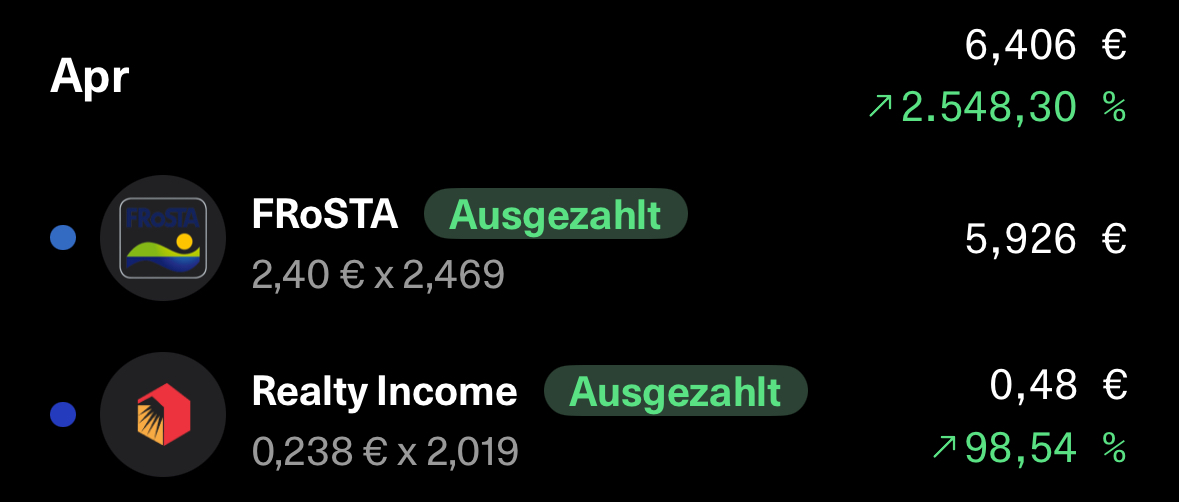

Dividends received April 2025:

A YouTube video is not yet available for this portfolio update. However, the first analysis video will be available the day after tomorrow ($AMZN (+3.08%) ).

Feel free to write what you would like to see in future (real) updates and, of course, how your portfolio performed.