Introduction:

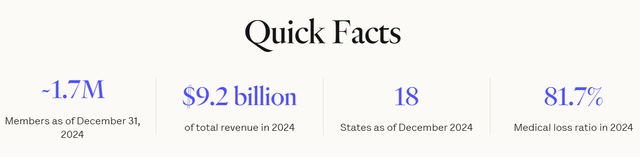

Oscar Health $OSCR is a medium-sized company based in the USA that provides around 1.7 million members with health insurance via a modern tech platform. Oscar relies on a digital, direct-to-consumer (D2C) business model. This enables more cost-effective premiums and high operational efficiency, particularly through the early and far-reaching use of artificial intelligence (AI). Unlike traditional insurers, OSCR is technologically digital and automated from the ground up.

Investment thesis:

- Scalability & margin improvement: Despite revenue growth of over 67%, Oscar has improved its EBITDA margins from -44% (three years ago) to -5.8% currently - a rare balancing act between rapid growth and cost control.

- Technological lead: While other insurers are still trying to integrate AI into their outdated systems, OSCR is AI-native from the ground up.

Cost efficiency: Automation lowers operating costs and makes Oscar an agile, high-margin player in the healthcare insurance market.

Great growth potential in the ICHRA market:

A particularly promising growth area is the market for Individual Coverage Health Reimbursement Arrangements (ICHRA). Here, employers reimburse their employees for individual health insurance policies - more flexible and often cheaper than traditional group policies.

- The ICHRA market is expected to triple to quintuple by 2030.

- OSCR's D2C approach is optimally geared towards this segment.

- Even though large competitors such as UnitedHealth are entering the market, OSCR has advantages in personalization through partnerships and its platform.

Risks:

- A significant portion of the current business is based on Affordable Care Act (ACA) subsidies, which were heavily subsidized under the current Biden administration.

- Should these subsidies be reduced or eliminated under a future administration (e.g. Trump), OSCR would have to switch massively to the ICHRA model - a potential challenge for a small cap company.

- Regulatory uncertainties in the pharmaceutical sector could also influence the expenditure structure.

Valuation & upside potential:

- OSCR is valued at 0.2 times expected sales - unusually low given its strong growth.

- There are hardly any comparable companies with similar sales growth (over 60 %) and market value (over USD 2 bn) - OSCR is a unique case here.

- Should the market normalize, a sales multiple of 3x would be realistic - which corresponds to a price potential of over +900% (10x).

- Even on an earnings basis (forward P/E 2026: ~22x), the fair price target according to analyst estimates is around USD 24.50 - over 40% potential over the next 12-18 months.

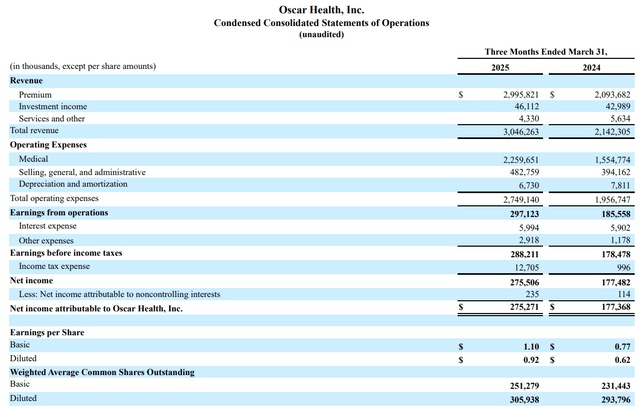

Financial highlights Q1:

- Sales growth of 42% to over USD 3 bn.

- Operating result (EBIT) +60 % year-on-year.

- Member growth and falling administration ratios reflect economies of scale.

- Solid balance sheet with around USD 4.9 billion in cash and cash equivalents.

Quote from Trump that could change the healthcare industry:

"In the White House, at 9:00 A.M., I will be signing one of the most consequential Executive Orders in our Country's history," President Trump wrote on Truth Social. "Prescription Drug and Pharmaceutical prices will be REDUCED, almost immediately, by 30% to 80%. They will rise throughout the World in order to equalize and, for the first time in many years, bring FAIRNESS TO AMERICA! I will be instituting a MOST FAVORED NATION'S POLICY whereby the United States will pay the same price as the Nation that pays the lowest price anywhere in the World"

Conclusion:

Oscar Health is a fast-growing, technology-leading insurer that is challenging the industry with its D2C model and focus on efficiency and AI. The ICHRA market offers tremendous additional growth potential, while regulatory risks - especially in the ACA area - need to be kept in mind. Whether there will be a breakout or the new $HIMS (+0.14%) we will have to see, it falls in comparison to safety and growth, I am analyzing the company for now.

Info written by me with LLM!