Artificial Intelligence is not just a software revolution; it's an energy. With the exponential growth of data centers, the demand for clean, constant and scalable energy has put the nuclear sector in the spotlight. But investing in nuclear is not just about buying uranium.

1. Tier 1: Mining (The Base)

2. Tier 2: The Fuel Cycle (The Funnel)

3. Tier 3: The Innovators (SMRs - The Future)

4. Tier 4: Engineering and Operation (The Execution)

Why NUKL?

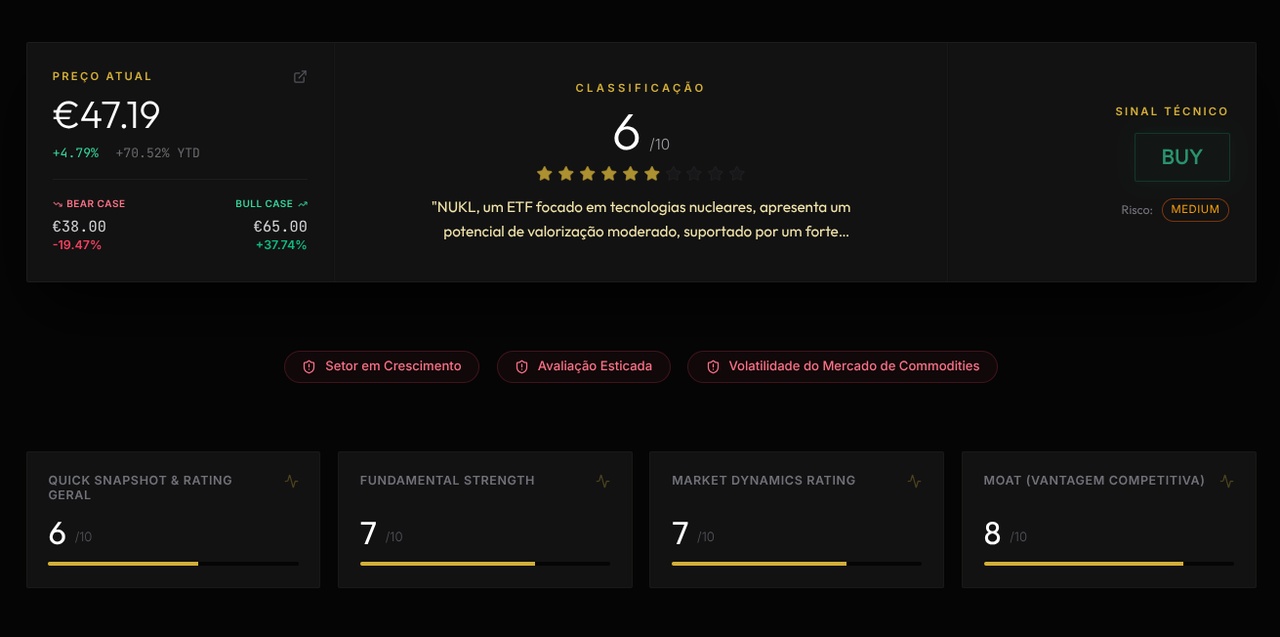

Unlike other ETFs that focus 90% only on mining, the NUKL offers the diversity needed to capture value throughout the supply chain. It is the tactical choice for those looking for

- Sector diversification: Less dependence on the volatility of the uranium spot price.

- Tax Efficiency: In the UCITS (Accumulation)ideal for European investors aiming for the long term without annual taxation of dividends.

If AI is the engine of the new economy, nuclear energy is the fuel.

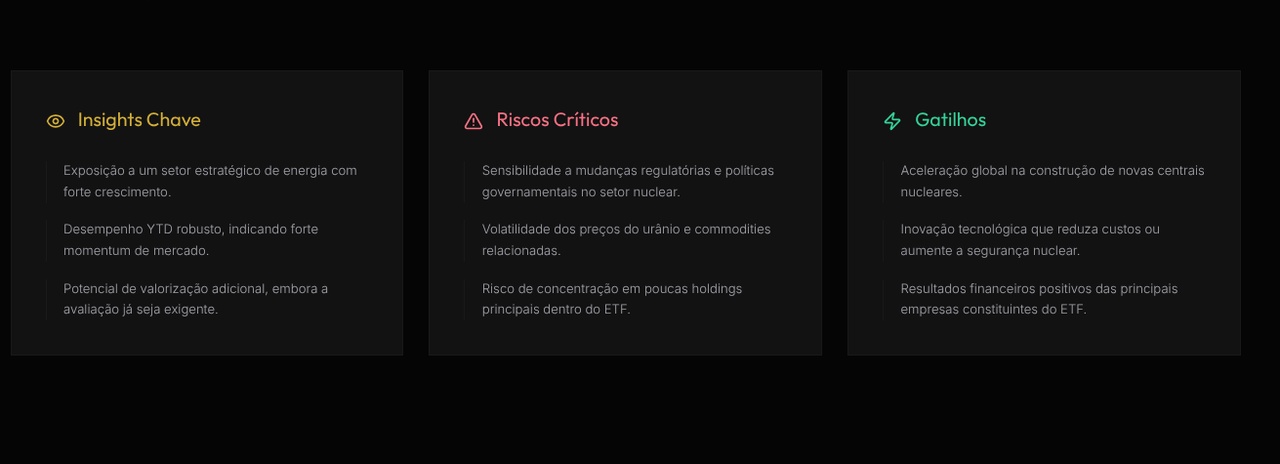

The 'competitive advantage' of $NUKL (+1.82%) lies in its exposure to a sector with high entry barriers and growing global strategic relevance. The companies in the ETF's portfolio benefit from specialized technologies, complex regulatory licenses and capital-intensive infrastructures, creating a significant 'moat'. The diversification inherent in an ETF mitigates the risk of individual companies, but performance is intrinsically linked to the dynamics of the nuclear sector.

$