As I already mentioned in previous posts over the last weeks, I think $AMZN (+0.75%) is an extremely well positioned company with a lot of runway to go and a reasonable valuation, similar to a few others of the Mag7, I should add.

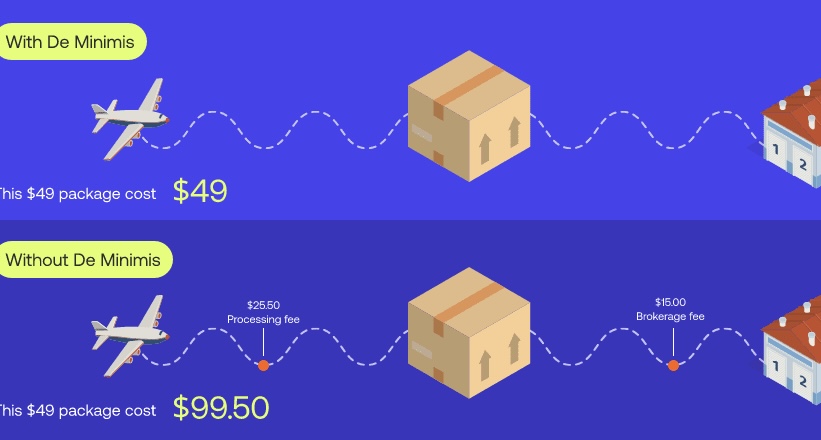

But the whole sentiment around $AMZN (+0.75%) just brightened up significantly, after the official end to the de minimis tax exemption. This loophole was mainly exploited by Chinese online retailers and built the backbone of Temu’s and Shein’s US operations. De minimis allowed these companies to ship low-value goods directly to consumers without paying import duties or going through rigorous customs scrutiny, enabling them to make products considerably cheaper than their US counterparts like said $AMZN (+0.75%) . Temu’s parent company $PDD (+0.11%) has already announced that they would pass on all the newly incurred costs directly to consumers.

So, why is this bullish for $AMZN (+0.75%) ? Because $AMZN (+0.75%) has a different approach when it comes to selling their products. Yes, they also import cheap goods from China, but instead of delivering them straight to the consumer they store them in one of their massive warehouses spread across the United States to ensure a smooth and fast delivery process. Now that they are playing on a levelled playing field, where every participant is held to the same rules, people will start prioritising fast delivery and the arguably more reputable name of $AMZN (+0.75%) compared to its Chinese competitors.

The main selling point of companies like Temu and Shein has been the disgustingly cheap prices on their goods, which was why people accepted the long delivery times. But that’s gone for now and even if Trump strikes some form of deal, the de minimis rule is likely to be in the past.

Here is an infographic to illustrate how big of a loophole de minimis actually has been: