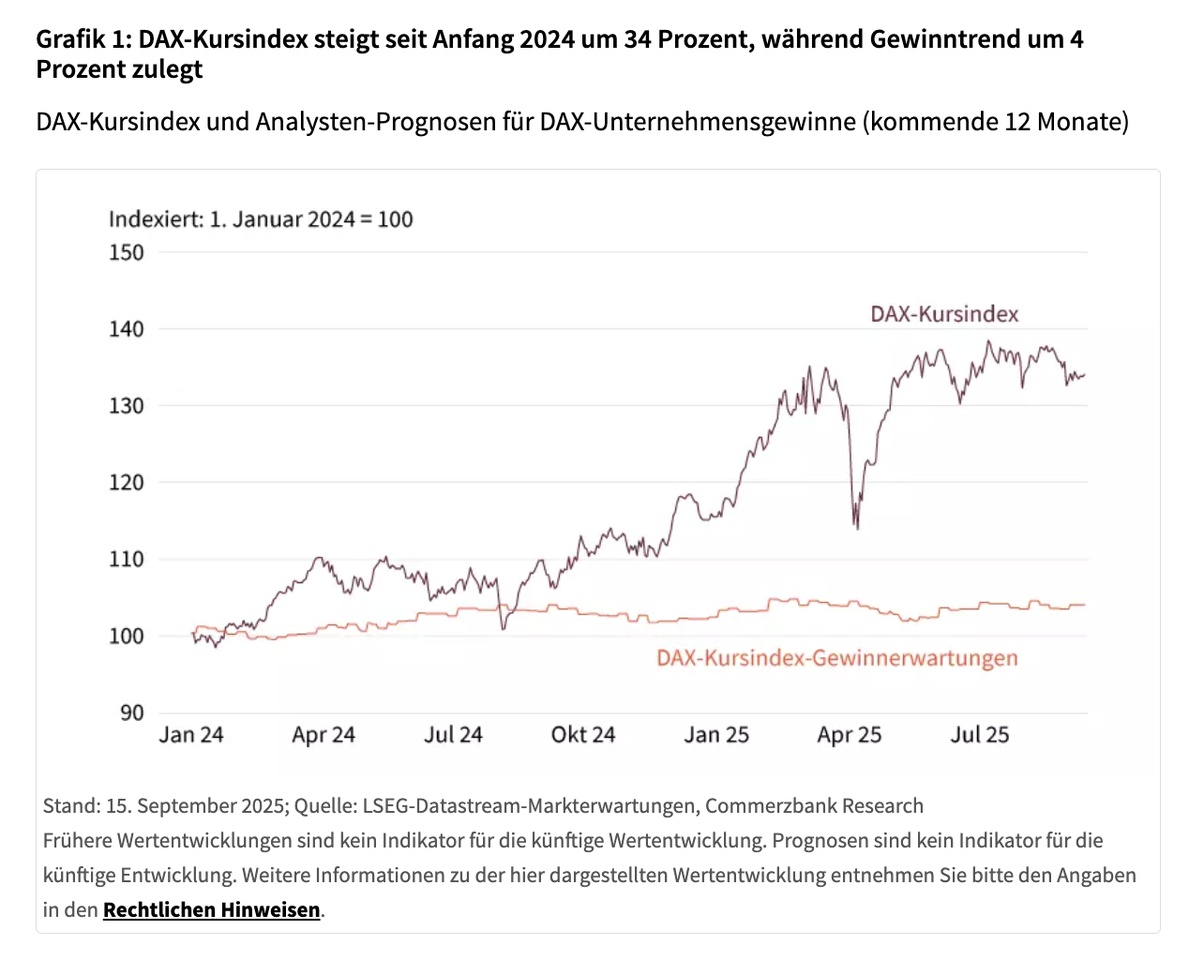

Corporate profits of German listed companies have recently fallen short of expectations. In 2024, earnings growth stagnated, weighed down by weak demand in China, high energy prices and geopolitical uncertainties. Analysts have revised their forecasts downwards and a significant increase in profits is not expected until 2026, but share prices are still at all-time highs.

Although the $DAX shows a plus over the year, valuation risks loom without sustainable earnings growth.

On the positive side, monetary policy is easing and interest rates are falling, which could provide a tailwind for German exports. The decisive factor will be whether margins recover from 2025 and profits increase in the long term.

The big question is therefore: is the current recovery of the DAX sufficient to sustain a sustained rally, or could disappointing earnings figures dampen sentiment in the coming years?

👉 You can find the full outlook for the DAX here in the Artikel

#DAX

#Börse

#Aktien

#Investieren

#Gewinne

This article is part of an advertising partnership with Société Générale