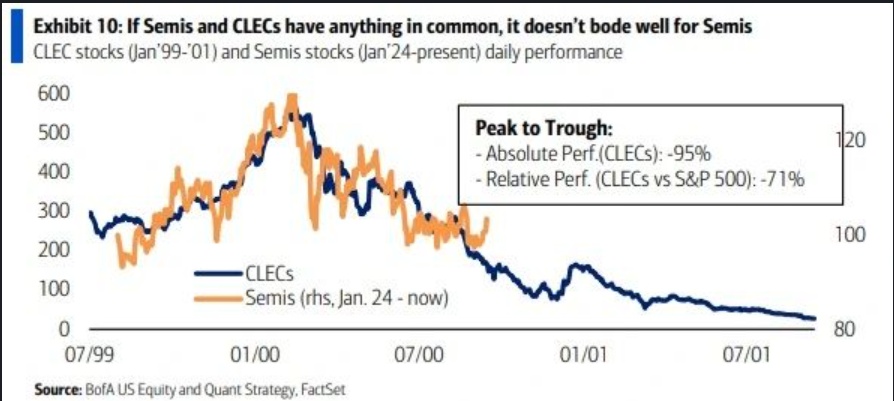

The current hype surrounding AI is reminiscent of the dotcom bubble, but above all the era of the Competitive Local Exchange Carriers (CLECs) in the late 1990s. CLECs were new telecommunications providers that emerged after the deregulation of the US market in order to compete with established providers such as $T (+0.29%) competition. They expanded aggressively, raising billions in investor money and shaping the dotcom bubble, but later failed spectacularly due to over-indebtedness and lack of profitability.

Today, the AI sector is attracting similar attention: high valuations, a race to expand infrastructure and euphoric growth forecasts dominate the news. But despite superficial parallels, there are crucial differences in profitability, demand dynamics and financial stability.

What do AI & CLECs have in common?

- As was the case with CLECs back then, we are now seeing extreme valuations for AIs. $NVDA (-3.26%) For example, AI is trading at a P/E of over 70, similar to the 200x sales valuation of Level 3 Communications in 1999.

- The AI sector is currently attracting billions, comparable to the USD 30 billion raised by CLECs up to 2000. Goldman Sachs forecasts 200 Mrd. USD globale KI-Investitionen bis 2025.

- AI companies are under pressure to massively expand infrastructure, while prices for cloud services are falling. This is reminiscent of the CLECs that inflated infrastructure despite falling phone rates.

Why AI is different

In the current valuation, the AI industry is fundamentally different from CLECs.

While $MSFT (-0.32%) or$GOOG (-3.34%) are profitable with stable operating margins of over 40%, CLECs operated at a loss at the time, i.e. their business model was largely limited to the costly reselling of standardized telecom services without added value. The AI sector is also much more financially disciplined. Big tech companies have debt ratios below 15% and have high cash reserves, whereas CLECs were up to 70% in debt and ultimately went under in the wave of mass bankruptcies around 2001.

A decisive difference also lies in the demand dynamics. AI tech is now used across industries, from precise drug development in the pharmaceutical industry to route optimization in logistics. This real, scalable demand contrasts with the CLECs, which built infrastructure for speculative customer groups that never materialized.

Then there is the innovative edge. Proprietary chips (such as Googles TPUs or Nvidias GPUs) and other software solutions create technological competitive advantages. CLECs, on the other hand, only offered standardized telecom services that hardly differentiated themselves.

There is also a paradigm shift in risk management. Companies like Meta are investing specifically in projects with a clear ROI focus instead of using debt for oversized and ultimately useless infrastructure projects like CLECs. This strategic agility underlines the maturity of today's tech industry compared to the dotcom era.

No dotcom 2.0

In my view, the AI boom is is not a bubblebut a structural change. The combination of real demand, financial stability and technological added value makes AI fundamentally different from CLECs.