Foreword

I know what you're thinking. Is it time for finance porn again? You normally only see figures like this in dubious YouTube videos, WhatsApp or Telegram groups. But behind this theoretical performance is not a "magic trick", but a tough, quantitative set of rules. You will not only see the historical backtest returns below, but I will of course also show you the real returns that have been achieved since the start of the project. In the end, decide for yourself how realistic and how high the average annual return can be.

Introduction

Many private investors invest based on gut feeling, news headlines or "hot tips". I have decided to tune out the noise and put my trust in the bare figures. After months of development and intensive backtesting, today I present to you the logic of my S&P 500 Hybrid Momentum Model.

My goal: to motivate you to understand momentum not as "gambling" but as quantitative engineering and, of course, to get as close as possible to the returns of the backtest.

🔍 The origin: From ETF to individual stocks

It all started with classic momentum ETFs and strategies such as GTAA (Global Tactical Asset Allocation). But I wanted to know: Could this principle be transferred to individual stocks to significantly beat the market? After hundreds of backtests, analyzing various universes (SPY, QQQ) and sectors, I now have my set of rules.

💡 The basic idea: "Buy high, sell higher"

Winners" statistically continue to run, while "losers" continue to fall - Buying at the ATH is historically more profitable than buying at the ATL.

While value investors act according to the motto "buy low, sell high", momentum uses the statistical tendency: Winners keep on running.

- An all-time high (ATH) is not a warning signal, but a sign of strength.

- The opportunity costs (waiting on the sidelines) are historically often higher than the risk of buying at the peak.

🧩 The concept: a selective powerhouse

My approach is a purely quantitative set of rules that isolates the strongest trends in the S&P 500:

The Universe: Focus on the 500 most liquid US large caps (S&P 500).

The selection: A pool of 8 stocks is selected through a time-weighted momentum scoring filtered. More recent price developments (last 6 months) weigh more heavily in order to capture trend reversals early.

The anchors: Oil & crypto proxies flow in as strategic counterweights to generate additional performance in specific cycles (inflation/risk-on).

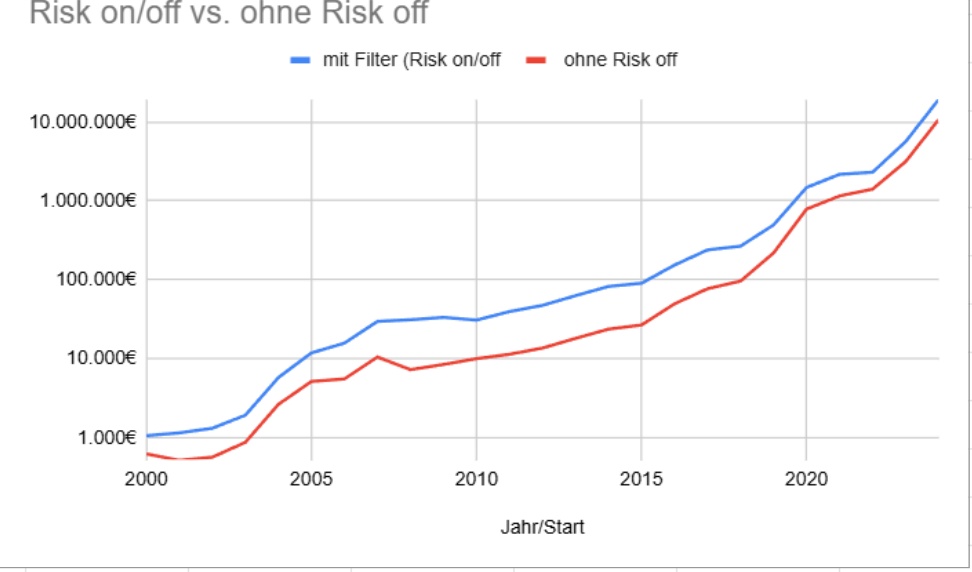

The safety belt (absolute momentum): To avoid massive drawdowns like in 2000 or 2008, the S&P 500 Index acts as a market filter. If the signal is negative, the model consistently switches to cash or money market cash or money market ETFs.

⚙️ Execution: focus on the leaders

A review takes place every month. Only the top 2 assets with the highest average score are held.

- Why only two? The model is optimized for maximum performance. Diversification (top 3 or top 5) would reduce the maximum drawdown slightly, but would significantly dilute performance. If you prefer a more relaxed and less volatile approach, it is better to diversify here.

- Capital preservation as a turbo: Those who lose less in crises benefit exponentially more from the next upswing due to compound interest.

📊 Performance & live results

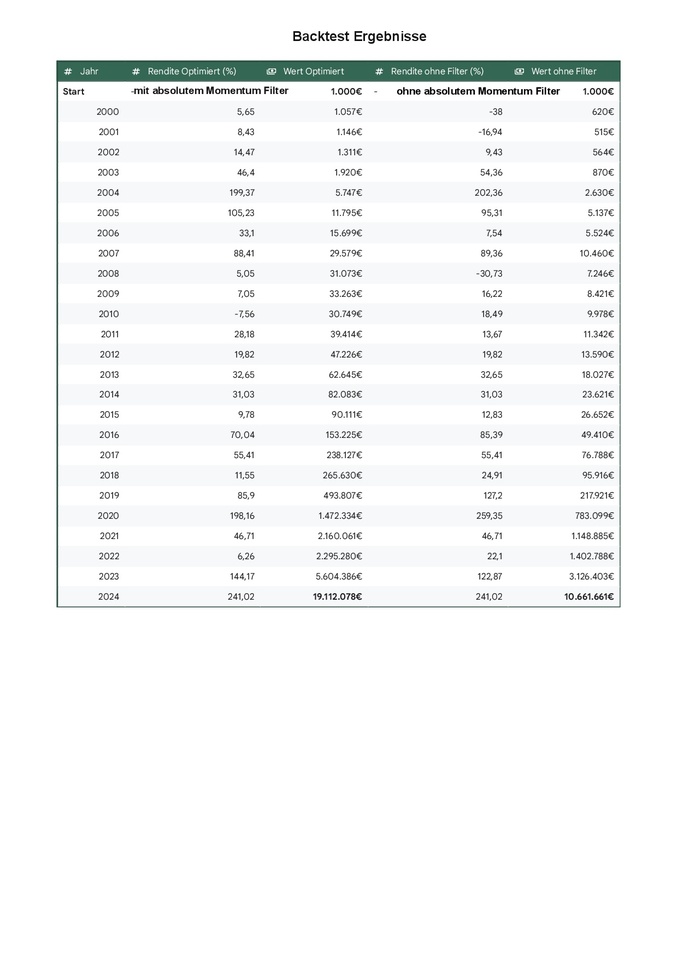

The theoretical data (2000-2024) shows an impressive CAGR of 56 %. I have been actively implementing the model since the end of 2023 - with approx. 80% of my total portfolio out of full conviction:

Returns

- 2024 +152,1 %

- 2025 YTD: approx. +30 %

⚠️ Transparency on risk & volatility

High potential returns require iron discipline. The strategy is not for the faint-hearted:

- Maximum drawdown: In the backtest there were setbacks of up to -37% (dotcom bubble 2000).

- Psychology: The biggest enemy is not the market, but deviating from the rulebook in volatile phases.

- Costs & taxes: Since it is a theoretical model, transaction costs and taxes reduce the result in reality. Nevertheless, the alpha advantage remains massive.

Conclusion

I will provide regular updates here on how the model assesses the current phase. This is not the only way to be successful - but it is my systematic way.

Become the engineer of your own portfolio. Test, optimize and stay disciplined.

Do you have any questions about the topic or anything else? Let me know in the comments! 👇

#Momentum

#Investing

#SP500

#SystematicTrading

#Finanzen

#TradingStrategy

#Backtest

#Wealth

Risk warning: No investment advice. Historical prices do not guarantee future profits. Any investment can lead to a total loss.

PS: The strategy can now also be viewed/bookmarked as a wikifolio: