On CoinGecko I see $SQD (+0.75%) at around 0.17 US dollars and a market cap of around 121 million dollars. YCharts calls for $SNOW (+0.42%) Snowflake at almost 74 billion dollars - a ratio of around one to six hundred. It's numbers like this that tickle the nerd in me.

Snowflake stores data for traditional enterprise customers. SQD wants to master the same discipline on-chain for more than two hundred blockchains, including real-time streams and ZK proofs. The OceanStream launch plus ex-Bridgewater head of technology Howie Altman in the cockpit shows: This is not a breezy pitch, it's already live.

Now for the retarded math that gets my pulse racing: If $SQD eventually reaches just one percent of Snowflake's valuation, we're talking $740 million. Spread over roughly 730 million tokens, that's about one dollar per SQD - six times the current price. Five percent? A good five dollars, thirty times the leverage. It's all purely theoretical, of course, but that's what makes weekends interesting.

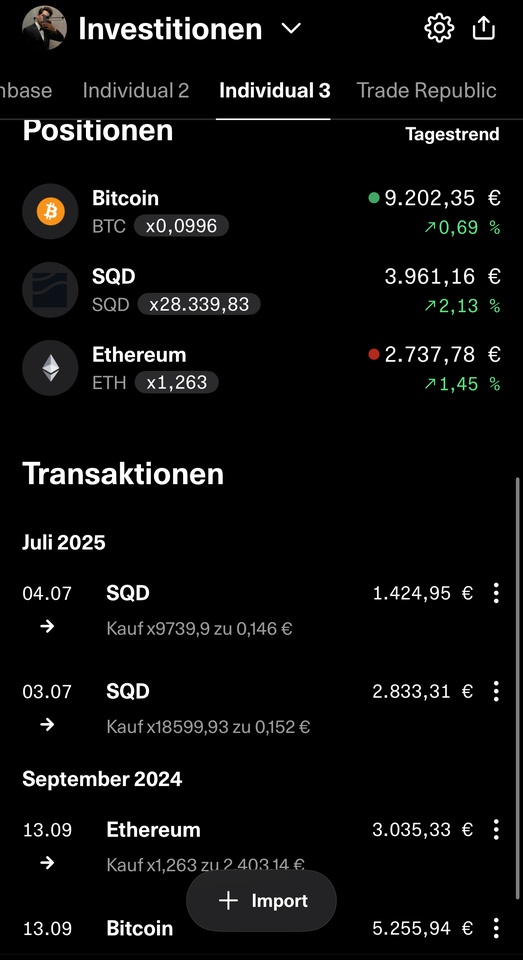

The tailwind doesn't just come from technology. The Piëch family is stacking up tokens via Heidelberger Beteiligungsholding, which is currently renaming itself SQD.AI Strategies AG and is raising up to €50 million. Christian Angermayer's Apeiron is also involved. When such long-term investors come on board, it's rarely about quick flips.

And the macro trend? Standard Chartered sees a market of a good 30 trillion dollars for tokenized real-world assets by 2034. Someone has to lay the data pipeline in this new financial internet, and SQD wants to be that tollbooth.

Yes, risks remain: Two hundred chains won't scale on their own, regulators might get in a bad mood, and the final staking model won't arrive until the third quarter of 2025. But that's exactly why the valuation is still dwarfed.

In short: for me, SQD is a small octopus with a jet pack. If it secures even one percent of the Snowflake buffet, it will be a sporty one.

Left

https://www.coingecko.com/en/coins/sqd-2