𝐁𝐮𝐜𝐡𝐮𝐧𝐠𝐬𝐭𝐚𝐠 ≠ 𝐖𝐞𝐫𝐭𝐬𝐭𝐞𝐥𝐥𝐮𝐧𝐠

Why I slipped into the overdraft facility at DKB

Today a contribution from the category "Learn from the mistakes of others" or, more precisely, from the mistakes of the donkey.

𝐖𝐚𝐬 𝐢𝐬𝐭 𝐩𝐚𝐬𝐬𝐢𝐞𝐫𝐭?

At the beginning of April, DKB debited "interest for granted overdraft" from my account. This irritated me because I always make sure to keep 10k in my checking account at the beginning of the month and my spending from the checking account has been far from 10k in recent months.

𝐖𝐚𝐬 𝐡𝐚𝐬𝐭 𝐝𝐮 𝐝𝐚𝐧𝐧 𝐠𝐞𝐦𝐚𝐜𝐡𝐭?

To be on the safe side, I did go back through my account transactions, but didn't find anything suspicious. The next thought was then of some form of fraud. But after I took a closer look at the debit, it was clear that it was initiated by DKB itself. So I wrote to the DKB support.

𝐖𝐚𝐬 𝐡𝐚𝐭 𝐝𝐞𝐫 𝐃𝐊𝐁 𝐒𝐮𝐩𝐩𝐨𝐫𝐭 𝐠𝐞𝐚𝐧𝐭𝐰𝐨𝐫𝐭𝐞𝐭?

First of all, nothing. The answer actually came today, almost a month later. Quote:

"On 04.01.2022 you received some credits from the deposit. However, as shown in the turnover display and indicated in the securities statement, these had a later value date.

Since you have already transferred the amounts on before the actual value date, your account was in debit from the value date."

𝐎𝐤𝐚𝐚𝐚𝐲𝐲𝐲 ...?!

I restructured my portfolio at the beginning of the year. In the process, I sold some stocks and ETF, waited until the sale proceeds showed up in my account (so I would also know right away how much tax was withheld), and then sent the money to Scalable to buy stocks / ETF according to my new strategy.

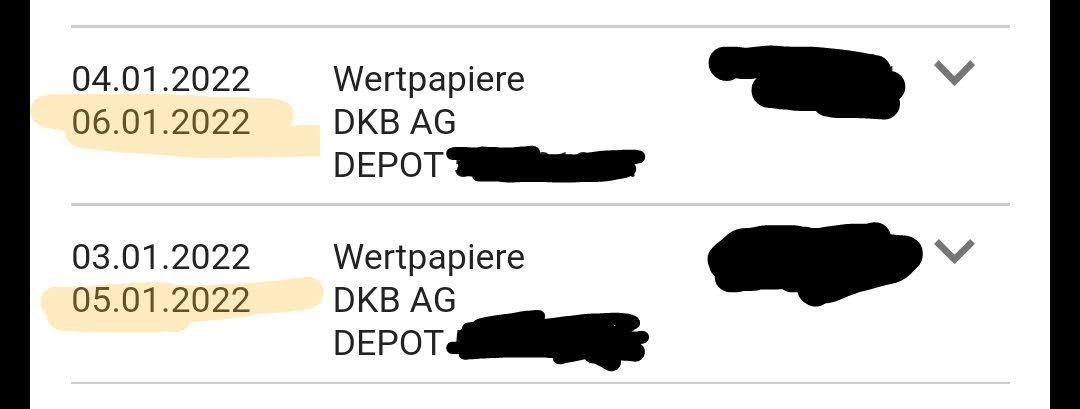

What I didn't pay attention to: The sales proceeds were indeed posted to my account on 04.01. (posting date) and also my balance in online banking was increased accordingly, but the value date was only 06.01. Since I assumed that my account balance shown in online banking is decisive (which was already increased by the sales proceeds on 04.01.), and not any value date, I transferred the money (> as the balance on my checking account) directly on 04.01. to Scalable. As a result, I slipped into overdraft for 2 days, even though my account had a positive balance.

Uh yeah ... Banks ... that would not have happened with crypto 🤡. Anyway, I learned the difference between booking day and value date and can only recommend everyone not to sell shares / ETF 🚀 or if then wait until the value date has actually arrived in the account before sending the money further. Do not rely on the account balance in online banking (especially if you are with DKB) but also check the value date. In the DKB app, this is the date at the bottom of your turnover display (see screenshot).

#broker

#buchungstag

#wertstellung

#learn

#esel