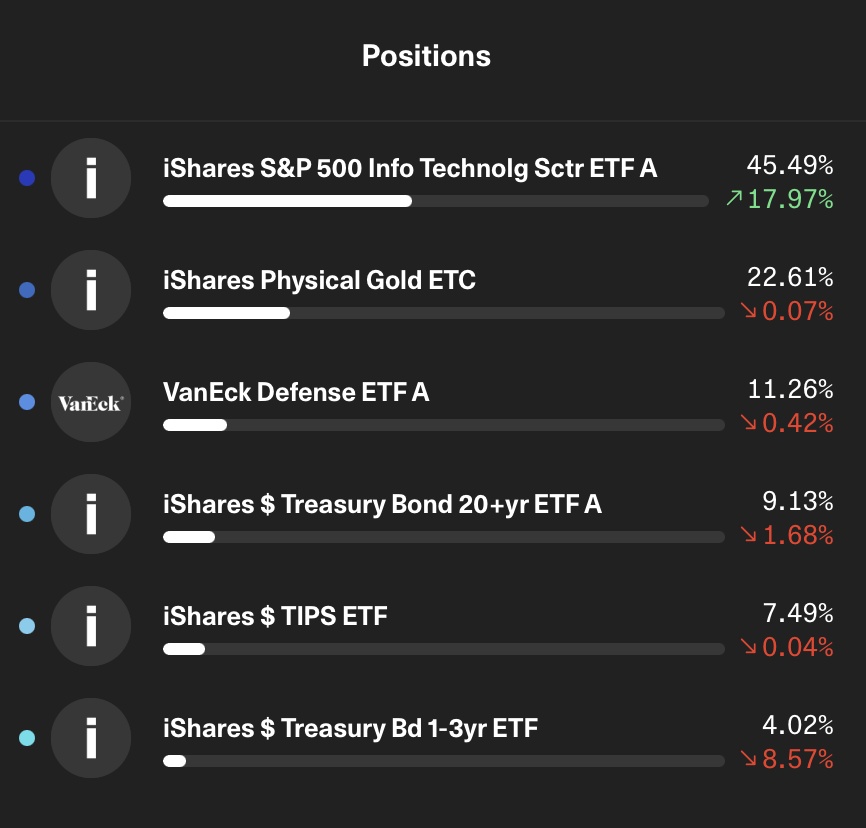

Due to my own inattention or incompetence, I will liquidate the positions except for gold and BTC.

Why? I only realized today that this taxation of unrealized gains on ETFs is actually coming into force.

In order to replicate the performance of Info Tech and Defense as closely as possible (I still want to exclude Mag 7 and the savings plan options also limit me slightly), I am betting on these stocks (all are equally weighted):