What began as a university project at Harvard Business School in 2012 is now a tech giant with billions in sales: Grab Holdings - the super app for mobility, delivery services and digital payments in Southeast Asia.

🚕 From MyTeksi to the super app

Founded by Anthony Tan and Tan Hooi LingGrab (then called MyTeksi) with the aim of making cab travel in Malaysia safer. The idea: an app with GPS tracking that connects passengers with registered drivers. Today, Grab is much more than just a mobility service.

🔍 What does Grab do today?

Grab combines the functions of about, DoorDash, Instacart and PayPal - all in one app.

🚗 1. mobility - market leader in almost all countries

- Over 5 million driver-partners

- Services like GrabCar, GrabTaxi, GrabBike and much more.

- Market shares:

- 🇲🇾 Malaysia: 97 %

- 🇵🇭 Philippines: 91 %

- 🇹🇭 Thailand: 85 %

- 🇻🇳 Vietnam: 67 %

- 🇮🇩 Indonesia: 50 % (competition with Gojek)

[1]. Rumors: Grab could take over Gojek - a recent USD 1.2 billion debt deal could be designed to do just that.

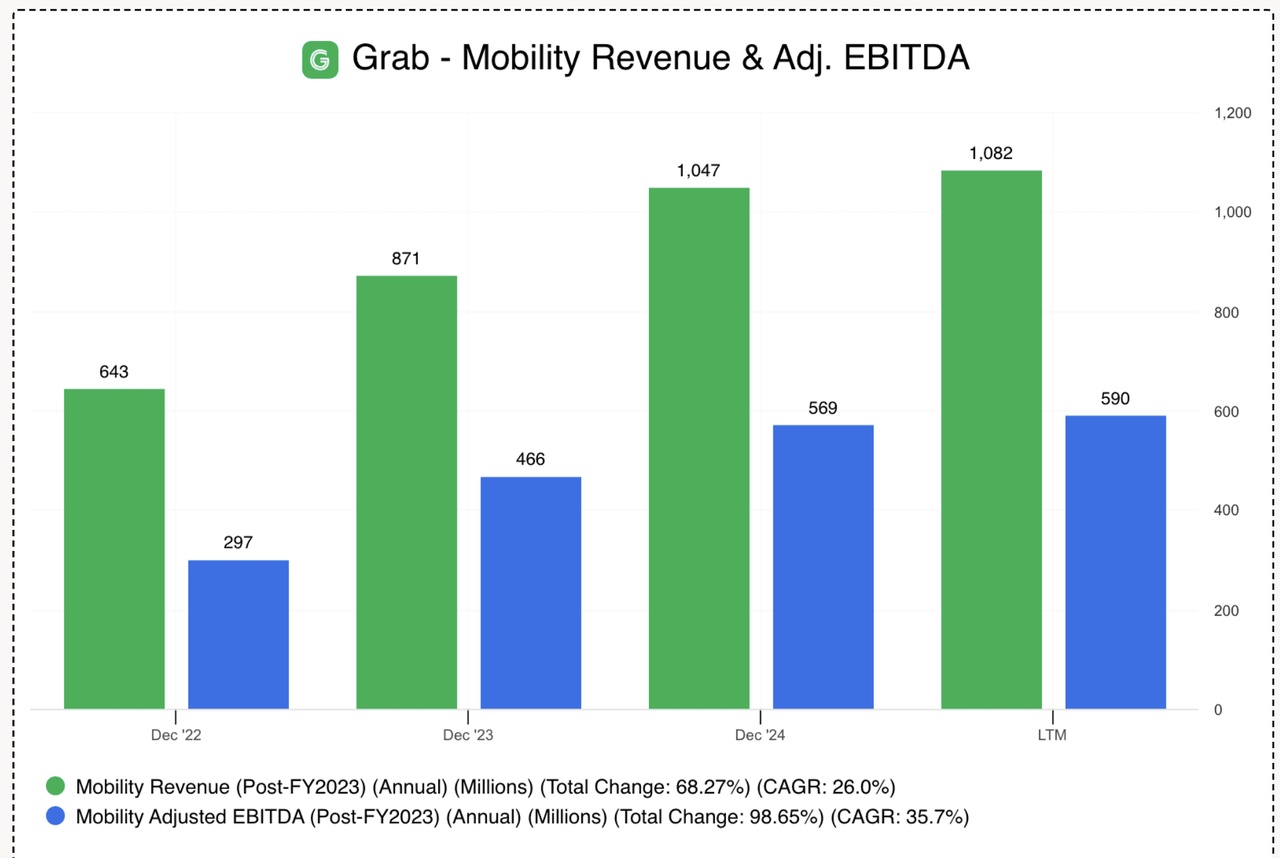

- Mobility turnover (12 months): approx. USD 1.1 billion

- EBITDA margin: approx. 55 %

🍔 2. delivery - largest sales driver

- Combination of food delivery & Grocery Delivery

- Market leader in all countries except Vietnam

- Grab supports retailers with financing and is itself active in retail

Most important step:

2021 Takeover of Jaya Grocery (Malaysia) → strong growth in product range & platform effects

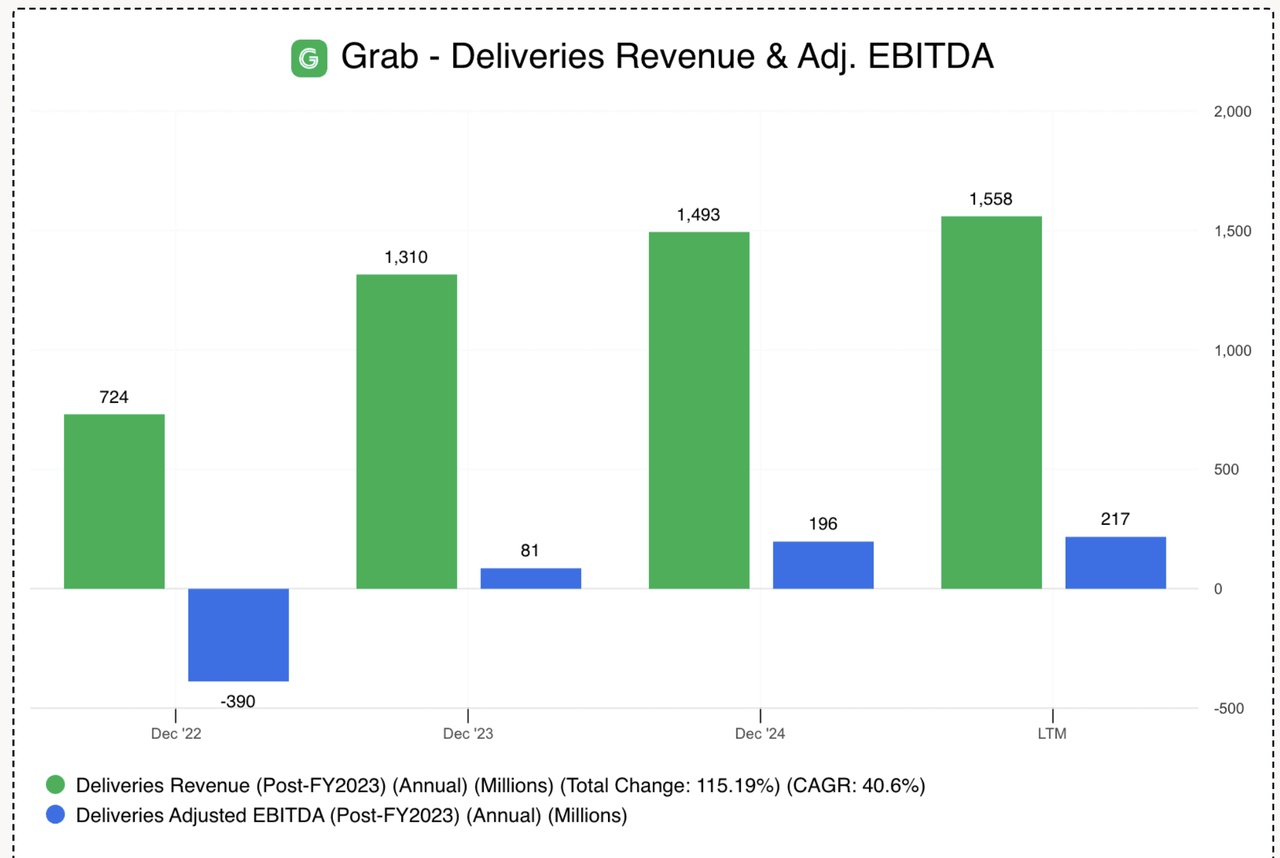

- EBITDA margin: of -54 % (2022) to +14 %

- Long-term target:

4% of GMV as EBITDA

📌 Conclusion:

Grab is much more than a ride-hailing service - it is an ecosystem for mobility, commerce and finance in one of the fastest growing regions in the world.

With a strong market position, growing profitability and potential expansion through acquisitions, Grab remains an exciting player.

My Youtube channel for more stock analysis: www.youtube.com/@Verstehdieaktie