Here are some thoughts on the shortening of the dollar:

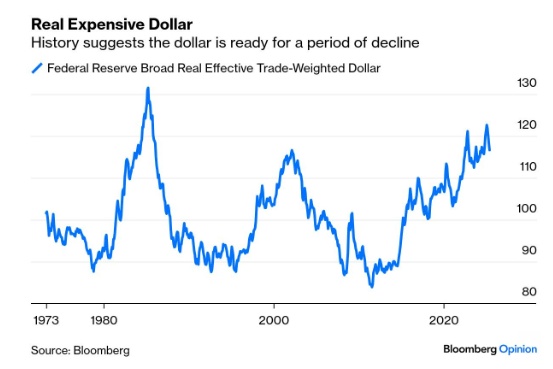

Where does the dollar currently stand?

-> still historically high, but!

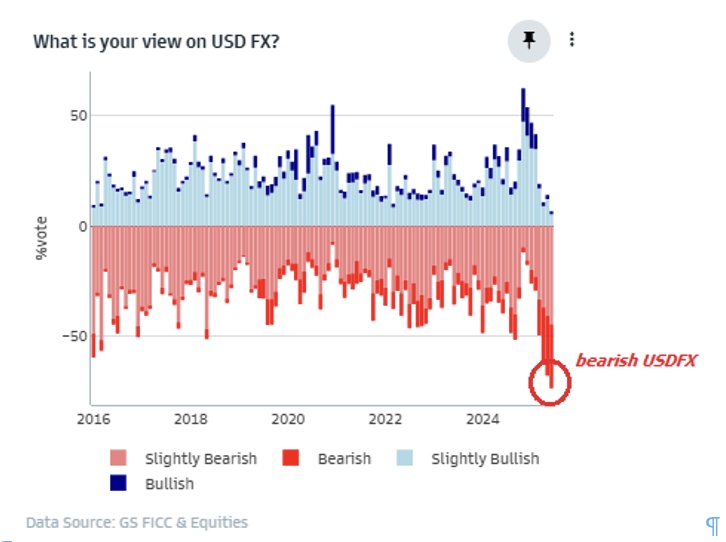

Current bias of the market:

-> shorting the dollar is therefore not

original idea (crowded trade)

Some catalysts for a dollar reversal:

> Trade surplus and financing abroad decrease

(Example: remittances to Mexico fall to a historic low)

-> growing "dollar shortage

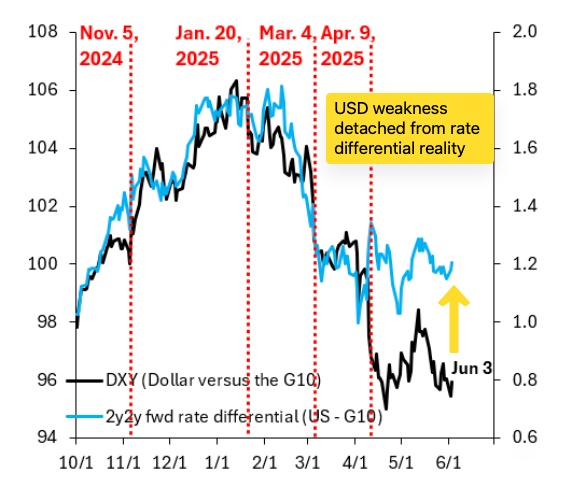

> US dollar has decoupled itself from the rise in interest rates in the short term. This will become relevant in due course (more on this in the conclusion).

(shown is the expected interest rate differential of the USA compared to the other G10 countries - over the next 2 years)

Conclusion/opinion: Even if the US dollar has lost its "safe haven" status in the eyes of some investors, despite its historically high valuation, I believe we will see a return to "dollar safety" with the next full-on crisis in another country, especially EM.

It has to be said that I am personally bearish on the dollar in the long term (10+ years), but it is easy to nuke your account when shorting.

I also don't think hedging is necessary for 99% of the community, as it also requires the right sizing, for example - not to mention that I think it only makes sense from a portfolio size of mid 6-digit to 7-digit range.

On this topic @Epi and @leveragegrinding have also written articles on this topic, take a look at them!

For the additional reach 😉

$NVDA (+0.07%)

$GOOGL (-0.76%)

$1211 (-0.54%)

$MSFT (-0.25%)

$BTC (-0.13%)