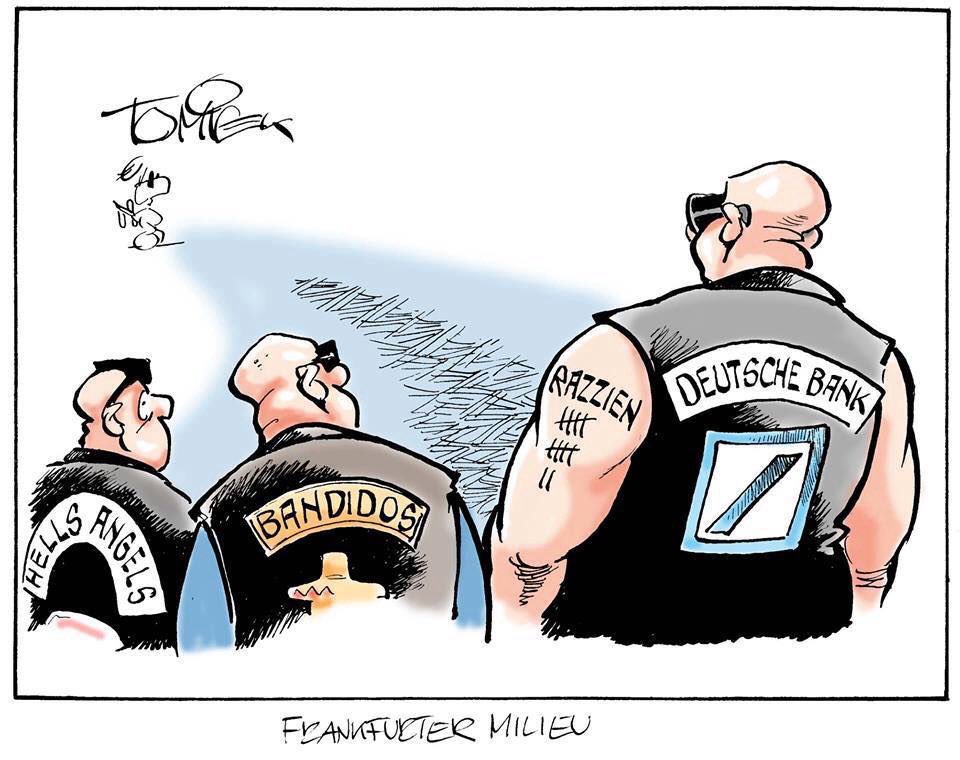

2010 - VAT fraud / fraud with CO₂ certificates

2012 - VAT fraud / fraud with CO₂ certificates (continued)

2012 - Tax evasion / tax fraud

2015 - Cum-ex transactions / aiding and abetting tax evasion

2018 - Panama Papers / suspicion of money laundering (delayed suspicious activity reports)

2022 - Suspected money laundering (late reports, including Syria/Assad clan)

2022 - Greenwashing allegations (with affiliated DWS)

2026 - Suspicion of money laundering (delayed suspicious activity reports on Roman Abramovich's companies)

-14% the share fell in 16 years 📉 but +74% in one year 📈. Which bank shares do you have and how did they perform? $DBK (+2.11%)