3 examples from my savings plan portfolio

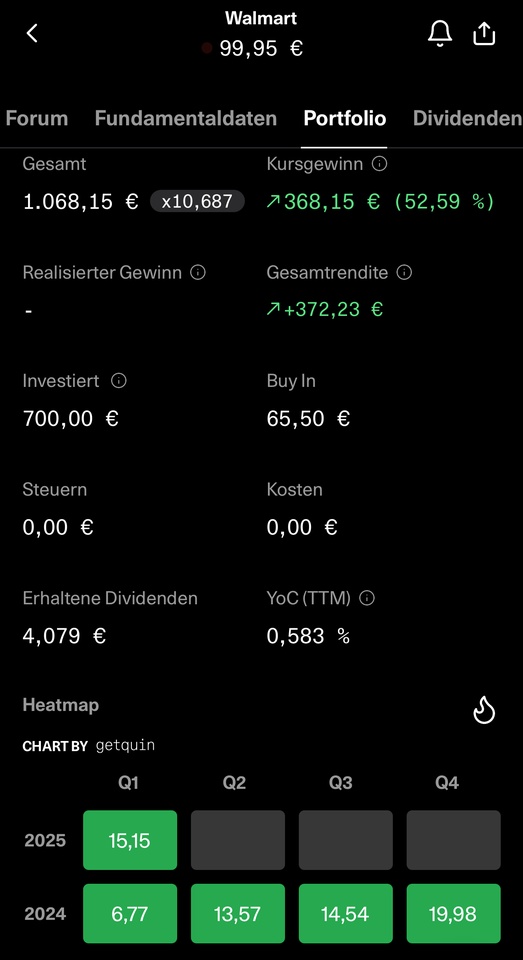

Walmart

$WMT (-2.31%)

A boring dividend aristocrat, solid figures and slight growth. Clearly outperformed the S&P 500 last year.

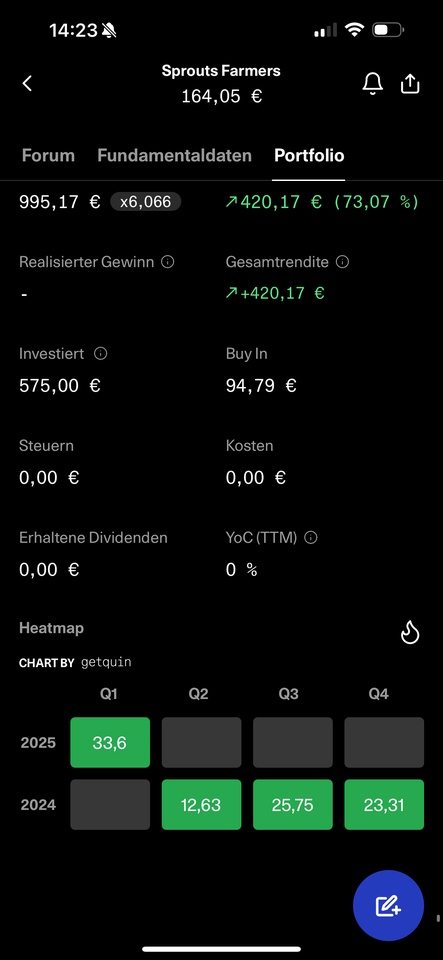

Sprouts Farmers

$SFM (-12.04%)

Return of approx. 240% in one year. The figures and growth (approx. 10-15%) are decent, but the share price development is a bit insane compared to the growth 😂

Microsoft

$MSFT (-1.57%)

A very good growth stock that belongs in every portfolio, sales and profits are increasing quarter by quarter, but Microsoft didn't stand a chance against the S&P 500 last year and has only gone sideways so far