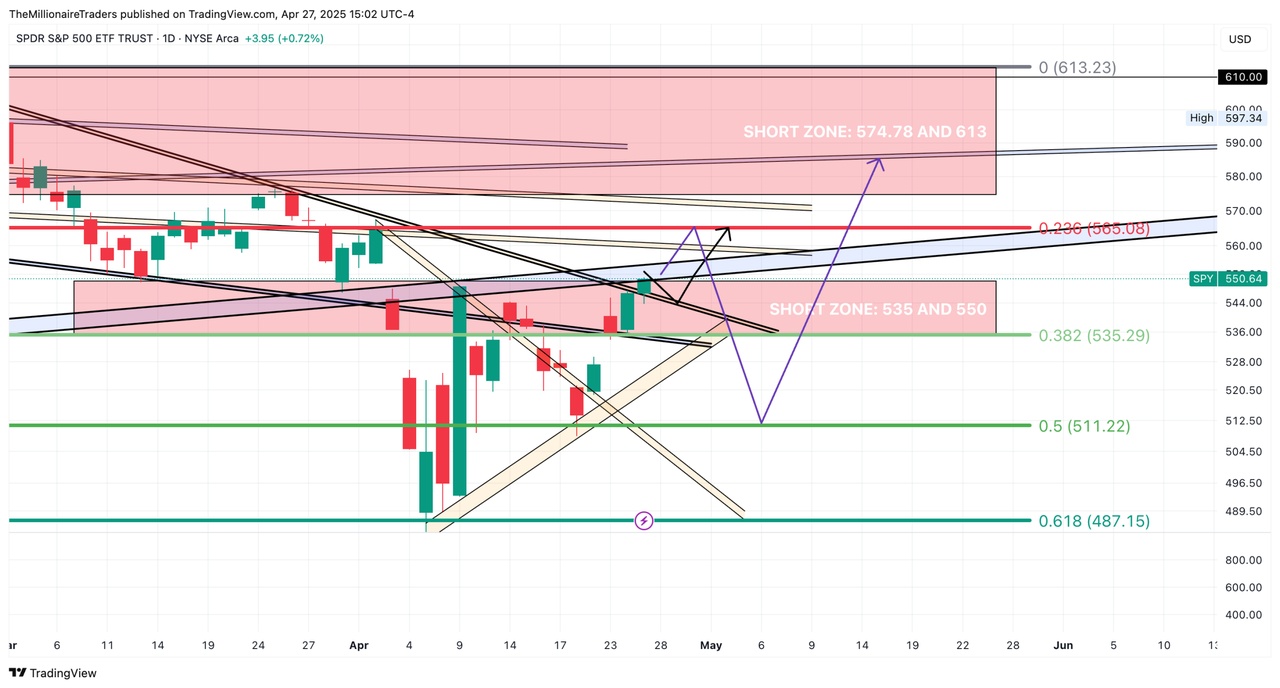

$SPY has 2 Scenarios playing that I can tell you now:

Scenario 1: Immediate Rejection (High Probability)

SPY is already inside the 535–550 short zone

If rejected soon (around 552–555), price could:

Roll back down toward 535 support

Then if momentum accelerates, test 511–487 (0.5–0.618 retracement zones)

This matches well with macro/astro cycles suggesting increased May volatility.

Scenario 2: Trap and Pop (Low-to-Medium Probability)

SPY fakes out above 555–560

Pops toward 574–613, hitting the second short zone

This traps late bulls and sets up a bigger and more violent reversal after May

(This would match a false sense of relief rally into late May before major trouble hits.)

535–550 zone = current battlefield

If SPY climbs toward 574–613 — the RSI, MACD, and momentum indicators will be bearishly diverging, making it a perfect trap.

Saturn, Mercury cycles point to May 6 – 9 window as an ideal reversal window if the second scenario happens.