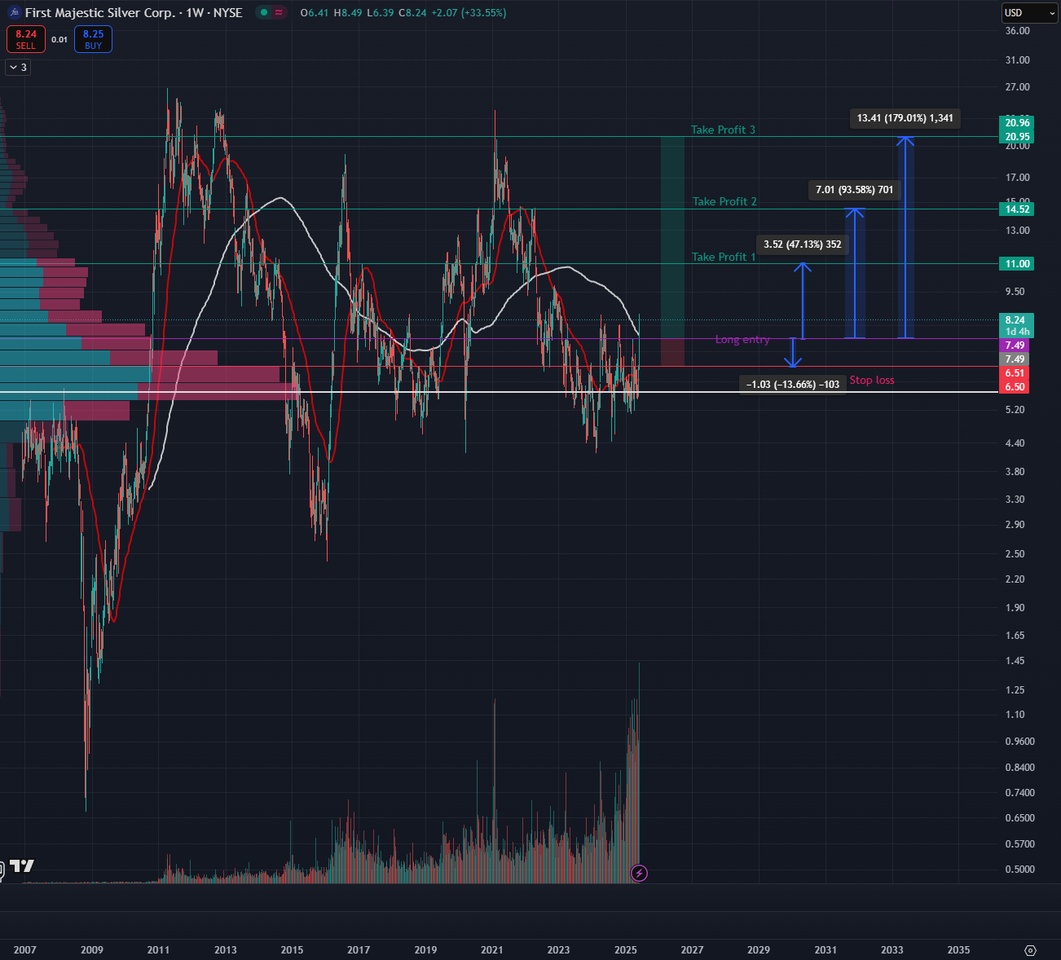

$FR (-9.54%)

broke out above the 200-week SMA today with massive buying volume.

Here is a possible trading idea to bet on a continuation of the silver rally with this mining stock.

This is not investment advice and is merely my personal opinion and trading idea. Everyone must make their own investment decisions and assess the associated risk themselves.

Trading in shares, especially in the commodities sector, can be subject to high fluctuations in value.

👉 Please DYOR (Do Your Own Research)!

🔍 Technical setup:

- Breakout above the 200-week SMA (white line)

- Volume support at a high level

- Horizontal level (~6.50-7.00 USD) was overcome with momentum

- Volume profile shows high interest in this zone → former resistance = potential new support

📈 Trade idea (swing trade on a weekly basis):

🟢 Entry

- Current price (~ USD 8.15) conceivable after breakout, but aggressive.

- Conservative: Wait for a setback to the breakout level ~ USD 7.20-7.50 (pullback to SMA200 or horizontal zone)

🟡 Stop loss

- Below the breakout zone:

- ~6.20-6.50 USDdepending on risk appetite and position size

- Alternatively: below the last weekly lows

🟢 Target zones (take profit)

Short-term (~10.50-11.00 USD): Last swing high range (2022/2023)

Medium/long-term (~13.00-15.00 USD): Consolidation zone from 2021

Bull case (~19.00-21.00 USD): Breakout from multi-year range

⚖️ Risk-reward ratio (CRV)

Example at entry 7.50 USD:

- SL at USD 6.20 (risk: USD 1.30)

- TP1 at USD 11.00 (opportunity: USD 3.50)

- → CRV: approx. 2.7:1

📌 Notes:

- AG is a very volatile silver share, reacts strongly to the silver price.

- Look at the silver future (XAG/USD) - a parallel breakout there increases the validity.

- For speculative trades, always adjust the position size to the risk.