Here is a new update

Strong increase of + 1.7 percent compared to the previous week

10.7 percent since the beginning of the year

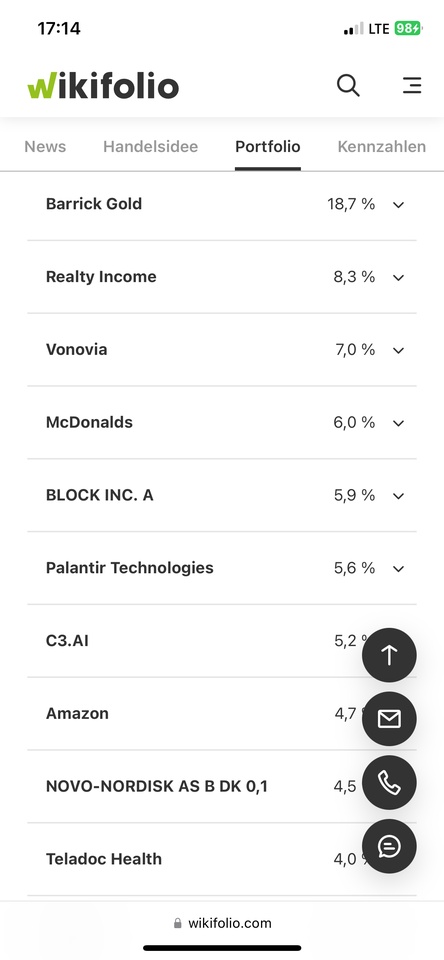

Gold and Bitcoin are both doing well, I have reduced both large positions a little today due to the very stable economy in America.

-Bitcoin/Barrick Gold

You can see that the general mood is very good, hot stocks are also being gambled more.

I have here $AI (+3.39%) and $TDOC (+5.04%) I'm taking the small Fomo wave with me for the time being.

GDP in America was over 5 percent in the last quarter and the economy is extremely strong.

Although there are signs that growth is slowing, we are a long way from a recession.

I am now playing the interest rate stagnation theme with Realty Income, $O (-2.19%) At the moment, inflation is also continuing to fall in Europe, which is currently pushing up interest rate-sensitive stocks such as $VNA (-1.42%) /Vonovia and Co.

You should also look at cyclical stocks such as $BA (-0.18%) -Boeing or $AIR (+0.99%) -Airbus, which are currently safe investments.

https://www.wikifolio.com/de/de/w/wf66zzzzzz