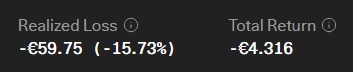

Today I made the choice to sell all of the shares of $AGNC (+0.05%) , I made a small loss of +- €4,316 despite the fact that I did have a price loss of €59 (dividend made up for a lot)

Today I looked at the data of $AGNC (+0.05%) all day and came to the conclusion that it does not fit with what I am doing at the moment.

( buy as many dividend safe stocks as possible and limit risks )

Despite the dividend being safe today I decided to sell today. With the money from $AGNC (+0.05%) and the money still on Etoro I will reinvest tomorrow/Friday

#dividend

#dividends

#dividende

#invest

#investing

#reit