⚠Only for those interested in trading - otherwise keep scrolling 😅

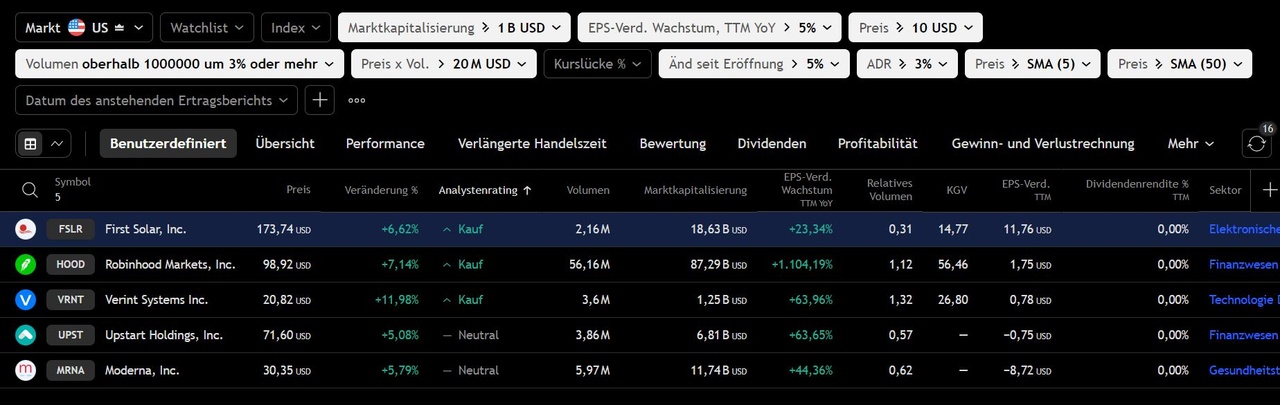

@MCKrummel-Divi-Holding Since I'm sitting at the computer after your comment, here are a few examples -> this is what the screener "spit out"

@Epi the recently discussed setup, I always look at the same pattern. Well secured on the downside

@Dividenden_Monteur something for you?😎

PS: I have added the link to the chart pictures everywhere, so you can still follow the chart live until the close of trading if you are interested 👈

$MRNA (+1.86%)

https://www.tradingview.com/x/vzNaFp6T/

$HOOD (+4.02%) wait here how it develops on the VWAP https://www.tradingview.com/x/l4g6iRhL/

$VRNT (+0%)

https://www.tradingview.com/x/usbMLEAZ/

$NXT

https://www.tradingview.com/x/hzo2u5SA/

$FSLR (+4.46%)

https://www.tradingview.com/x/JWZVSjVl/

$W (-0.45%)

https://www.tradingview.com/x/rCO7KhVs/

@Multibagger my tubular cracker $STZ (+0.12%) maybe something will happen, from the -8% we are already at only -3% - I'll give this swing trade a little more time 🤕