After your last feedback I have revised my strategy for my long term portfolio (1000€/month via savings plans) and would like to ask for your feedback again.

Enclosed my key data:

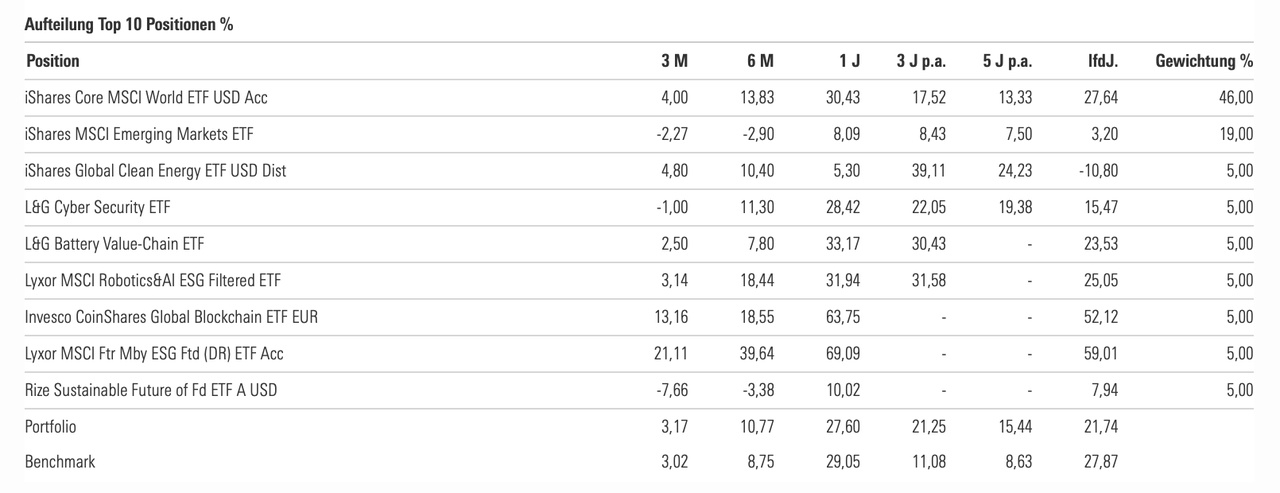

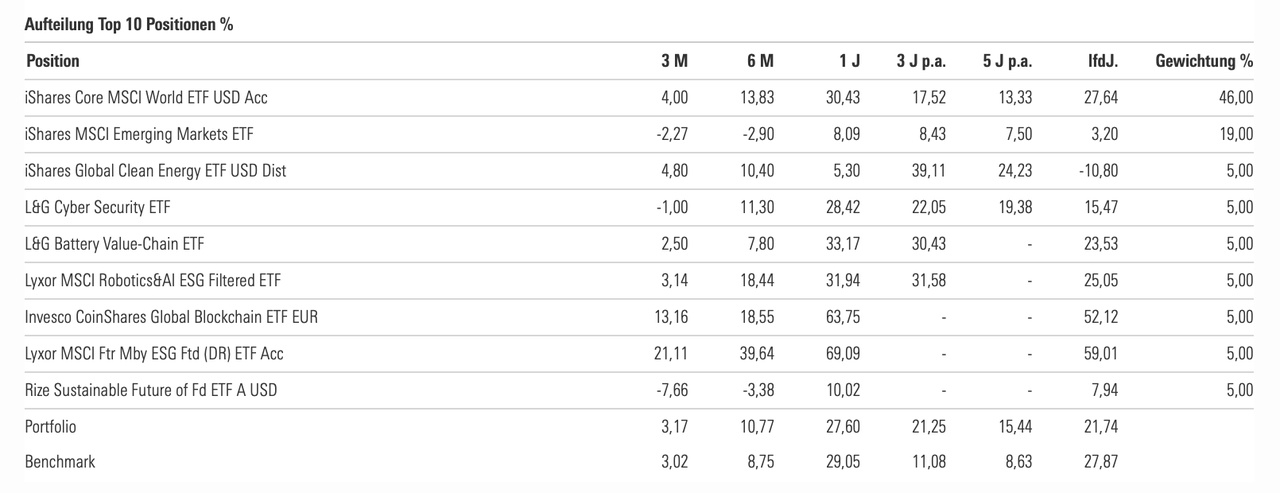

- Core Satellite strategy with 65% MSCI World / EM (70/30 split) and 7 sector based ETFs with 5% each.

- List of ETFs and comparison to benchmark (MSCI World) in screenshot below.

- In total, the ETFs have 3122 positions and of these 92 are duplicated

- Regional breakdown 19% Europe, 52% America, 29% Asia

- Costs approx. 0.35% p.a.

- All accumulating, as 15+ years targeted

Do you see any blunders in the strategy or do you have any other suggestions for the satellites?

Thank you! $BURT39F

$EEM (+0.27%)

$IQQH (-0.55%)

$USPY (-0.65%)

$BATE (+0%)

$ROAI

$BNXG (-0.37%)

$RIZF (-0.38%)

$ELCR (+0.18%)