I have found the following:

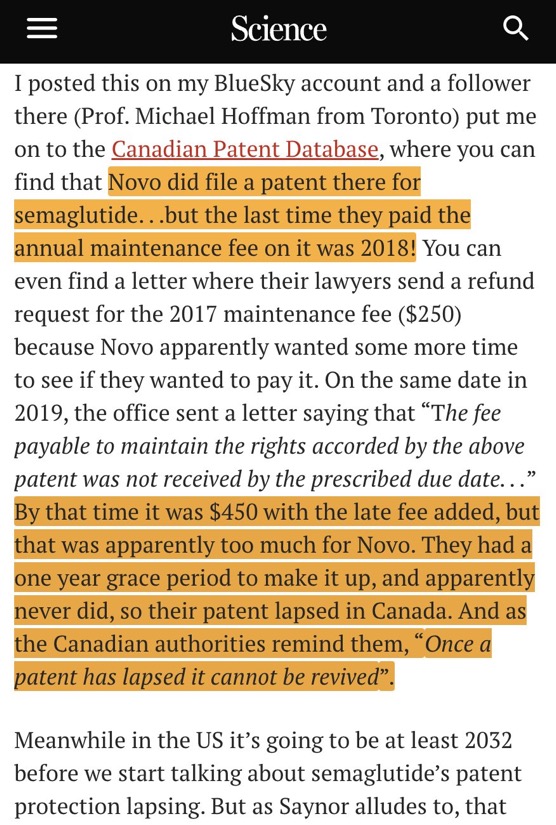

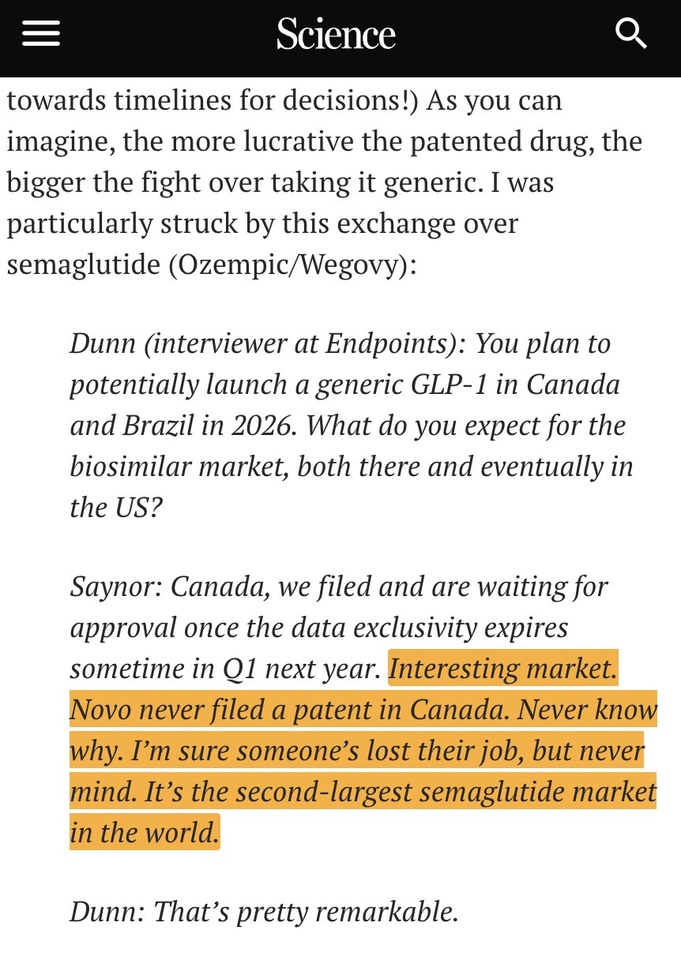

Yesterday rumors surfaced that $NOVO B (+2.52%) had not paid the maintenance fee for its semaglutide patent in Canada, causing the patent to expire prematurely. This could pave the way for generic competition in Canada as early as 2026, years before the patent expires in other countries.

The article that first reported this was published six days ago. So far, no market reaction. Novo has not commented. It remains unconfirmed.

At first glance, it seems unlikely that Novo simply "forgot" to pay, but some have suggested that it may have been a deliberate strategy related to Canada's unique pricing rules.

In Canada, patented drugs are under the jurisdiction of the PMPRB, a pricing authority that limits the prices of patented drugs. However, if a drug is not patented, the PMPRB loses jurisdiction. So no patent means no price control (until generics come on the market).

When the patent expired, the PMPRB proposed stricter price regulations that could have led to a significant price reduction for drugs like Ozempic.

Novo may have compromised:

- Lose patent protection sooner

- In the meantime, avoid PMPRB price controls

- Maximize pricing while still enjoying de facto exclusivity (until generics come to market).

Interestingly, other Canadian patent applications for Ozempic have also been withdrawn, suggesting that this may not have been a one-off mistake but a deliberate IP strategy.

In a nutshell:

It may not be a case of incompetence/a mistake , but a choice between longer exclusivity under price caps and shorter exclusivity with freer pricing.

However, these are unconfirmed rumors and not official statements.

Here is also a report on this:

https://www.labiotech.eu/in-depth/novo-nordisk-semaglutide-patent-expiration-canada/

https://www.ncbi.nlm.nih.gov/books/NBK602920/table/t03/

Let's see how it goes on ✌️