Introduction: What is it about?

Many of you know that I invest a large part of my retirement savings in 3xGTAA, 2xSPYTIPS and 1xGTAA. I do not invest in the classic B&H WeltAG at all. Why am I putting my financial future in the hands of momentum strategies? You are quite right to ask this question and I keep asking myself the same thing. After all, experts educated in financial market theory preach B&H WeltAG almost in unison. In the following article, I would like to give you (and myself) an account of my alternative investment approach.

I will explain the conceptual background of my strategies, in particular that of my flagship portfolio "3xGTAA" (https://www.wikifolio.com/de/de/w/wf03x0gtaa). It could be the most important post you will ever read from me, especially for 3xGTAA investors. So if you want to broaden your financial horizons and aren't afraid of some very basic thoughts on the stock market, you're invited to take a 10-minute wild ride down to the deepest reasons for investing.

In this article, I would like to explain in order:

1. on which financial market theory assumptions is the classic "B&H world AG strategy" based?

2. what is the alternative to these assumptions and how are momentum strategies derived from these alternative assumptions?

3. how do the intuitive beginner investor, the strategic B&H WeltAG investor and the tactical momentum investor compare?

Disclaimer: The basic ideas come from momentum research. However, this is often fragmented and backtest-focused. You will not easily find a fundamental and focused introduction to the topic.

1. the classic: B&H WeltAG and EMH

a. B&H WeltAG

First of all, I would like to avoid any possible misunderstandings: we are leaving behind investment-related pipe dreams such as fixed-term deposits, insurance policies or managed savings bank funds. Casino bets such as 10x leverage certificates, meme coin futures and Canadian mining microcaps are also being left behind. We leave wishful thinking such as "get rich in 10 days" or "simply never work again" to naive beginners.

Our reference point is the best-known and most widespread basic strategy of enlightened private investors: "Sparplan B&H Welt AG" or "B&H strategy" for short, i.e. a passive, monthly savings plan on a globally diversified equity ETF or a basket of high-quality individual shares. Most pursue the B&H strategy either as a simple one-ETF solution (ACWI ETF), 70-30 strategy (MSCI World + Emerging Markets ETFs) or core-satellite strategy (ACWI ETF + ETFs/world equities/gold/BTC). This is also recommended by most reputable financial experts: this is the best way for private investors to achieve a long-term market return of around 7%. More returns can only be achieved with luck or more risk (e.g. with factor investing). But how do the experts actually come to this conclusion? The answer can be found in the central assumptions of modern financial market science.

b. Efficient market hypothesis

The B&H strategy follows directly from the so-called efficient market hypothesis (EMH). The EMH refers to the assumption that the capital markets are essentially efficient, i.e. that all available information is already included in the market prices and therefore the market prices are rational relative to the information. It follows from these three central assumptions about modern capital markets - efficiency, informedness, rationality - that it is impossible to systematically beat the broad market without taking excessive risk. Therefore, the best long-term strategy for private investors is to track the broad equity market in the form of a passive, broadly diversified index ETF (S&P500, MSCI World, ACWI...). The main aspects of "Sparplan B&H WeltAG" are derived specifically from the three assumptions mentioned above:

Efficiency -> Savings Plan: All available information is contained in the current prices, any new information is priced in immediately. Market prices can therefore not be systematically predicted. A monthly savings plan accepts market efficiency and does not attempt to beat the market (e.g. through timing) ("Time in the market beats timing the market.").

Rationality -> Buy & Hold: Prices may fluctuate in the short term, but in the long term they always approach the intrinsic value of the underlying investments. The B&H strategy ignores short-term fluctuations and merely attempts to participate in the long-term growth of the underlying fundamental values (in the case of world ETFs, the global economy) ("Stocks are the best long-term investment.").

Informedness -> WeltAG: Price changes of individual stocks are based solely on new information. As soon as they are known, they are priced in immediately. The B&H strategy avoids the single stock risk through a broad diversification of the investment and only participates in the general market return of approx. 7%pa ("Diversification is the only free lunch.").

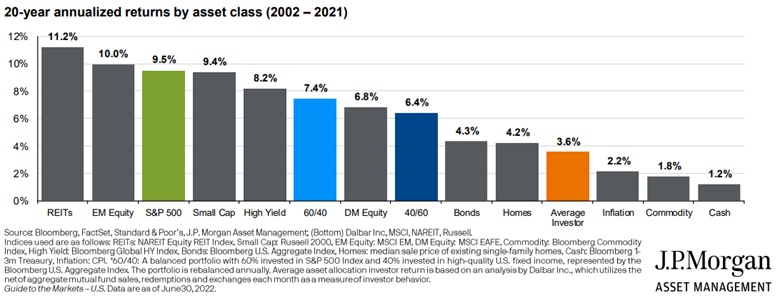

Well-known empirical evidence for this argument is the following graph from 2021, which shows that a private investor who simply invests passively in the broad S&P500 does significantly better than the average investor who tries to beat the market intuitively.

c. Advantages and disadvantages of the B&H WeltAG strategy

Advantages:

Stability: The B&H WeltAG strategy delivers a stable long-term market return of over 7%pa. So far, the strategy has not posted a loss in any 15-year period. Most private investors and fund managers do not achieve this.

Security: B&H WeltAG spreads the risk across the entire stock market. There is no individual stock risk.

Simplicity: B&H WeltAG does not require any special knowledge or active management. An MSCI World ETF in a savings plan with a neobroker is sufficient.

Costs: An MSCI World ETF is extremely cheap to buy and manage, 0.1%pa is feasible. No insurance or active fund can work so cheaply. So your money works for you.

Disadvantages

Stress risk: Stock markets can fall sharply and cause investors to panic sell right at the low when news breaks. Anyone who has never experienced a crash of -50% or more is at a particularly high risk of irrational behavior. This behavior also explains a large part of the poor returns of the average investor.

Risk of return sequence: The possibility of 50% drawdowns every 20 years mathematically leads to a long-term safe withdrawal rate of just under 3%pa despite average returns of over 7%pa. This means that a great deal of capital is required for financial freedom, which postpones the time for this far into the future.

d. Conclusion

The B&H WeltAG strategy is empirically well documented and scientifically substantiated by the EMH. Despite the disadvantages, it is superior to the alternatives mentioned above for the average private investor. So what should be the problem with it? Are there any sensible alternatives to B&H WeltAG and the efficient market hypothesis? There are! So keep watching.

2nd alternative: Momentum and IMH

a. The blind spot: Momentum

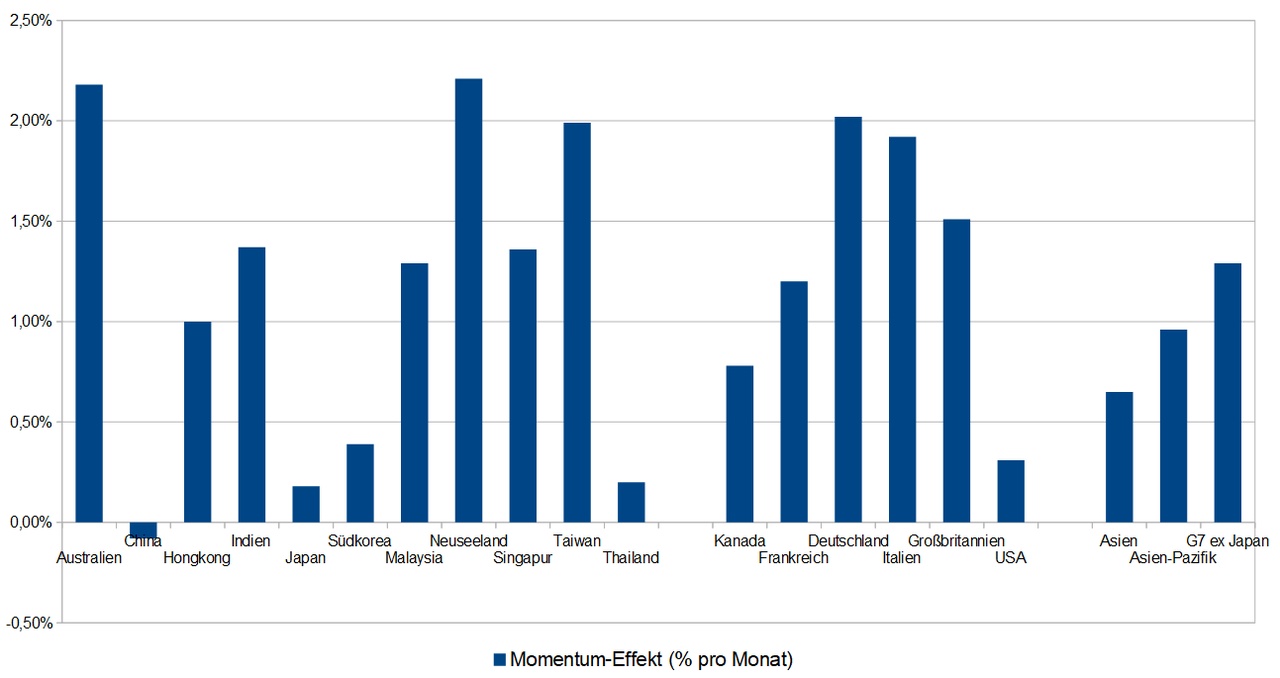

While the EMH can explain the various factors (value, size, etc.) (higher risk premium, volatility), the most significant thorn in the flesh of the EMH remains the momentum effect. It describes the tendency of markets to maintain a chosen direction for longer in the future. Jegadeesh and Titman were the first to document the effect in 1993. They showed that US stocks that perform best (worst) over 3 to 12 months tend to perform well (poorly) in the following 3 to 12 months. Many subsequent studies have confirmed the effect for other markets worldwide.

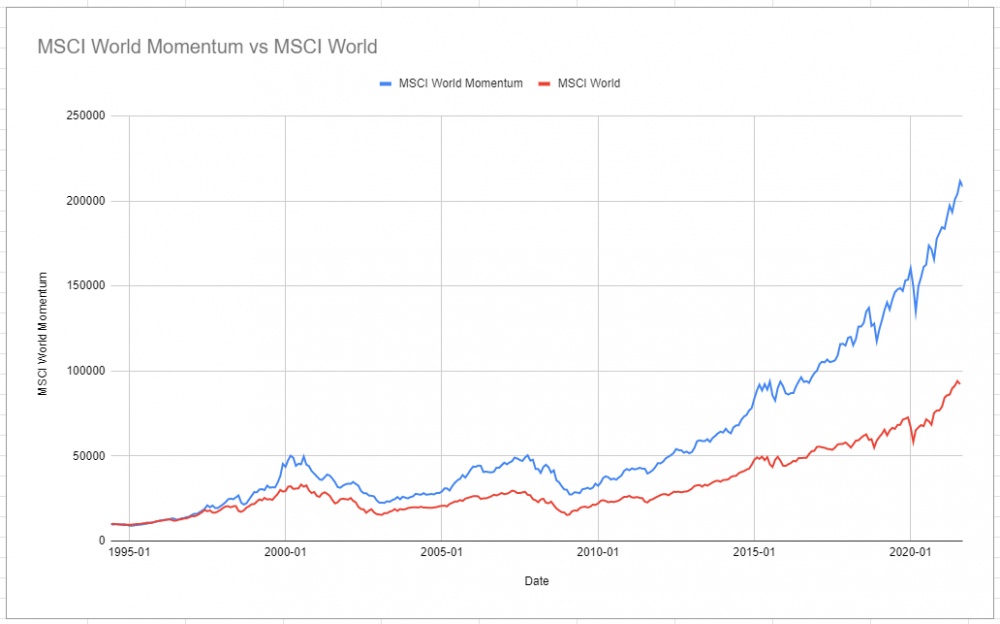

However, the EMH cannot explain the momentum effect! Momentum causes irrational exaggerations in both directions and thus contradicts the assumptions of efficiency, rationality and informedness (certain sub-versions of the EMH leave room for random influences on market prices, but they cannot explain them). Long-term studies across different markets show that momentum strategies that systematically exploit the effect achieve above-average returns with below-average risk. According to the EMH, this is impossible. And yet it really is, as the following comparison of an MSCI World with the MSCI World Momentum illustrates. The latter implements a simple momentum strategy (twice a year, rank the MSCI World stocks according to their 12-month performance and buy the strongest 150 stocks).

b. Inefficient market hypothesis

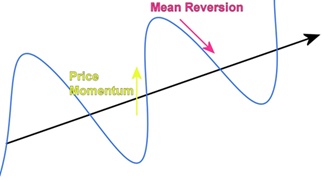

How can the momentum effect be explained if not by the EMH? The starting point for an explanation is the well-known observation that the market is strongly determined in the short to medium term by psychological and informational factors of market participants. Fear and greed often drive prices to levels that are difficult to justify fundamentally. Different access to relevant information and its correct evaluation lead to different assessments of the market by investors. The following image illustrates the momentum effect and its logical counterpart, the mean reversion effect, against the backdrop of a steady fundamental trend.

The illustrated situation looks almost trivial, but has enormous consequences! It means that the capital markets are not efficient in the short to medium term. I refer to this assumption as the inefficient market hypothesis (IMH), based on the classic efficient market hypothesis (EMH). Even though this assumption hardly plays a role in classical financial market science, it is neither new nor unknown. There is a separate branch of science that deals with the reasons for market inefficiencies: behavioral finance.

Behavioral finance explains the momentum effect through various effects, e.g. loss aversion (investors react more sensitively to losses than gains), anchor heuristics (misjudgments based on previous information), underreaction (slow processing and pricing in of new information), overreaction (overoptimism and extrapolation when prices rise), overconfidence (self-attribution of successes and overweighting of winning stocks), herd instinct (orientation towards the behavior of the masses). All these effects mean that markets often react too weakly to new information at first and then too strongly later on. Behavioral finance therefore confirms the IMH and explains the momentum effect.

The IMH turns the assumptions of the EMH on their head. If the capital markets are inefficient, irrational and uninformed in the short to medium term, then it may still be possible to systematically beat the broad market - with an appropriate momentum strategy! The main aspects of the momentum strategy are derived from the IMH's reversal of the central assumptions of the EMH:

Inefficiency -> trend following: market prices are more likely to follow a trend once it has started in the short to medium term. The momentum strategy exploits this market inefficiency by betting on the continuation of the current trend ("The trend is your friend.").

Irrationality -> price sequence: Markets can be overvalued or undervalued for a long time and continue to move in irrational directions. The momentum strategy ignores fundamental over- or undervaluations and only follows price movements ("Markets can stay irrational longer than you can stay solvent.").

Uniformity -> market rotation: Different markets are in different phases of information processing. An effective momentum strategy observes different, uncorrelated markets and always invests in rising markets while avoiding falling markets ("There is always a bull market somewhere.").

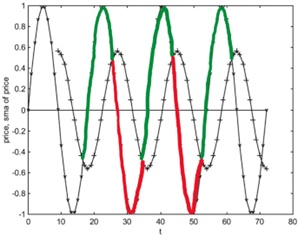

The following chart shows the basic idea of the simplest form of a momentum strategy: "Invest in an index when it is trading above the 200-day simple moving average." In contrast to the B&H strategy, a momentum strategy would only be invested in the green phases. As a result, the momentum strategy would generate a positive return, while B&H would remain at 0 overall.

The following comparison with the B&H ACWI strategy in the period 1971-2015 by Antonacci, the inventor of the "dual momentum strategy", provides empirical evidence of the effectiveness of momentum strategies. As you can see, most of the excess return does not result from outperformance in bull markets, but from avoiding bear markets. (Absolute momentum: Hold S&P500 when it is higher than a year ago. Relative momentum: Hold S&P500, ex-USA markets or bonds, whichever has the best 12-month performance. GEM: Hold S&P500, ex-US markets or bonds, whichever has the best 12-month performance and is higher than a year ago).

c. Advantages and disadvantages of momentum strategies

Advantages

Excess return: Momentum strategies can systematically generate significant excess returns over the long term.

Risk reduction: The lower drawdowns of momentum strategies reduce the risk of subsequent returns. This increases the safe withdrawal rate and significantly reduces the age of financial freedom.

Stress reduction: Investing in rising asset classes statistically reduces the probability of crashes and thus the risk of wrong decisions under stress.

Disadvantages

Complexity: Simple momentum strategies can either reduce risk but not increase returns (MSCI World + SMA200) or vice versa (MSCI World Momentum). Increasing returns while reducing risk requires more complex strategies. In-depth knowledge of the characteristics of asset classes (correlations, currency influences, ETF range) and backtests (parameter optimization, model programming, avoidance of overfitting) is required to build such strategies.

Activity: Implementing a momentum strategy requires discipline, patience and attention over many years and decades: the portfolio must be regularly reviewed and the composition adjusted accordingly. It is possible to design momentum strategies that only require signal evaluation and implementation once a month. But the psychological risk of deviating from the chosen strategy after a long period of underperformance is statistically very high. This is also the main reason why complex momentum strategies such as 3xGTAA are only suitable for experienced investors who understand that a 20% drawdown can happen at any time.

Costs: Regular portfolio rebalancing can result in higher trading costs and taxes. Choosing low-cost ETFs with low iXLM, a low-cost, reliable broker, and possibly a tax-free wrapper will have a significant impact on performance. A mistake in any of these areas can make a strategy unprofitable.

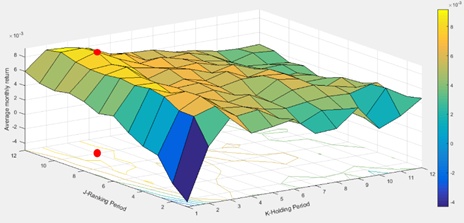

The difficulty of finding an optimal momentum model can be seen in the following graph from momentum research. Each point on the surface represents one of 575 possible momentum portfolios on the German stock market. It shows the monthly return (Avg. mon. return) depending on the lookback period (J-Ranking Period) and the holding period (K-Holding Period) in the period from December 1989 to January 2018. You can see that the worst performing strategy is one with a 1-month lookback and 1-month holding period, and the best with a 10-month lookback and 3-month holding period (red dot).

d. Conclusion

The momentum effect has been proven historically and systematically. This makes it possible to criticize the classic efficient market hypothesis and to search for alternatives to the classic B&H WeltAG strategy. More complex momentum strategies, such as 3xGTAA, systematically promise significantly higher returns and lower risks than are possible from a classic perspective. However, the development and implementation of such momentum strategies require above-average knowledge and activity. They are perfectly feasible for private investors, but not necessarily suitable for everyone.

3. comparison of investment strategies

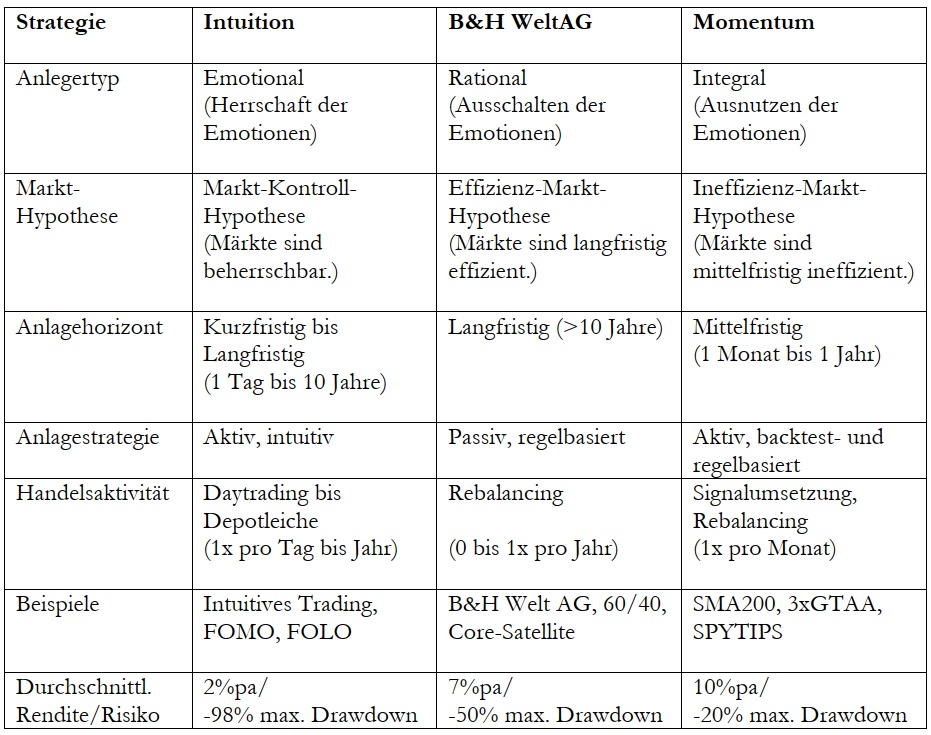

The following table compares the key characteristics of the three most important investor types and strategies (there are of course more, e.g. day trading, value investing, etc., but these should each fall somewhere in the spectrum):

4. conclusion: the decision

So why momentum strategies instead of B&H strategies? In short: because they are based on financial market theory assumptions that enable significantly higher risk-adjusted returns than B&H WeltAG.

The decision as to whether to use B&H or momentum depends largely on your own understanding of the financial markets: Do I think the markets are rationally or emotionally driven? The truth probably lies somewhere in between: in the short to medium term, they tend to be emotionally driven, prices need have nothing to do with intrinsic values; in the long term, they tend to be rational, prices ultimately always find their way back to their intrinsic values.

What does this mean for choosing your own strategy? For the layman with no further knowledge, the easiest and safest way is probably to bet on the long-term efficiency of the markets with B&H WeltAG. WeltAG ETF, savings plan, sleeping pill, 7%pa. If you want more and are prepared to acquire the necessary knowledge and discipline, you can exploit the short-term inefficiencies of the markets via Momentum. Model building, signal implementation, perseverance, >10%pa.

The decision is up to each individual. I have made my decision. And I invite everyone to become part of the paradigm shift in investing. Momentum still has a shadowy existence among investment strategies!

Who of you prefers to stay in the EMH paradigm and who dares to make the paradigm shift? Perhaps the most important decision in your financial life!

5. literature

Gary Antonacci: Double the momentum for double the profits, 2015.

Gary Antonacci: Absolute Momentum: A Simple Rule-Based Strategy and Universal Trend-Following Overlay https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2244633

Meb Faber: A Quantitative Approach to Tactical Asset Allocation https://papers.ssrn.com/sol3/papers.cfm?abstract_id=962461

6. sources of the illustrations

https://www.justetf.com/en/academy/commodities-and-inflation.html

https://medium.com/gradient-growth/trading-styles-mean-reversion-v-trend-following-896aee482f40

https://www.optimalmomentum.com/why-does-dual-momentum-outperform/