👋 Hello dear Getquin community,

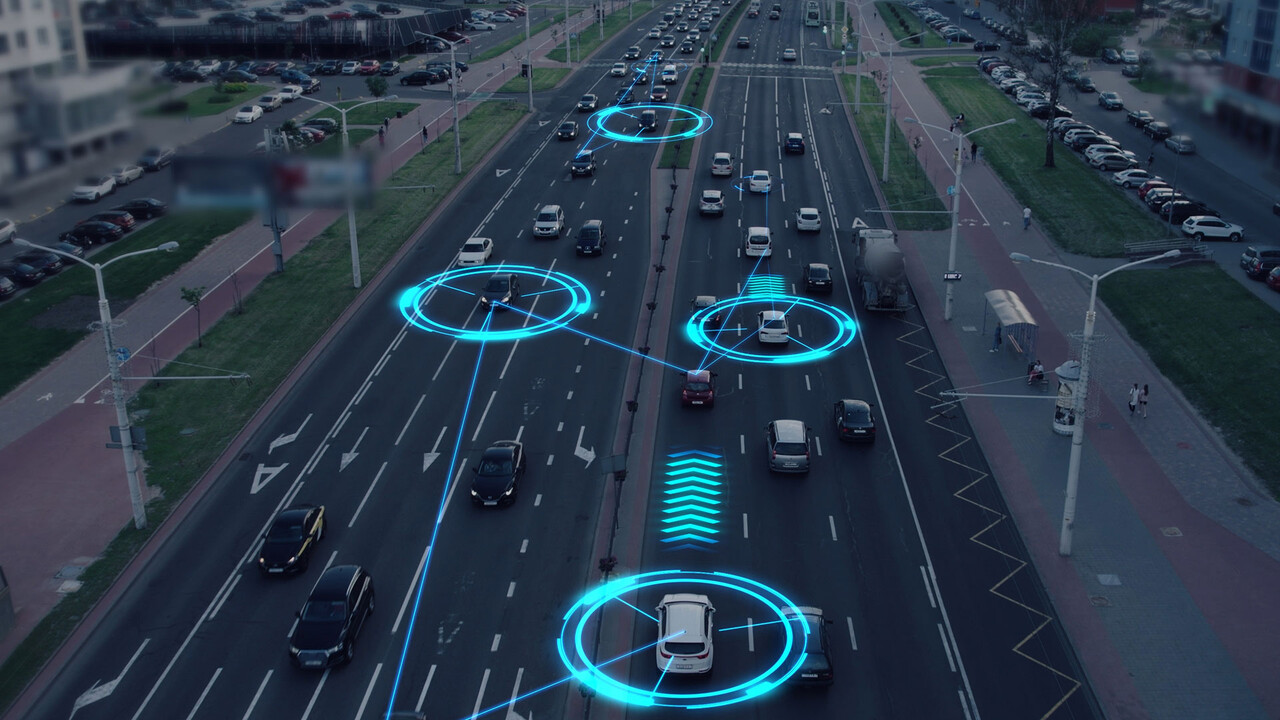

Anyone who has followed my last posts will know that I have already addressed the topic of robotaxis. Today I would like to follow up on this and add an update. This time with a special focus on $08X (-1.1%) Pony.ai. I have not yet presented this company in detail, although it is one of the most exciting players in the global competition.

🌏 The exciting thing about Pony.ai is its dual role. Officially, the headquarters are in Guangzhou, China, while Fremont in California serves as an important research and development location. So you could say that Pony.ai has two centers: China as the operational base with the major test sites and approvals, and the US as the tech hub for development and partnerships. However, the real growth is happening in China. Pony.ai has the largest test areas there, the first permits for driverless robotaxis and strong industry partners. China is pushing the topic of robotaxis on a massive scale with the aim of becoming the world market leader in autonomous driving by 2030. This is precisely why the greatest market potential is currently not in the USA, but in China.

$08X (-1.1%) (CN) Pony.ai as an up-and-coming player in the field of autonomous robotaxis with strong roots in China

$TSLA (+3.46%) (US) Tesla with ambitions in autonomous driving, so far more pilot projects than fleet deployment

$GOOGL (-1.02%) (US) Waymo as a tech pioneer with first large-scale deployments in US metropolitan areas

📊 Market & outlook

Pony.ai currently operates over 300 robotaxis in Chinese tier 1 cities and has over 200 7th generation vehicles in production. The target is 1,000 robotaxis by the end of 2025 and 10,000 units in the medium term. Studies predict a market potential of USD 183 billion in China by 2030 - a huge growth market for all providers.

🏙️ Comparison of the players in the robotaxi market

Pony.ai: approx. 300+ vehicles in China, target 1,000 by 2025

Waymo: approx. 2000 vehicles in US metropolitan areas

Tesla: pilot projects so far, no real robotaxi fleet

👉 Impact: Pony.ai is already in practical use before Tesla and is developing into a serious competitor to Waymo.

📌 Take-away

The battle for supremacy in the robotaxi market is on. Whoever achieves economies of scale and overcomes regulatory hurdles first will secure the platform and thus recurring revenue streams. Pony.ai is one of the most exciting candidates here. Still risky, but with a clear plan towards profitability.

You can find out more about investing in robotaxis and autonomous driving here:

👉 Question for you: Do you believe that Pony.ai will achieve its growth targets and become one of the leading providers in the global robotaxi market by the end of the decade or will a tech giant like Google or Tesla end up overrunning the Chinese competition?

Source: UBS market study, company information Pony.ai, chinadaily.com

Picture: Photo: AlinStock/shutterstock