Brief analysis for all ducks, ducks etc. 🦆🐣🐔

and of course for everyone else.

The last few days I have noticed that the big

food companies are very popular again.

e.g. Nestlé, General Mills, Mondelez,

Apart from Lotus Bakeries, however, I don't like the historical performance.

And that is perhaps why Lotus is valued so highly.

That's why I went on a search.

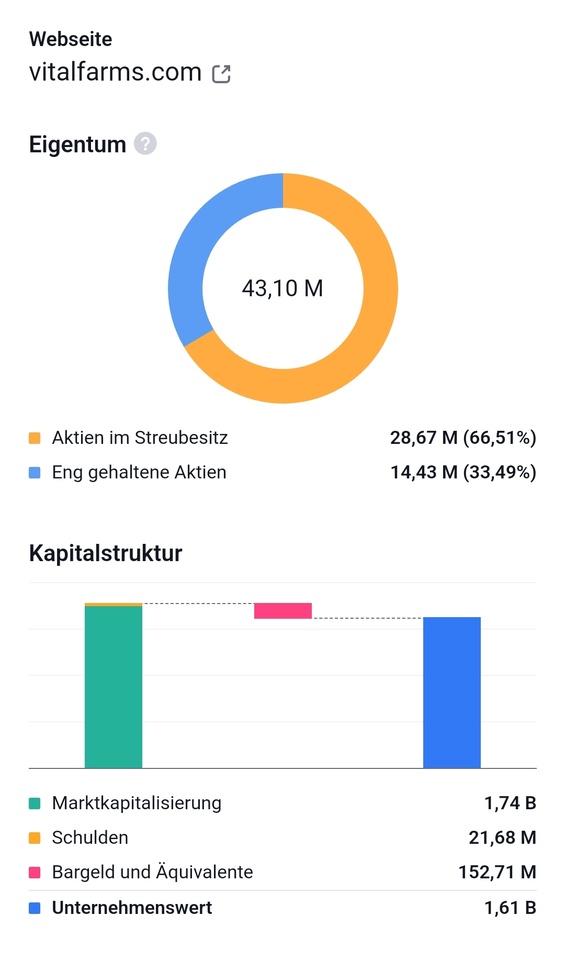

And I found a small growth stock with a market capitalization of

market capitalization of 1.74 billion dollars.

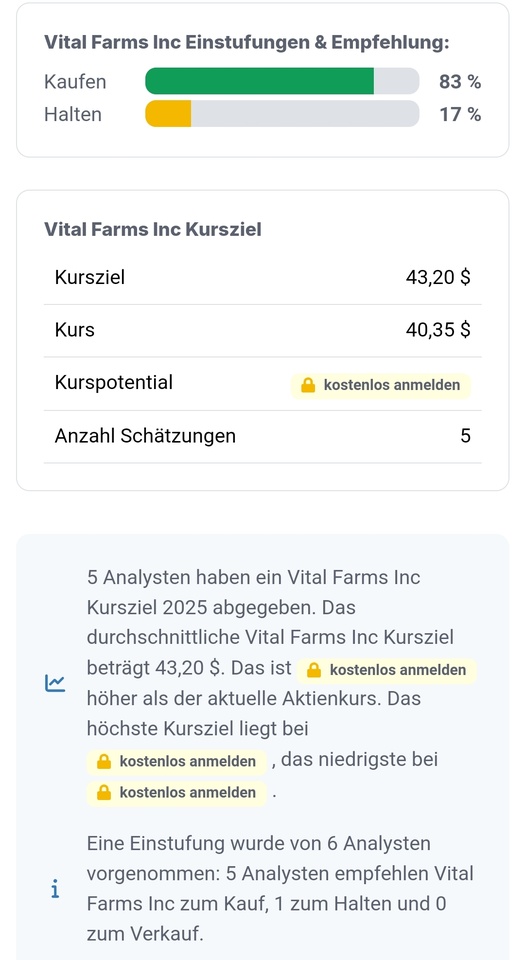

According to the share finder, it is undervalued.

The company in question is

Vital Farms $VITL (+0.46%)

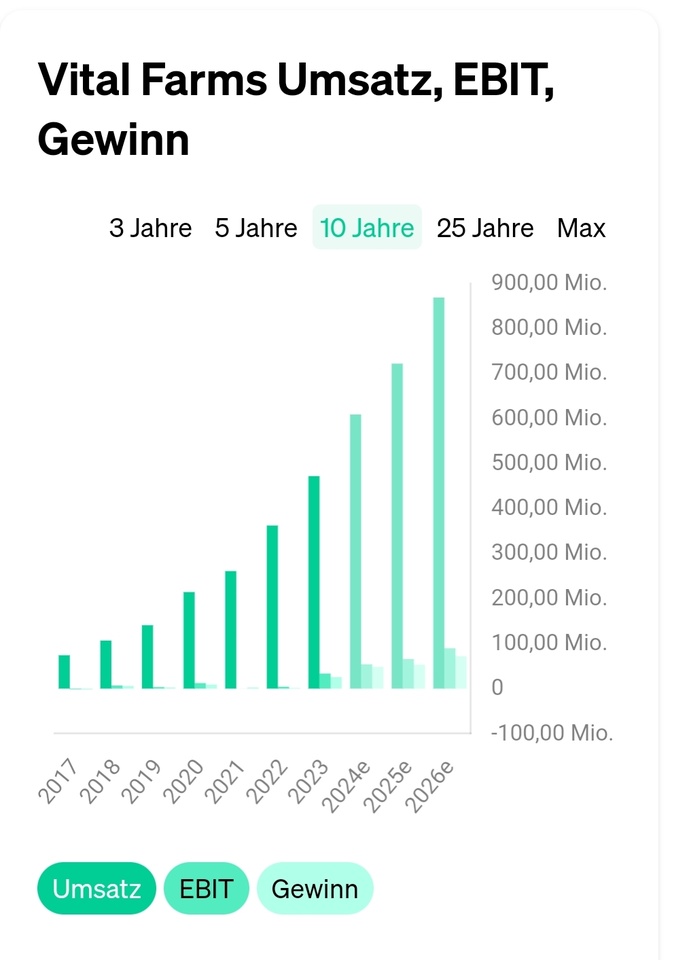

KGV: 2024: 37.65. 2025: 33.80. 2026: 24.22

Profit growth: 2024: 65.68%. 2025: 41,80%

Turnover: 2024: 608.73 million EbiT: 53.84 million.

2025: 721.63 million 65.51 million

2026: 868.36 million 89.49 million

EbiT margin: 2024: 8.84%

2025: 9,08%

2026: 10,31%

Earnings per share: 2024: 1.07

2025: 1,19

2026: 1,67

Vital Farms achieves record revenues with pasture-based products in the 1st quarter - sales to double to USD 1 bn by 2027!

Vital Farms (VITL) is one of the leading suppliers of pasture-raised egg and butter products in the USA. It cooperates with over 300 family farms located in the climate-friendly "Pasture Belt", whose products are sold via a network of 24,000 retail outlets after being processed in the company's own Egg Central Station. Restaurants are also supplied directly. Consumers are increasingly willing to spend more money on high-quality and environmentally friendly products.

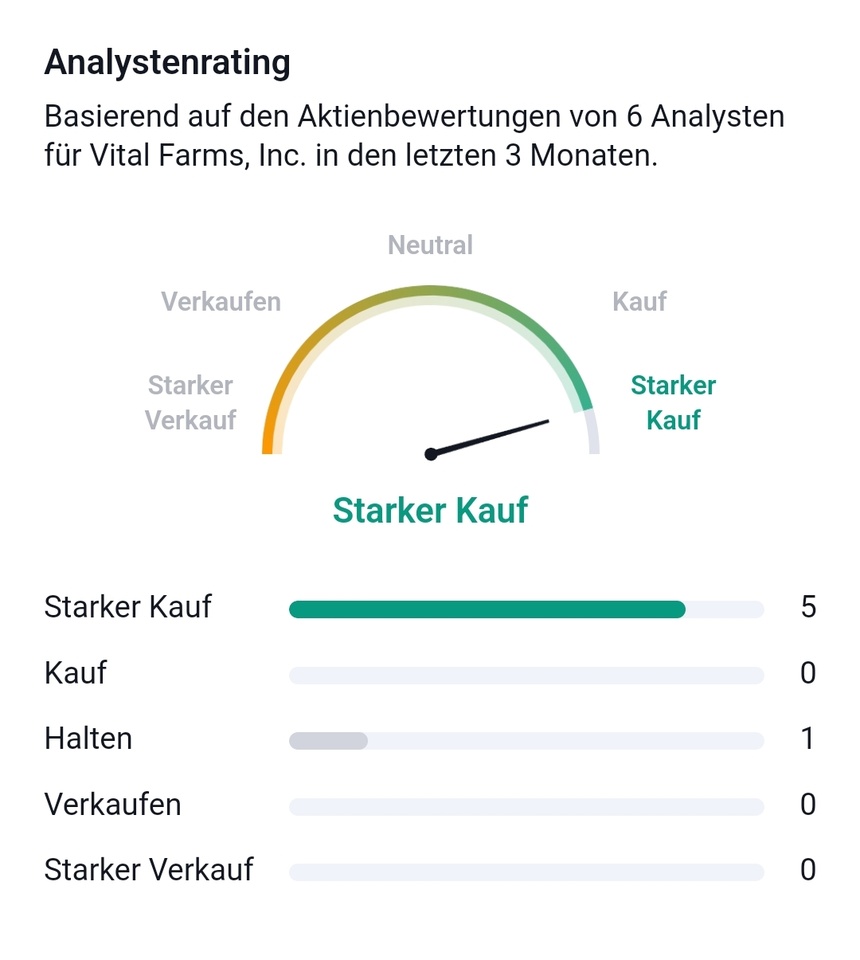

Surveys show that 36% of Vital Farms customers would rather leave a store than buy products from the competition. On May 9, the company delivered one of the strongest quarters in its history with a 24.1% increase in record sales and a doubling of net profit. This increase followed sales growth of 55% in the same quarter last year, when the category was impacted by avian flu. DA Davidson and Lake Street analysts raised their price targets to USD 45 (Buy) and emphasized that 2024 could represent a surprisingly significant advance that could "substantially boost" future estimates.

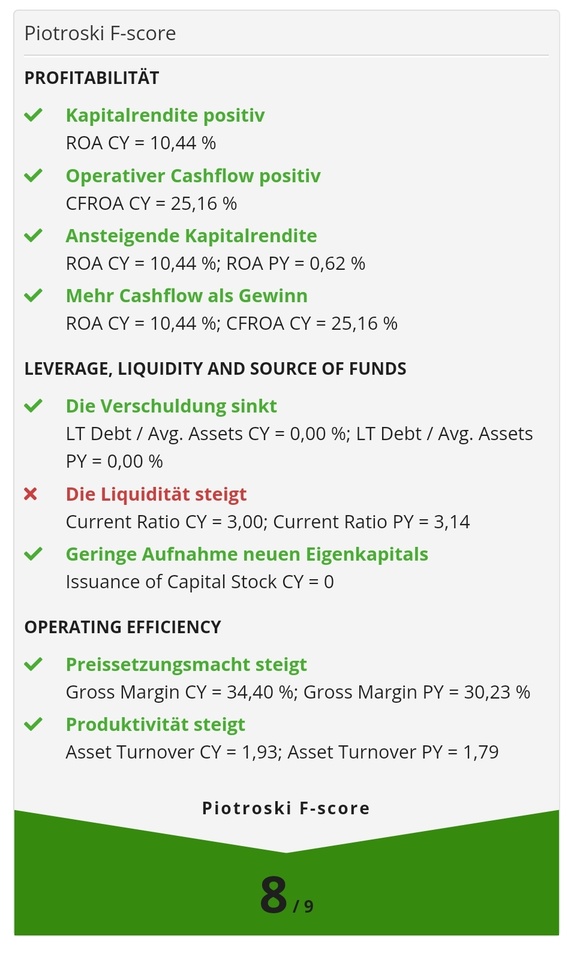

Revenues are expected to more than double to USD 1 billion by 2027. A new facility in Indiana is expected to be operational from 2026 to support scaling and increase reach to 32,000 locations and 550 family farms. The share has already gained 165% this year and scores top marks in the growth check. With a P/E ratio of 3 and a P/E ratio of over 45, the share is no longer cheap,