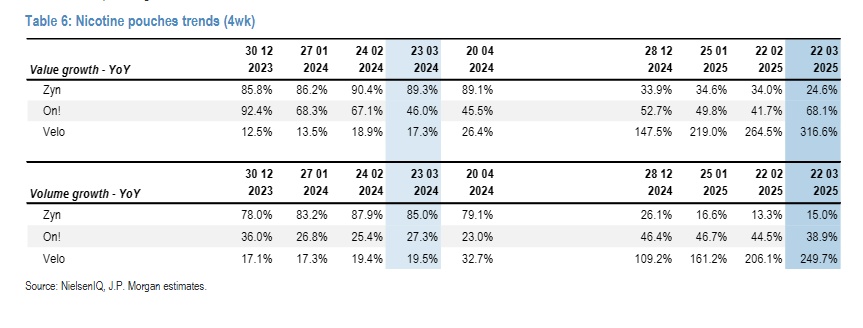

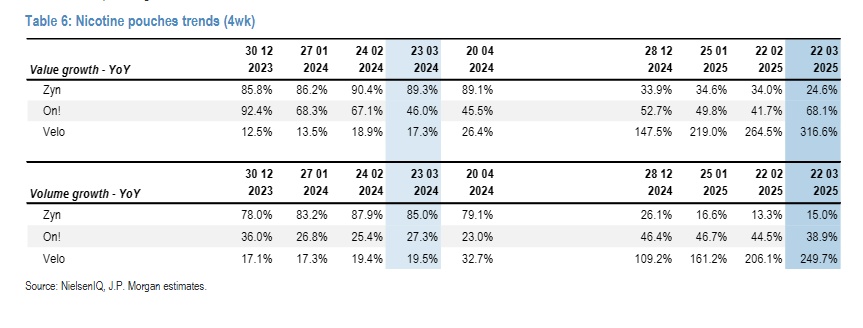

VELO Plus from $BATS (-2.42%) continues to grow rapidly and is driving bicycle growth. The data from the new Nielsen report shows growth of >300% yoy.

VELO Plus from $BATS (-2.42%) continues to grow rapidly and is driving bicycle growth. The data from the new Nielsen report shows growth of >300% yoy.

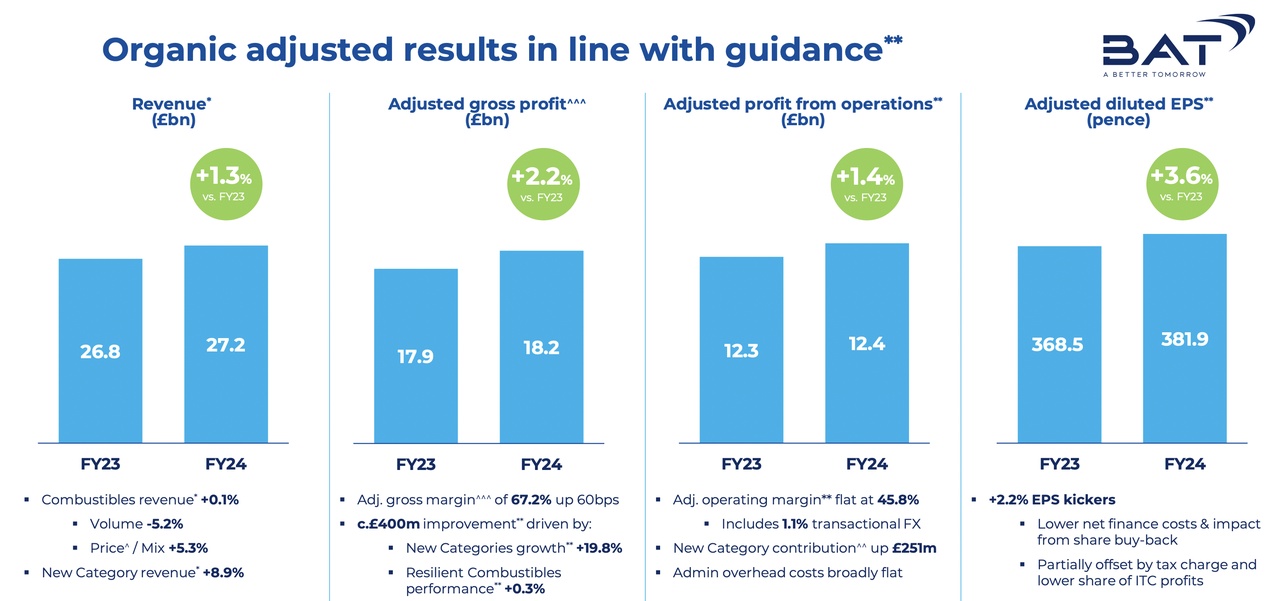

TLDR: while the numbers are not as impressive as Philip Morris, the company has exceeded general expectations, with a beat in revenue and EPS. In addition, the targets were largely met, even if VUSE in particular was rather disappointing. I remain confident and assume that a change of direction at GLO into the premium segment, as well as new Velo and VUSE products, will accelerate growth again. It is also important to note that the operating business was primarily weakened by the sale of the Russian subsidiary.

The weak euro is also weighing on the European business, which is performing very well.

My conclusion:

The figures look very disappointing at first glance, but in my opinion the management is making the right decisions and can also successfully turn them into sales (combustibles in the USA) and there are new products in the pipeline that should continue to drive RRP's growth, just like an environment that is expected to improve. RRP has grown very strongly for years now, even if it is disappointing, a small plateau is more than normal.

I welcome the share buybacks and the increased dividend and with the reduction in debt, this should increase in the future.

First a few words from Tadeu Marocco CEO of $BATS (-2.42%)

Sales in billion pounds

RRP sales in billion pounds

Combustibles

VUSE

Velo

Grizzly

GLO

Profit in billion pounds

EPS

Free cash flow and debt reduction

Dividend and share buybacks for 2025

A few words from the CFO

The company wants to use key performance indicators (KPIs) performance and expects a gradual gradual improvement by 2025 and a return to growth of 3-5 % turnover and 4-6% operating profit (on a constant currency basis) by 2026.

Five strategic pillars with 2024 highlights

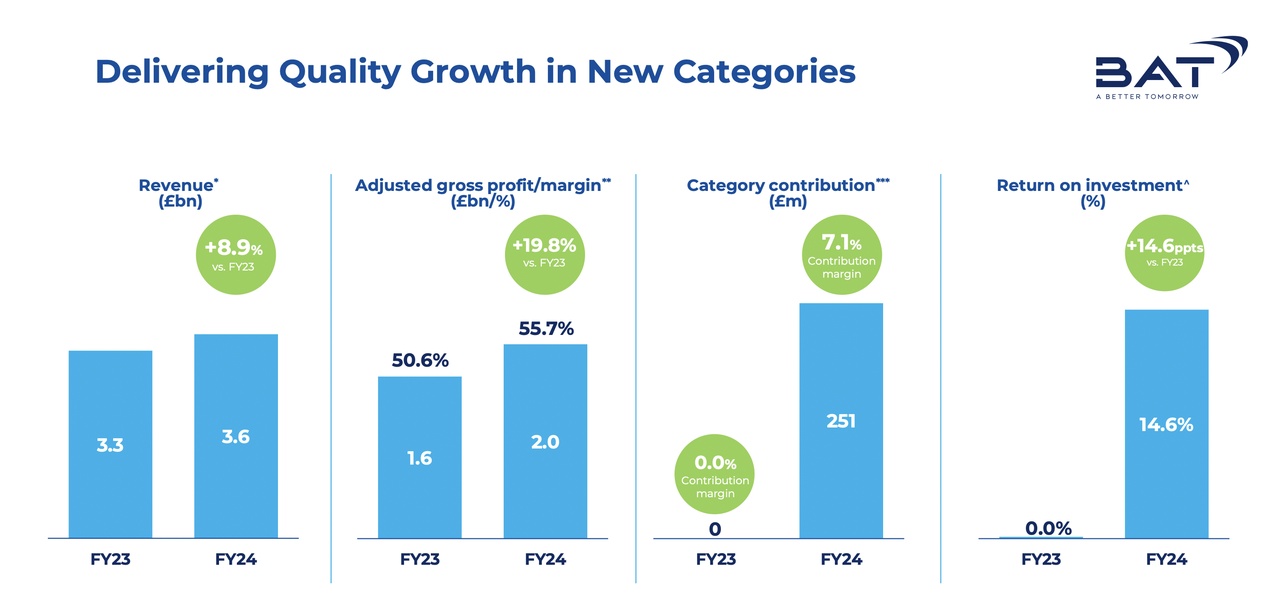

Qualitative sales growth

Increase in gross profit

Acceleration of new category contribution

Sustainable profit growth

Cash flow generation of over £50 billion (2024-2030)

Combustibles

The company recorded different developments in the cigarette business:

Volume & sales development

US market & regional developments

VUSE

Market share & growth

Turnover & volume development

Regional developments

Outlook & challenges

GLO

Market & sales development

Regional developments

Modern Oral Velo

Traditional Oral Grizzly (chewing tobacco & snus)

+ 6