Hello dear swarm intelligence,

I have made a mistake and apparently invested in something that I have not yet fully understood.

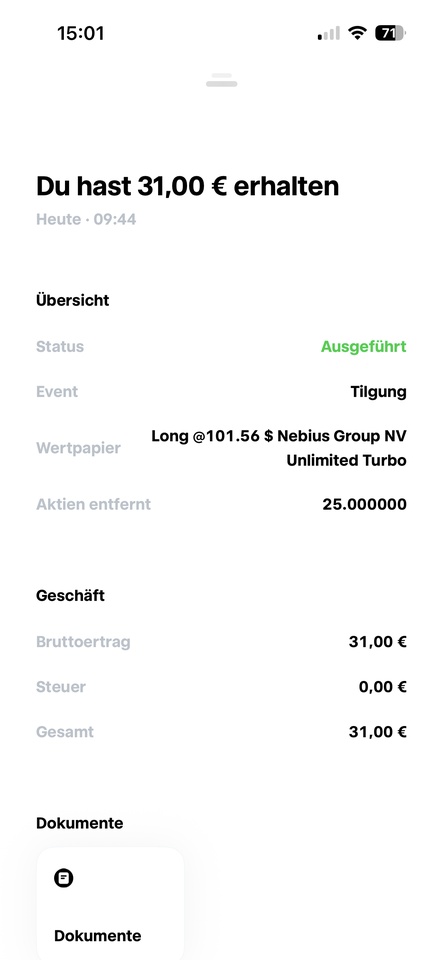

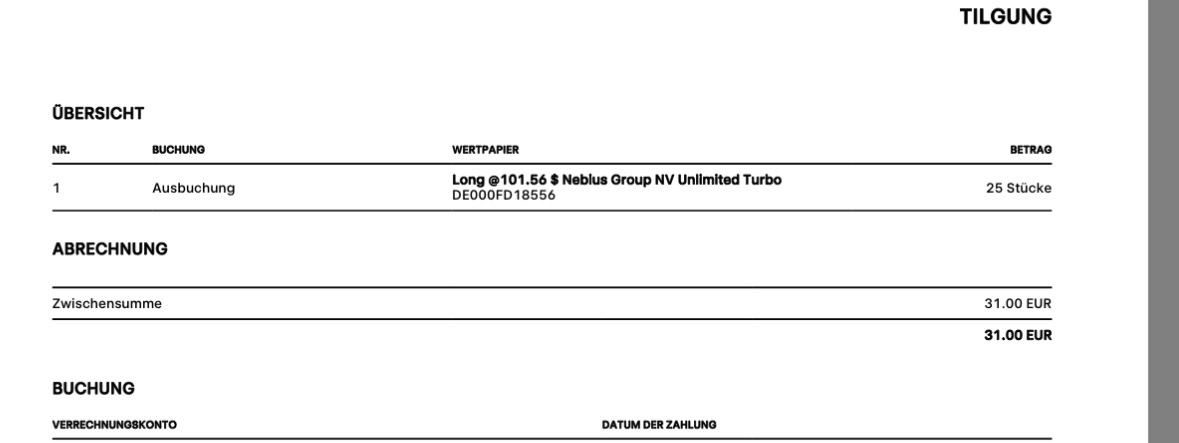

I recently had a small leverage long on $NBIS (+2.73%) the other day. This reached the knockout and flew. So far so good. Now I thought that I would only receive a cent amount when I redeemed it. But did I get back about 33% of the stake? Is this a mistake by TR or how does this happen?

I would appreciate your kind comments. Many thanks in advance!