Hello,

In my securities account I have in addition to my $ISAC (-0.88%) a small cap ETF $WSML (-1.22%) in my portfolio.

As I am now reviewing my investments again, I am faced with the decision to sell the small cap position.

In the end, it has yielded less than I thought or than the ACWI.

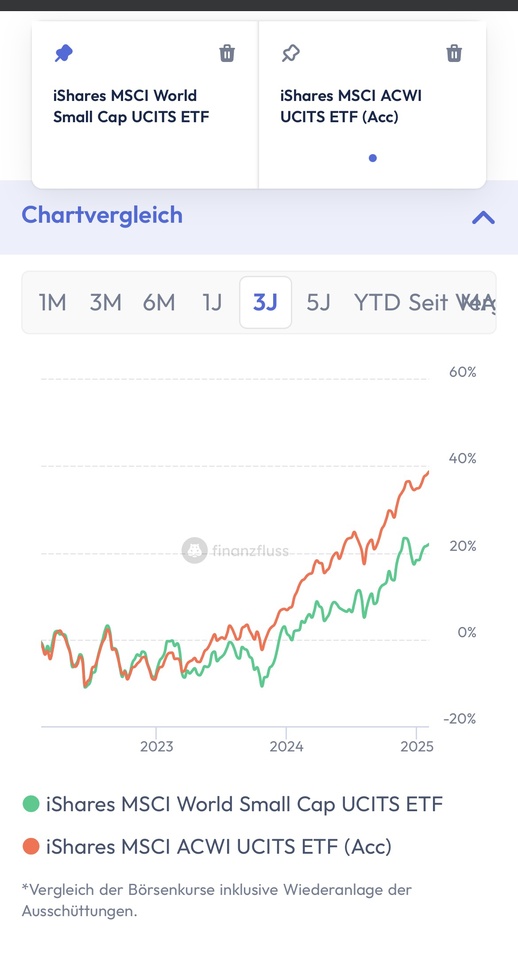

So that I don't just have one year for comparison, I have also compared the performance again using the FF ETF comparison and the ACWI is clearly outperforming the small caps.

My current plan is probably a complete reallocation of the SC into the ACWI.

Are there any big small cap enthusiasts among you? Who can tell me why I should perhaps keep the small caps ETF after all🤓