Mid-April 2025 casts the tanker market into a gripping saga of resilience and flux. VLCCs stand firm against oil price plunges, Suezmax and Aframax soar on scarce tonnage, and clean tankers weave between Eastern woes and Western grit. Sanctions tighten, tariffs loom, and shadow fleets slip through cracks. This is a tale of a sector thriving amid chaos—let’s set sail.

⏬ VLCC Market: Steadfast Giants

Earnings Snapshot

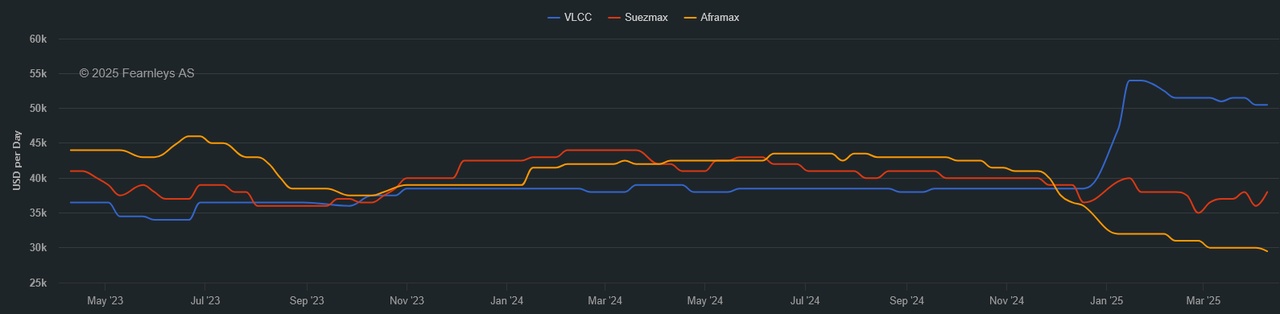

The VLCC fleet, those towering behemoths of crude, holds its ground as oil prices falter. Middle East Gulf-to-China rates linger at WS54.10, delivering $36,533 per day after a $1,100 weekly dip. West Africa-to-China rests at WS58.19, yielding $41,981 daily with a $700 gain, while U.S. Gulf-to-China settles at $8.26 million, equating to $46,629 per day after a $1,000 drop. Earnings cling to the mid-$30,000s, a sturdy anchor as Brent crude slumps to $63 per barrel (its lowest since 2021), trimming bunker costs. Robust cargo flows keep rates buoyant, even as stock markets tremble with unease.

Supply Boosts

A fresh gust lifts the market as OPEC+ unveils a bold 411,000 barrel-per-day output hike, set to ripple through from May. New cargoes will hit the water next week, promising a lifeline against softening trends. Meanwhile, U.S. sanctions on Iran’s exports carve out shadow fleet capacity, sidelining 54 VLCCs and pushing utilization to 90% from 83% since October 2024. Off Malaysia’s east coast, two Russian Suezmaxes offload 2 million barrels to the VLCC Atila, now steaming toward Dongjiakou, China, by April 9. Shadow trades flex their resilience, tightening the reins on compliant tonnage, and VLCCs ride this swell with quiet strength.

Broader Impacts

Global tides tug at the horizon. U.S.-China tariffs climb to 145% versus 125%, stirring unease among traders, with Frontline’s stock down 34% since January yet rebounding 4% in recent Oslo trading. OPEC+’s bullish move jars against recession murmurs, but VLCCs find footing in low orderbooks and an aging fleet averaging 15 years. Analysts glimpse a late-2025 surge if sanctions and output align. For now, stability reigns, with promise bubbling beneath the surface.

For illustrative purposes

⏳ Suezmax Market: Cresting the Wave

Rate Climb

Suezmax tankers, mid-tier maestros of crude, seize a scarcity-driven ascent. Nigeria-to-UK Continent rates rise to WS104.72, netting $48,650 daily after a 9-point gain. Guyana-to-UK Continent reaches WS103.61, delivering $47,818 per day with a 7-point uptick, while CPC-to-Mediterranean steadies at WS130, yielding $65,500 daily. Middle East Gulf-to-Med inches to WS91, and the Baltic TCE leaps to $56,540 per day (a 2025 peak), adding $1,428 in a day. Tight U.S. Gulf and West Africa lists propel late April fixtures to WS102.5 for 145kt cargoes, handing owners a commanding perch.

Hot Zones

The U.S. Gulf ignites with chaos as fixture failures force charterers to secure ships via unconventional routes, shelling out premiums as tonnage vanishes. West Africa pulses with unresolved stems, where owners spurn softer deals, betting on further gains. The Caspian Pipeline Consortium (CPC) roars back with 1.6 million barrels daily from the Black Sea, driven by Kazakhstan’s Tengiz field, stretching hauls to Asia. Middle East Gulf tonnage fades as some vessels ballast south to the Cape of Good Hope, lifting eco-Suezmax rates to $50,300 daily from $45,000 last week. Scarcity fuels this fiery climb.

Trade Twists

Trade flows twist under strain. A Chinese Suezmax, Arina, ferries Venezuelan Merey crude from Cuba to Asia, dodging sanctions or shedding surplus. India rejects the Andaman Skies over non-IACS class issues, prompting a cargo swap to Ozanno for Vadinar delivery. CPC’s export revival and U.S. license cuts in Venezuela (Repsol pivots to Mexican Maya) stoke Suezmax demand. Tariffs rumble in the distance, yet today, scarcity keeps this market ablaze, with risks lurking for tomorrow.

Oil tanker Kerala, chartered by Chevron $CVX (+0.76%)

, is being loaded in the Bajo Grande oil terminal at Maracaibo Lake, Venezuela, January 5, 2023 - for illustrative purposes

⏱️ Aframax Market: Atlantic Roar

Rate Highlights

Aframax tankers, the fleet’s nimble warriors, roar across the Atlantic. U.S. Gulf-to-UK Continent peaks at WS200 before settling at WS190, yielding $52,404 daily after an 11-point rise. East Coast Mexico-to-U.S. Gulf hits WS225.83, delivering $68,309 per day, and Covenas-to-U.S. Gulf reaches WS221.56, netting $61,039 daily—both up 4 points. Cross-Mediterranean climbs to WS178.39, offering $60,646 per day, while North Sea holds at WS135-137.5, equating to $53,221 daily. The Baltic TCE rises to $49,397 per day (2025’s high), gaining $1,015 in a day—Atlantic might echoes loud.

Tonnage Trends

U.S. tariffs on Canadian oil redirect ships to Europe, siphoning Mediterranean tonnage. The U.S. Gulf’s gravitational pull deters ballasters, amplifying rate gains. Mid-April cargoes mostly settle, though stragglers may stretch timelines. Black Sea earnings stand tall with few available ships, while Mediterranean oversupply curbs third-decade fixes—Atlantic vigor lifts the region’s tide. Eco-Aframax rates touch $52,000 daily, outpacing yearly norms as thinning lists stoke the flames.

Sanctions Strain

Sanctions ripple outward. Four shadow Aframaxes—Hui Hai Atlantic, Krymsk, Reneez, and Ladoga—slip Russian and Iranian crude into China’s Dongying after AIS blackouts. Sovcomflot shifts 700,000 barrels of Sakhalin crude off Hong Kong to Gulei, China, bending around curbs. India’s IACS stance narrows compliant options, and U.S. pressure on Iranian facilitators adds tension. Yet Aframax roars on Atlantic strength, unfazed by the undertow—for now.

For illustrative purposes

⏸️ LR/MR/Handymax Market: Currents Apart

Rate Rundown

Clean tankers sail divergent paths. LR2 MEG-to-Japan plunges from WS250 to WS130.28, with MEG-to-UK Continent dropping $271,000 to $3.73 million. LR1 MEG-to-Japan eases to WS139.69, MEG-to-UK Continent falls to $2.86 million, yet UK Continent-to-West Africa holds at WS130, yielding $25,000 daily. MR MEG-to-East Africa slips to WS190, UK Continent-to-U.S. Atlantic dips to WS132.5 ($13,895/day), and U.S. Gulf TC14 slides to WS98.57 ($19,668/day basket). Handymax Med TC6 leaps to WS192.22, while UK Continent TC23 lingers at WS150—East and West drift apart.

Market Moods

Asia’s clean waters darken as weak demand drags LR rates, though cheaper bunkers soften the sting. The West stirs with life—Handymax Med surges on short supply, and U.S. Gulf resists collapse, holding above Covid lows at $19,668 daily basket. Q1 spot rates rival late-2024 peaks, with rising crack spreads defying gloom—OPEC+’s boost could stretch clean hauls if refineries roar. Eastern fade meets Western flicker in this split-sea tale.

Outside Forces

U.S. sanctions on Iranian oil movers intersect with gray fleet pressures. BRS predicts 60 ships—especially LR2 and Aframax—could face scrapping if Russian curbs ease. Tariff jitters drag stocks into the mire, yet tankers’ lean balance sheets (25% debt-to-asset ratios) signal endurance. Clean markets teeter between Eastern slump and Western spark—external winds shape their course.

🌐 What’s Moving It: Oil and Tensions

Oil and Supply

OPEC+’s 411,000 barrel-per-day hike and CPC’s 1.6 million barrel-per-day exports fuel tanker demand. Brent at $63 trims fuel costs, though stock volatility keeps owners on edge. Shadow trades off Malaysia, China, and Hong Kong—moving over 4 million barrels—persist, with sanctions shrinking compliant fleets and lifting utilization. Oil’s surge steers this ship.

Global Dynamics

U.S. sanctions target 30 tankers tied to Iranian and Houthi networks. U.S.-China tariffs (145% vs. 125%) and EU’s 25% countermeasures brew trade war fears. Tankers shine with old fleets and low debt—resilience amid geopolitical storms sets them apart from faltering sectors like containers.

🌐 Market and Stocks: Value in the Vortex

Stock Swings

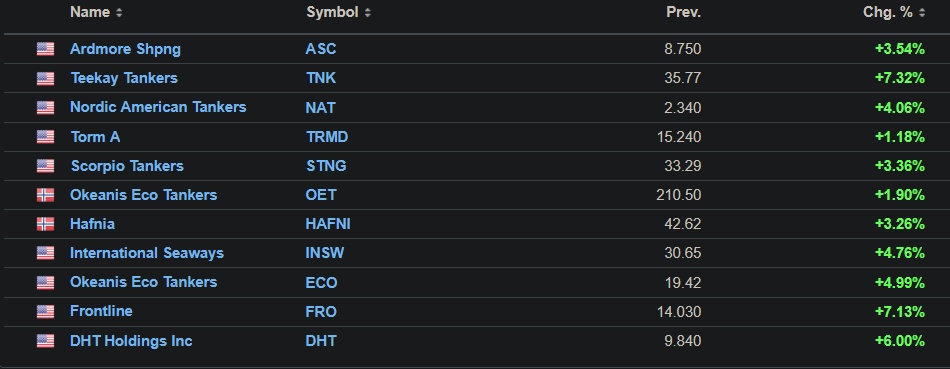

Tanker stocks weather a brutal squall. Frontline $FRO (-0.67%) slides 34% since January, clawing back 4% recently, while Teekay $TNK (+0.38%) nears cash-plus-scrap value ($14 million for a 15-year Suezmax). Hafnia $HAFNI (-1.81%) and Scorpio $STNG (-0.07%) slump to Covid-era lows, yet Q1 rates defy the gloom—tariffs cast a heavy shadow, misaligning stocks with fundamentals.

Investor Angles

Pareto deems the sell-off excessive, noting firms with 25% debt-to-asset ratios trade at trough vessel values—unheard of with elevated rates and newbuild prices. If valuations stagnate, buybacks or take-private moves could surge. Scorpio $STNG (-0.07%) and Torm $TRMD A (-0.42%) lead with deleveraged balance sheets, poised to weather storms. DNB positions tankers to outlast containers in a recession, thanks to rerouting benefits—value beckons, but patience is the watchword—upside whispers grow louder.

Sector Outlook

U.S. tariff pauses (excluding China) nudge shares upward, yet 145% Chinese tariffs cloud consumer impacts. Aging fleets (10% over 20 years) and inflation hint at a 2028 tightening—near-term jitters mask long-term bets. Stocks lag reality, ripe for a rebound if trade steadies—undervalued gems gleam in the chaos.

Tanker stocks - previous close prices (April 10th)(Prev) and intraday (April 11th) moves (Chg %)

🌐 Outlook: Shifting Horizons

Fluid Futures

VLCCs hover at $36,000-$46,000 daily—OPEC+ steadies the keel—resilient yet poised. Suezmax spans $47,000-$65,000 per day—scarcity powers ahead—robust and ready. Aframax ranges $49,000-$68,000 daily—Atlantic thunders on—strong as steel. Clean tankers diverge—LRs at $25,000-$36,000, MRs at $13,000-$19,000 daily—West rises, East wanes—mixed currents flow.

Your Call

Will Suezmax hold its crest, or VLCCs reclaim the helm? Share your take—let’s chart the course! 🚢

1 Year T/C - VLCC SUEZMAX AFRAMAX ECO / SCRUBBER - April 9th

*The Worldscale (WS) rate is a system used to calculate tanker freight rates, where WS 100 represents a standard base rate for a specific route. Rates above or below this benchmark indicate how much more or less a charterer will pay relative to the base cost. A higher WS rate means better earnings for shipowners, while a lower WS rate means lower transportation costs for charterers.