Hello my dears,

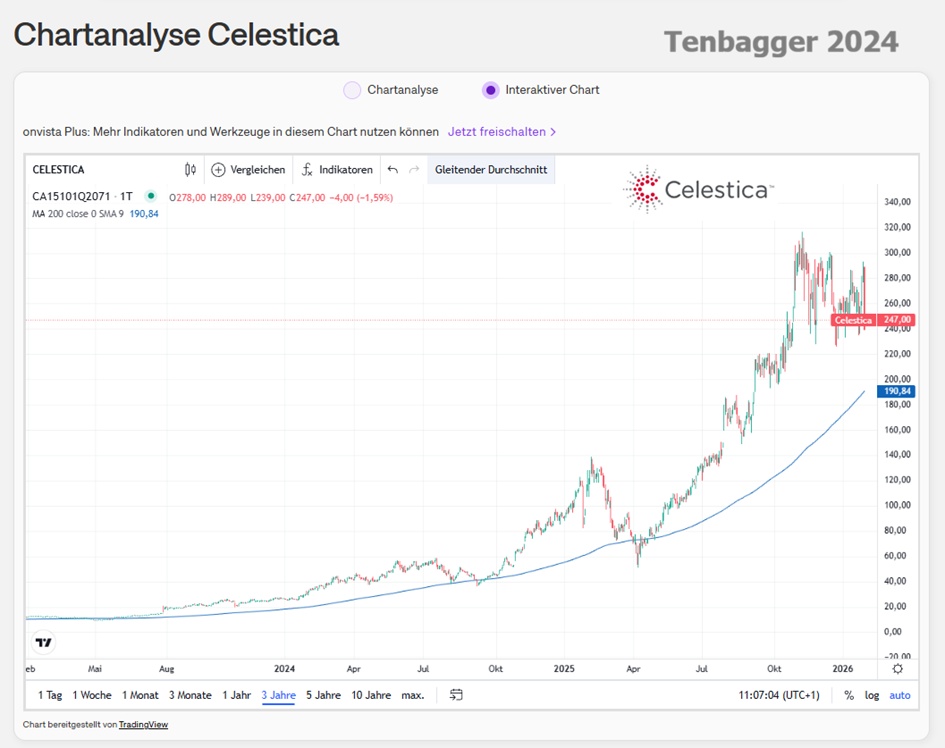

I'm sure many of you will have already seen it yesterday. That I used the little dip at Celestica for my first purchase. @Hotte1909

Due to the sudden purchase, the company presentation is only available today after the purchase.

Opinions and assessments of the company are welcome in the comments.

Celestica Inc. is engaged in the design, manufacture and deployment of hardware platforms and supply chain solutions. The company offers its customers worldwide supply chain solutions in two business segments: Advanced Technology Solutions (ATS) and Connectivity & Cloud Solutions (CCS). The ATS segment comprises the ATS end market and is made up of the Aerospace & Defense (A&D), Industrial, HealthTech and Capital Equipment business units. The Capital Equipment segment comprises the Semiconductor, Display and Robotics Equipment business units. The CCS segment consists of the Communication and Enterprise end markets. The enterprise market consists of Celestica's server and storage business. Celestica provides a range of product manufacturing and related supply chain services to its customers in both segments, including design and development, new product introduction, technical services, component sourcing, electronics manufacturing and assembly, testing and systems integration.

Number of employees: 21,914

Celestica is a Toronto-based contract manufacturer of high-performance hardware. The group develops, builds and integrates complete server, storage and network platforms for large tech customers - right up to fully equipped racks for data centers. In addition to cloud and communications equipment, Celestica also supplies industrial customers, aerospace, medical technology and semiconductor equipment manufacturers, providing not only manufacturing, but also engineering, supply chain and post-delivery service.

It is precisely this model - Celestica sells not just components, but complete, customer-specific infrastructure blocks for data centers - that is now at the heart of a major stock market story: the Group reports a strong quarter, raises its annual forecast and presents an aggressive growth target for 2026 for the first time. The management is thus openly positioning Celestica as a beneficiary of the global AI data center boom.

AI data centers drive the story

The growth driver is the "Connectivity & Cloud Solutions" (CCS) division, in which Celestica supplies complete server, storage and network platforms for cloud and communications customers, among other things. This unit generated revenue of 2.41 billion dollars in the quarter, an increase of 43% compared to the same period last year. The division is benefiting directly from the fact that hyperscalers and other major customers are currently building up additional AI data center capacities - including hardware for AI inference, network technology, power supply and cooling. Hardware Platform Solutions alone generated around 1.4 billion USd in revenue, +79% compared to the previous year.

Celestica is thus openly presenting itself as part of the AI infrastructure chain: The company argues that the current expansion of AI data centers is not a short-term peak, but a multi-year investment cycle that will continue into 2026 and 2027. It is precisely this narrative - structural growth instead of a one-off effect - that is now at the heart of the investment thesis surrounding the share.

Markets

Tailor-made solutions bring next-generation computing, storage and networking products to the market faster for data center and edge markets.

- Verkehrsmittel

- Luft- und Raumfahrt und Verteidigung

- Industrie- und intelligente Energie

- HealthTech

- Kapitalausrüstung

Services

- Entwurf und Ingenieurwesen

- Fertigungsdienstleistungen

- Logistik und Erfüllung

- Nachrüstdienste

- Präzisionsbearbeitung

- Lieferkettendienstleistungen

- Produktlizenzierungsdienste

- Einführung eines neuen Produkts

- Prüfung und Qualität

- Rack-Integrationsdienste

Celestica Inc (TSX: CLS) (NYSE: CLS) is a leader in design, manufacturing, hardware platforms and supply chain solutions for the world's most innovative companies.

Locations: Over 40 manufacturing and design centers worldwide

Locations

America

- Canada, Toronto

- Canada, Newmarket

- USA, Alburtis

- USA, Boston

- USA, Fremont

- USA, Maple Grove

- USA, Portland

- USA, Richardson

- USA, Tucson

- USA, San Jose

- USA, Silicon Valley

- USA, Rancho Cucamonga

- Mexico, Monterrey

Europe

- Ireland, Galway

- Romania, Oradea

- Spain, Valencia

Asia

- China, Kunshan

- China, Dongguan

- China, Shanghai

- China, Suzhou

- China, GBS Suzhou

- China, Xiamen

- Hong Kong

- India, Chennai

- Indonesia, Bandung

- Indonesia, Batam

- Japan, Hino

- Japan, Miyagi

- Philippines, Manila

- South Korea, Asan

- South Korea, Incheon

- Laos, Savannakhet

- Malaysia, Johor

- Malaysia, Johor

- Malaysia, Kulim

- Malaysia, Penang

- Singapore, Serangoon

- Singapore, Pioneer Road

- Singapore, Woodlands

- Thailand, Laem Chabang

November 17, 2025

Celestica introduces SD6300 platform aimed at ensuring maximum storage density for enterprise and AI applications

Q4 2025 financial results

Jan. 29, 26 at 8:00 a.m. EST

Finanzergebnisse Q4 2025 | Celestica Inc.

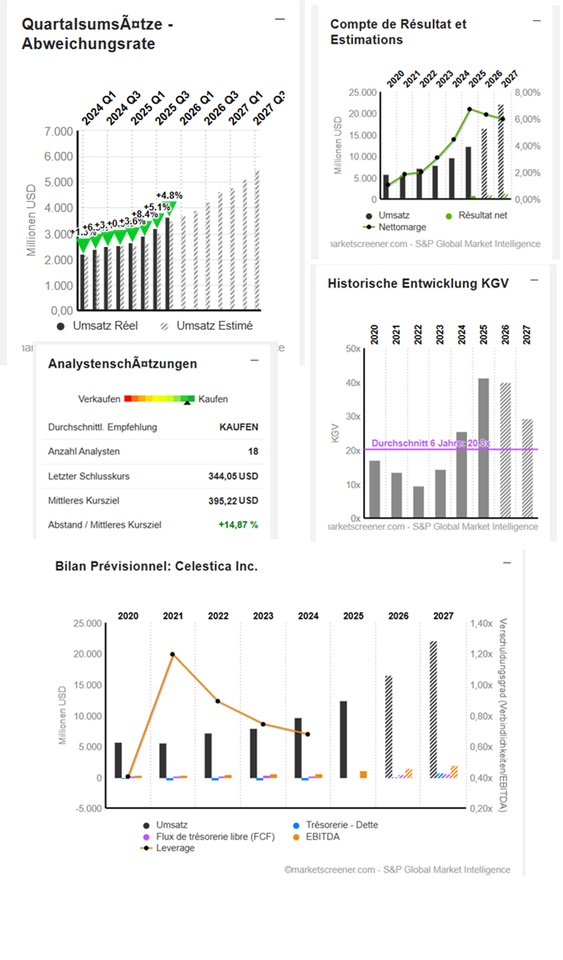

USD in millions

Estimates

Year Sales Change

2024 9.646 21,17 %

2025 12.391 28,46 %

2026 16.496 33,13 %

2027 22.103 33,99 %

Year EBIT Change

2024 441,6 -0,81 %

2025 927 109,92 %

2026 1.385 49,37 %

2027 1.788 29,1 %

Year Net result Change

2024 428 74,98 %

2025 832,5 94,51 %

2026 1.039 24,8 %

2027 1.323 27,3 %

Year Net debt CAPEX

2024 373 168

2025 362 189,1

2026 -157 347,1

2027 429,4

Year Free cash flow Change

2024 261,4 -14,18 %

2025 421,8 61,34 %

2026 525,8 24,67 %

2027 658,8 25,29 %

Year EBIT margin ROE

2024 4,58 % 23,34 %

2025 7,48 % 31,86 %

2026 8,39 % 32,72 %

2027 8,09 % 35,68 %

Year Earnings per share Change

2024 3,61 77,83 %

2025 7,16 98,34 %

2026 8,62 32,59 %

2027 11,7 35,8 %

Year P/E ratio PEG

2024 25.5x 0.3x

2025 41.4x 0.4x

2026 36.4x 1.4x

2027 25.1x 0.6x

Market value 34,283

Number of shares (in thousands) 114,900

Date of publication 28,01,2026

Share structure

- Number of shares outstanding decreases continuously:

- 121.6 million (2022) → 119.0 million (2023) → 116.1 million (2024). → Buy-backs have an EPS-increasing effect.

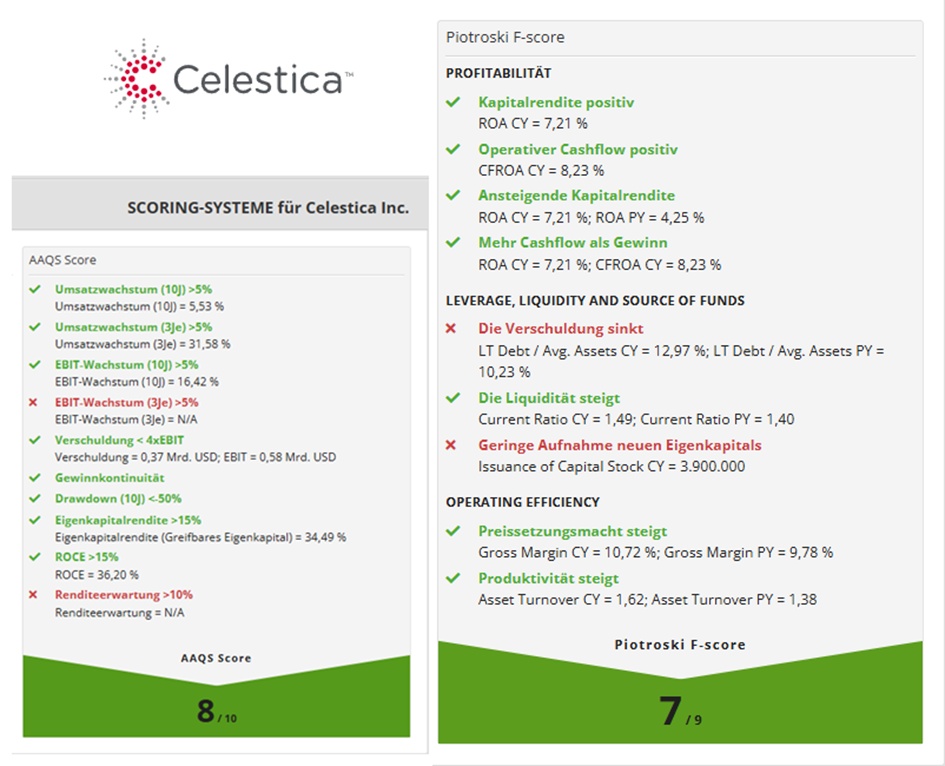

Celestica shows exceptionally strong operational momentum with increasing sales, margins, cash flows and returns on capital - driven by AI/cloud demand and efficient capital management.

Celestica Performance

Ø 10 years 41.86 %

Ø 5 years 105.96 %

Ø 4 years 121.26 %

Ø 3 years 186.34 %

Ø 2 years 200.66 %

2024 215,23 %

2025 220,27 %