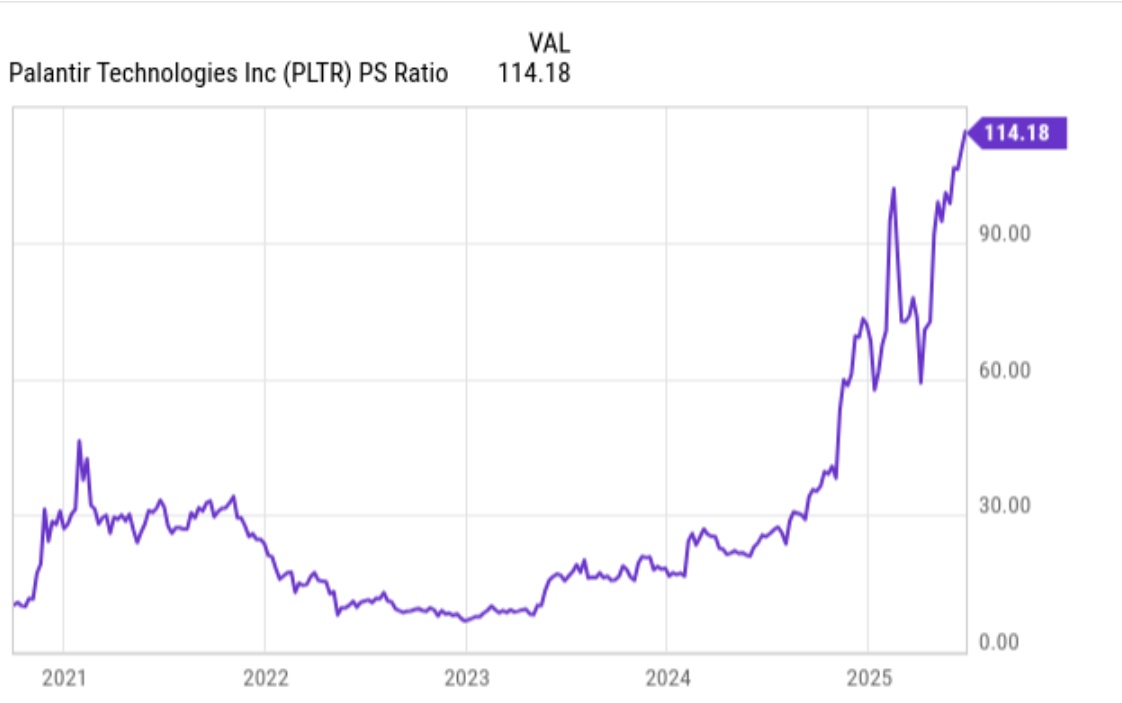

I find the PS ratio of 114 at $PLTR (-1.22%) frighteningly high! When have we seen something like this on the stock market that is then relativized by growth?

Of course the company is growing strongly and now it could also participate more in the 5% NATO spending, but how fast?

Opportunity costs are too high: there are better stocks on the market!