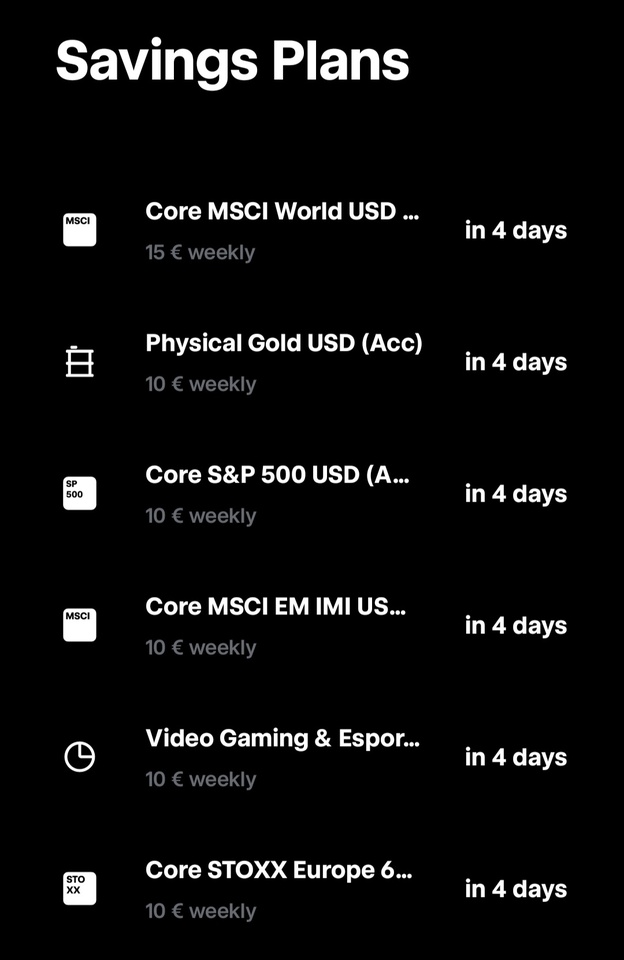

Savings plans Feedback

Hello dear GQ community, I just wanted to share my savings plans and get some opinions on whether it all fits.

These 6 ETFs currently make up ~70% of my portfolio and are to be expanded in the long term. They all have the same weighting at the moment, with the MSCI World getting a little more.

I am 19 years old and would like to build up a long-term portfolio, and these 6 ETFs looked attractive at the time and are doing quite well so far (all about 1 year old)

$ESGB (-0.54%)

$CSPX (+0.52%)

$IWRD (+0.31%)

$IGLN (-0.76%)

$EIMI (+0.16%)

$n/a (+0.28%)