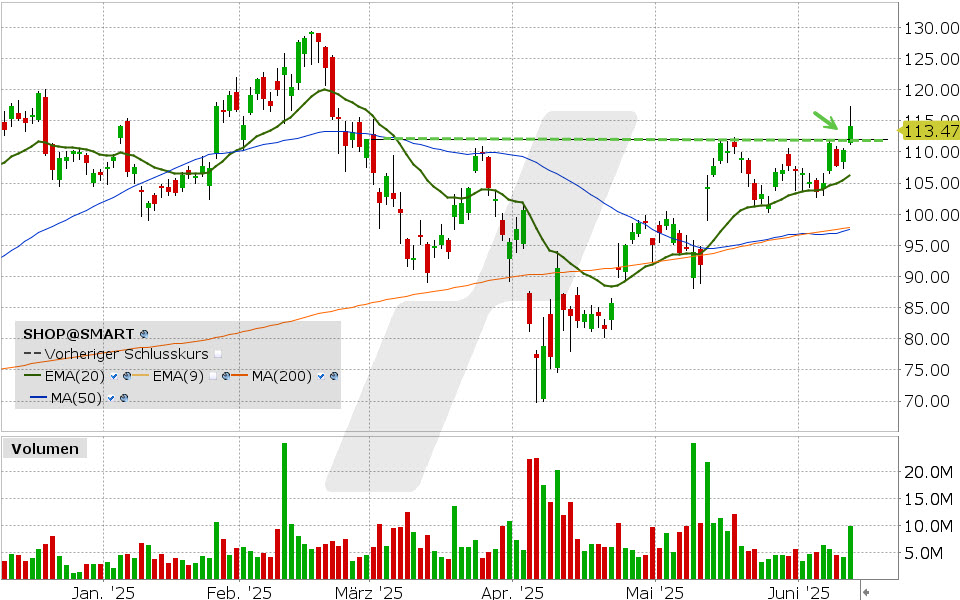

Shopify share: Chart from 09.05.2025, price: USD 94 - symbol: SHOP | Source: TWS

If a breakout above USD 100 now succeeds, a procyclical uptrend will ensue Kaufsignalwith possible price targets at USD 110, 120 and 129.

If, on the other hand, the share falls below USD 89, a renewed setback to USD 80 or to the Aufwärtstrend close to USD 70.

Growth at all levels

In the last five years, turnover has increased massively from USD 2.93 billion to USD 8.88 billion. The leap in profitability was achieved in 2019.

During this time, earnings rose from USD 0.05 to USD 1.22 per share and free cash flow from USD 0.01 to USD 1.23 per share.

On May 8, Shopify presented the Quartalszahlenfor the first quarter.

At USD 0.26 per share, earnings were in line with expectations. With sales of USD 2.36 billion, the company exceeded analysts' estimates of USD 2.33 billion.

For the year as a whole, this corresponds to a 27% increase in sales. The operating result increased by 136% to USD 203 million.

The most significant figure, however, is the free cash flow, which climbed by 56% to USD 363 million. The FCF margin was 15%.

Monthly recurring revenues improved by 20% to USD 182 million.

Gross profit climbed from USD 957 million to USD 1.17 billion

The trading volume (GMV) processed via the Shopify systems increased by 27% to USD 74.75 billion.

Outlook and valuation

For the second quarter, the company is forecasting an increase in sales of around 25% and a rise in gross profit in the high teens.

The FCF margin is expected to be at a similar level to the first quarter, i.e. 15%.

According to the Management Board, there were no signs of a slowdown by the end of April. Shopify continues to record strong growth across all channels and has achieved an increase in GMV of more than 20% for the seventh consecutive quarter.

Growth is particularly strong in Europe, where an increase of 36% was achieved, led by the UK, the Netherlands and Germany.

The current customs issue will be addressed this month with the automated calculation of duty-included prices.

In addition, new major customers such as FAO Schwarz and Grand Seiko have been acquired. Large companies such as Tapestryand Birkenstock are increasingly relying on Shop Pay components.

According to consensus estimates, earnings are set to rise by 18% to USD 1.44 per share this year and FCF by 27% to USD 1.55 per share.

So Shopify is definitely no bargain, but with the continued high growth, the path of least resistance is still the upside.