$OKTA (-2.12%) achieved GAAP profitability for the first time in the latest quarter.

Looking at Okta's financials, it has a strong balance sheet and generates solid free cash flow.

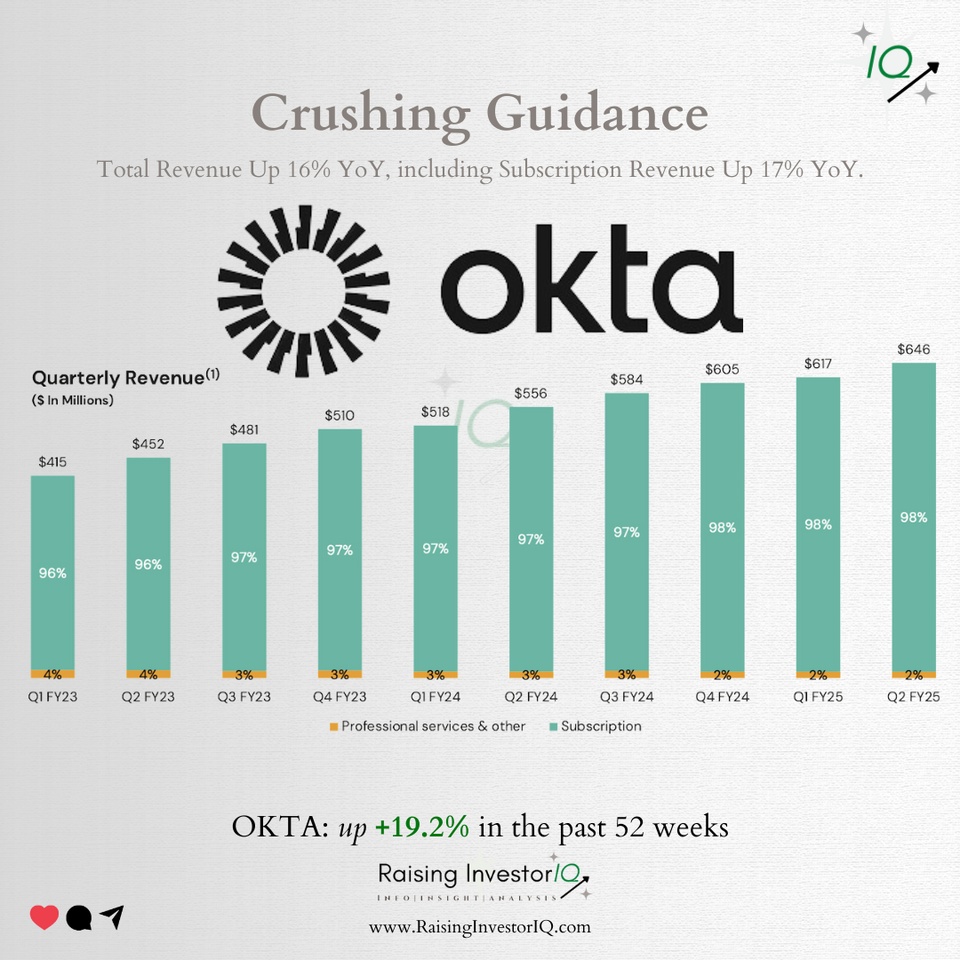

With approximately $700 million in free cash flow expected for FY25 and potentially around 29% free cash flow margin for fiscal 2026, Okta demonstrates robust financial health.

At about 19x forward free cash flow, Okta presents a potentially appealing valuation for a company with appealing prospects. Thoughts?🤔