Dear Community,

Today we have released another extremely powerful feature for you - initially in the web version, and soon also in the mobile app.

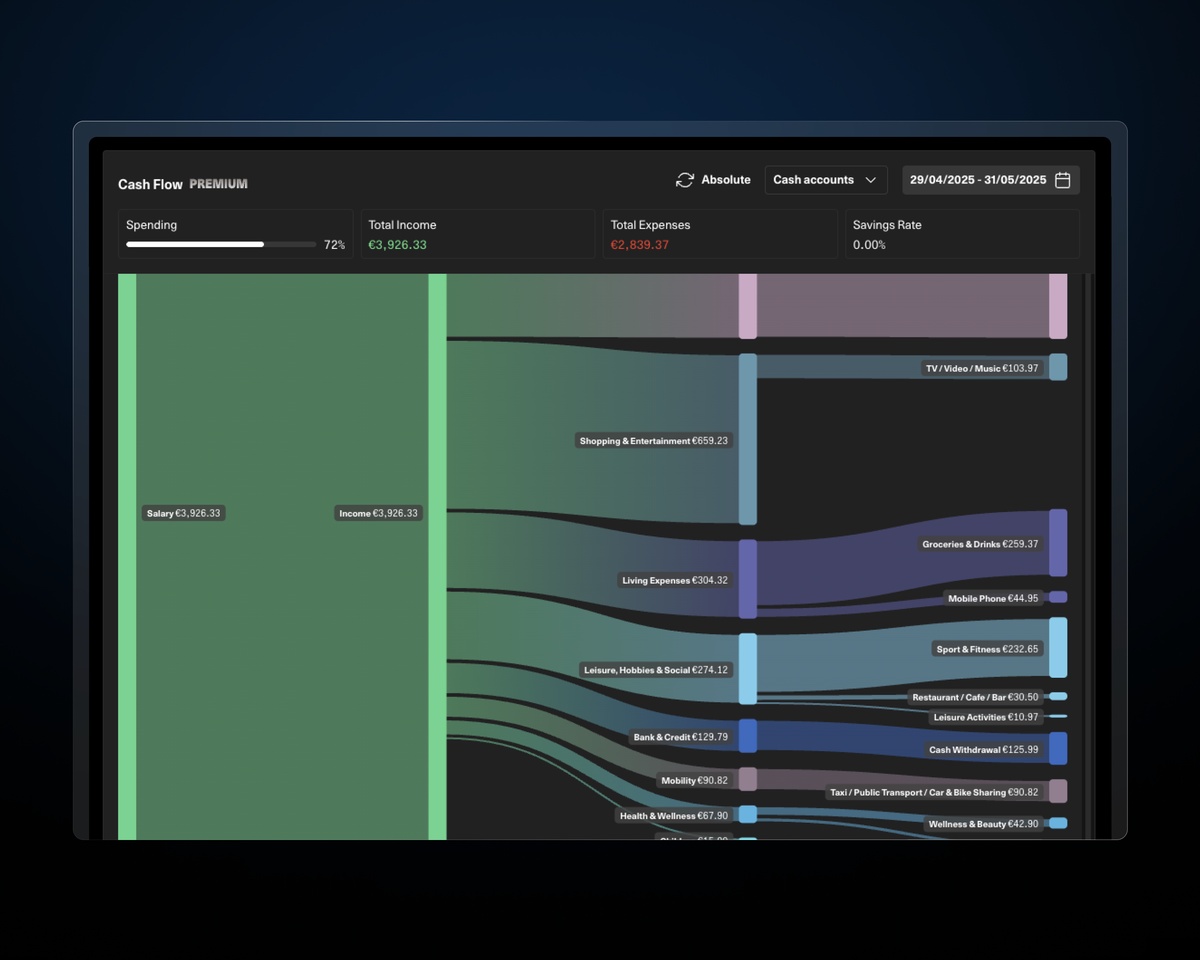

Under Net Worth > Cash > Cash flow you will now find a Sankey chart overview of all your income, broken down by category and your savings rate. This makes it even easier for you to understand what you are spending your money on.

Have fun testing!