Equity analysis

1.brief overview

2.introduction

3.divisions

4.holding structure

5.business figures

6.valuation

7.conclusion

Brief overview

Market capitalization: 4.33 billion euros

KGV/KGVE: 26/18

Annualized return: 30% p.a.

Analyst rating: Buy

Introduction

Ionos $IOS (-2.53%) is a German digitalization company with a broad product portfolio. The company was formed in 2018 under the umbrella of the listed internet group United Internet AG through the merger of the subsidiary 1&1 Internet and the IaaS provider Profitbricks. Achim Weiss, a long-time employee at 1&1, founded Profitbricks and has been CEO of Ionos since the merger. The IPO took place in February 2023 and the share price has increased by 88% since then. Ionos has over 6 million customers worldwide and employs 4,182 people. Turnover in 2024 amounted to 1.56 billion euros (+9%) and profit was almost 170 million (-2.67%). In addition to Germany, the most important sales markets are North America, the UK and Spain.

Business divisions:

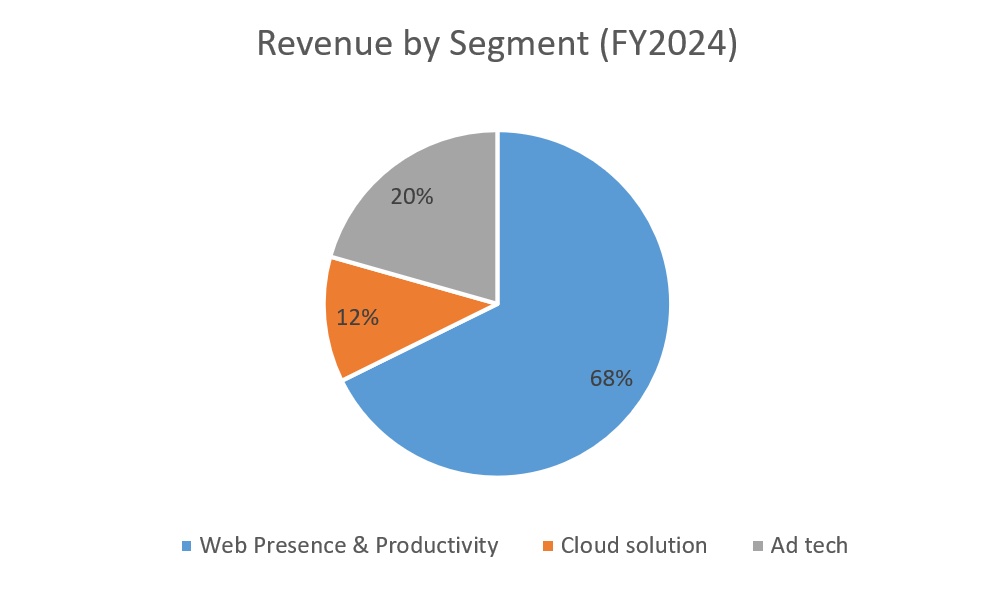

Ionos is divided into three business divisions: Web Presence & Productivity, Cloud Solutions, Ad Tech [1].

Web Presence & ProductivityWith 66 % of total sales, this area is the most important for Ionos. The focus is on small and medium-sized companies. Among other things, Ionos offers customers solutions for web hosting, domain registration and website development (e.g. Strato). After 11.8% revenue growth in 2024, Ionos expects growth to slow to 7-8% in 2025.

Cloud Solutions: This business division generated 117 million in revenue (+13.3%) in 2024, including, for example, the development of a cloud for the federal government to store the Flensburg points register [2]. The cloud business is expected to reach profitability this year and record revenue growth of 15-17%. The medium-term goal is annual growth of ~20 %. Overall, Web Presence & Productivity will achieve an adjusted EBITDA margin of 32.9%.

Ad Tech: Ad Tech comprises the domain business, in which the company is the European market leader. A key component of this is Sedo, a marketplace for domain trading with 22 million registered domains. The adjusted EBITDA margin was 13.4% in 2024 and no major jump in revenue is expected next year.

Holding structure

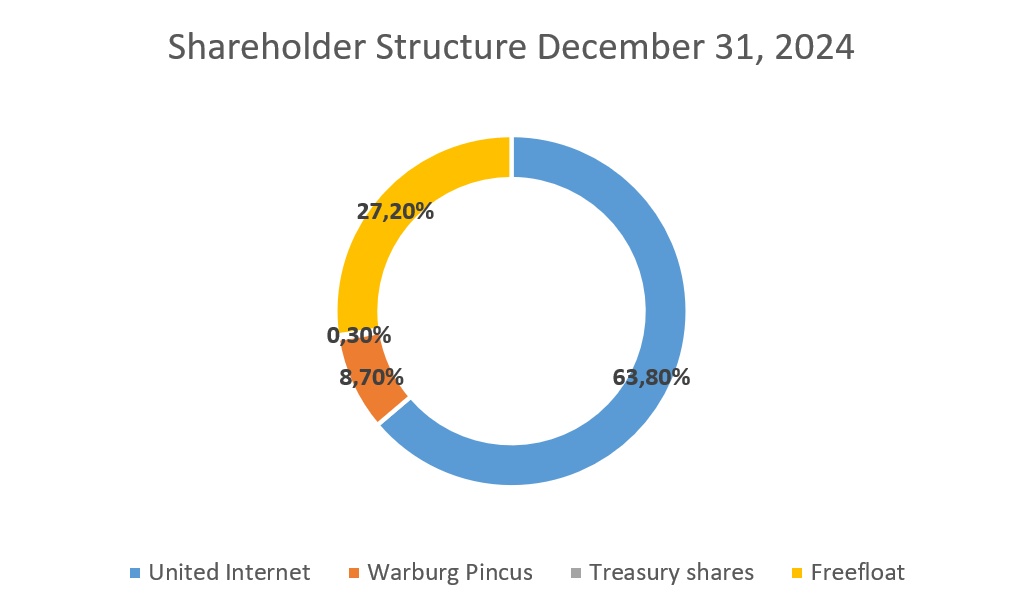

Warburg Pincus acquired the United Internet subsidiary several years ago for 450 million euros. After the IPO, Warburg still held 25% of the shares in Ionos. In 2024, the decision was made to exit Ionos. Since then, Warburg's own stake in the company has been reduced to 8.7% through sales in September and December [1]. The final separation of the position followed in March. The share price reacted negatively to this. A planned change in the shares held in United Internet (63.8%) is not known and is unlikely. The free float amounts to approx. 35% of the shares

Business figures

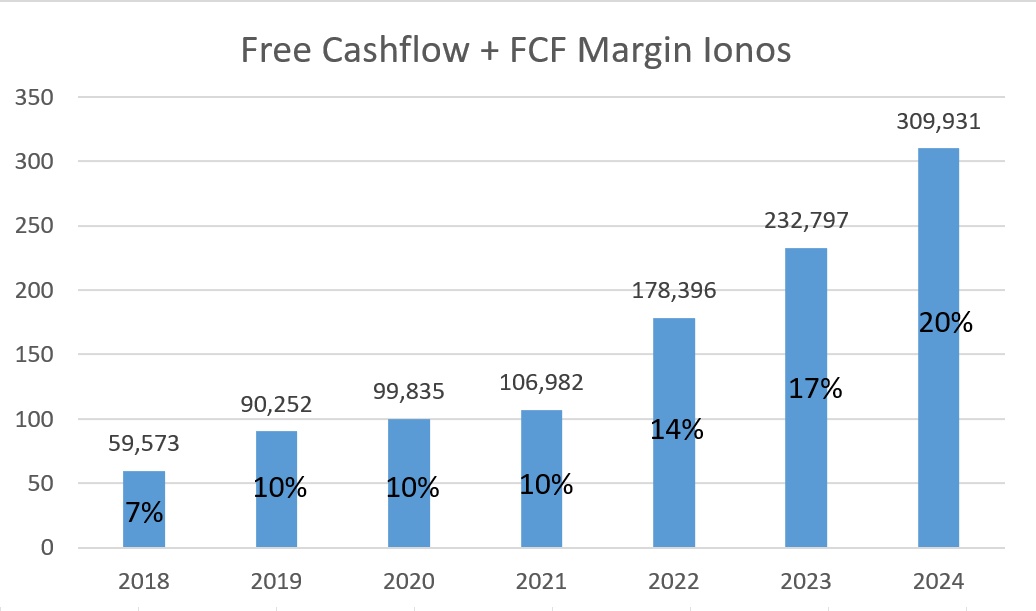

The rising margins, which can be explained by the declining relevance of the Ad Tech segment and efficiency improvements, are positive. I therefore believe that the medium-term targets of 10% sales growth and an adjusted EBITDA margin of 35% (2024: 32.9%) are easily achievable. The sharp rise in the share price can primarily be explained by the strong free cash flow development, which has continued since 2021. From an initial 7% FCF margin in 2018, it was recently increased to 20%. It is particularly important for the share price that this trend continues. A strong dilution of the number of shares is not in sight: from 2023 to 2024, the number of shares rose by just 0.73%. The high liabilities are a negative factor. Only around 1.645 billion euros in assets are offset by 1.485 billion euros in liabilities (including 800 million euros in bank debt).

Disclaimer

This is not investment advice. These are personal assessments that cannot replace professional advice. If you do not want to miss any further stock analyses and additional statistics on the stocks presented, please subscribe to my free sub-subscription. Link is in the profile.

Rating

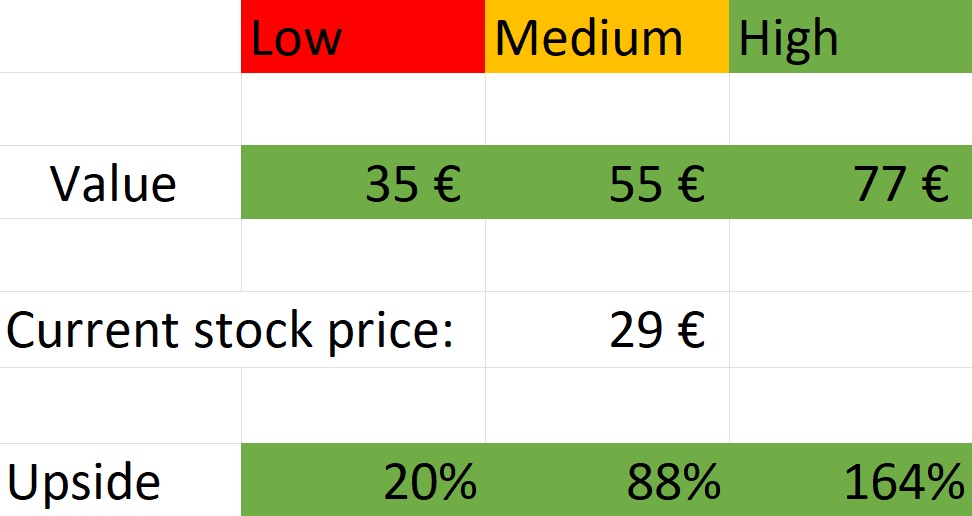

With an expected P/E ratio of 18 and a P/E ratio of 3, the valuation is above the historical average. This must be seen in relation to the expected sales growth, which is expected to be around 8% p.a. over the next few years. Profits are expected to increase disproportionately by around 20% p.a. due to the increase in margins. The multiples indicate an undervaluation. However, as a DCF model is ultimately more meaningful, we are now making further estimates. We add a margin of safety of 25% to all values.

- For the pessimistic scenario, we assume a perpetual growth rate of 1.9% p.a. and use the average FCF margin of Ionos, which is 12%.

- For the medium scenario, a growth rate of 2.2% p.a. and an FCF margin of 18%.

- For the optimistic scenario, a growth rate of 2.56% p.a. and an FCF margin of 23%.

Conclusion

In summary, Ionos is a very exciting company. Ionos is benefiting greatly from increasing digitalization. The gigantic financial package from the CDU/CSU and SPD will also provide a tailwind. Therefore, if margins continue to rise (as forecast by management), I would not be surprised to see a similar pleasing return as in the past. The risks are manageable. What speaks against an investment is the ad tech business, which has not yet been able to return to growth. The high debt burden is also a point of criticism, although it is not an acute threat at the current FCF margins.

Sources

[2] https://www.tagesschau.de/wirtschaft/ionos-cloud-bund-100.html