Hello my dears,

After my gold mining special, I have now delved even deeper into the world of copper mines.

Copper is experiencing a renaissance as a strategic commodity of the future. At over USD 11,900 per tonne on the London Metal Exchange, the red metal is reaching historic highs - and this is more than just a cyclical swing. The combination of scarce supply, geopolitical risks and explosive growth in demand from AI data centers and electromobility is creating an environment from which selected mining companies can benefit disproportionately. Structural supercycle on the rise: the figures speak for themselves.

Why copper

DID YOU KNOW THAT?

- The typical battery-powered electric vehicle requires about four times as much copper than a conventional combustion vehicle.

- Copper is one of the most widely used metals in the world and one of the most widely recycled.

The scarcity of copper

- We are currently seeing a significant gap in the inability of global copper mine supply to meet long-term demand expectations due to new copper projects, declining grades and increasing social and technical challenges in bringing new projects on stream.

10,000 years

Copper is the oldest mined metal known to man and has been used for over 100 centuries

400 +

copper alloys are currently used, including brass and bronze

33 %

Current demand is met by recycled copper

18 elements

including gold, silver, cobalt and molybdenum are by-products of copper mining

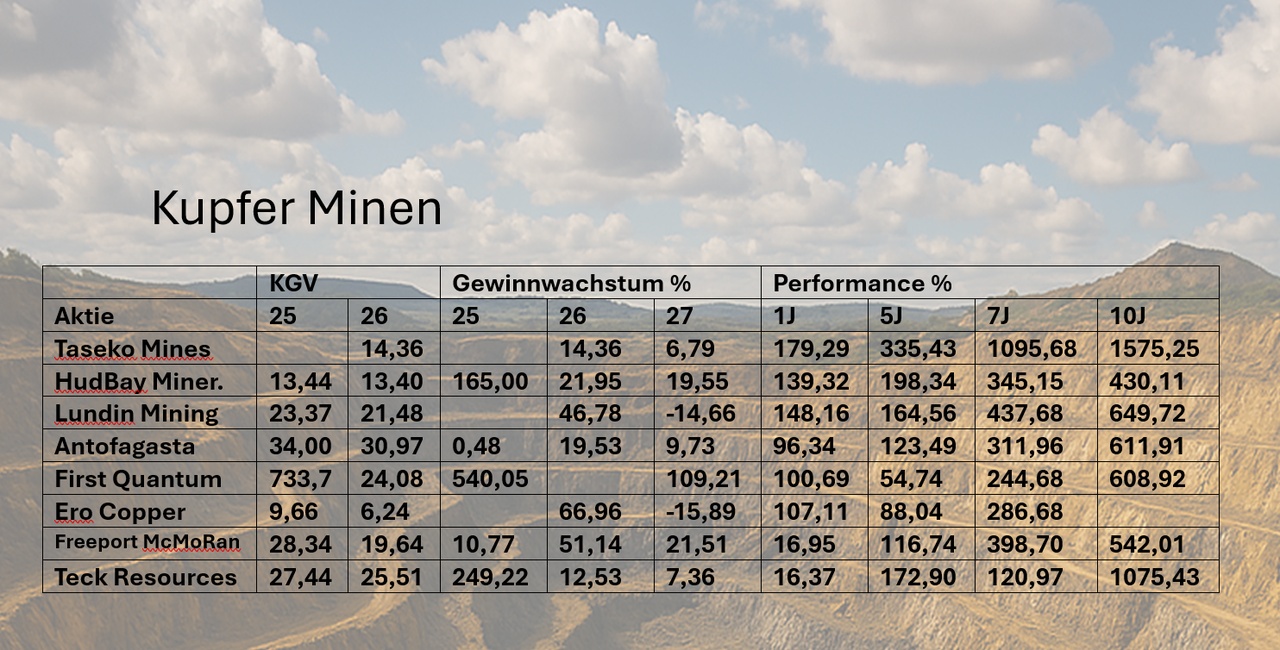

I have picked out 8 mines. But I haven't found a clear favorite, so I need your help with the selection this time.

Which mine is your favorite?

In the quality and growth check are

- HudBay Minerals $HBM (+0.29%)

Freeport-MCMoRan $FCX (+2.99%)

the winners.

In a few years, Hudbay will celebrate its 100th anniversary

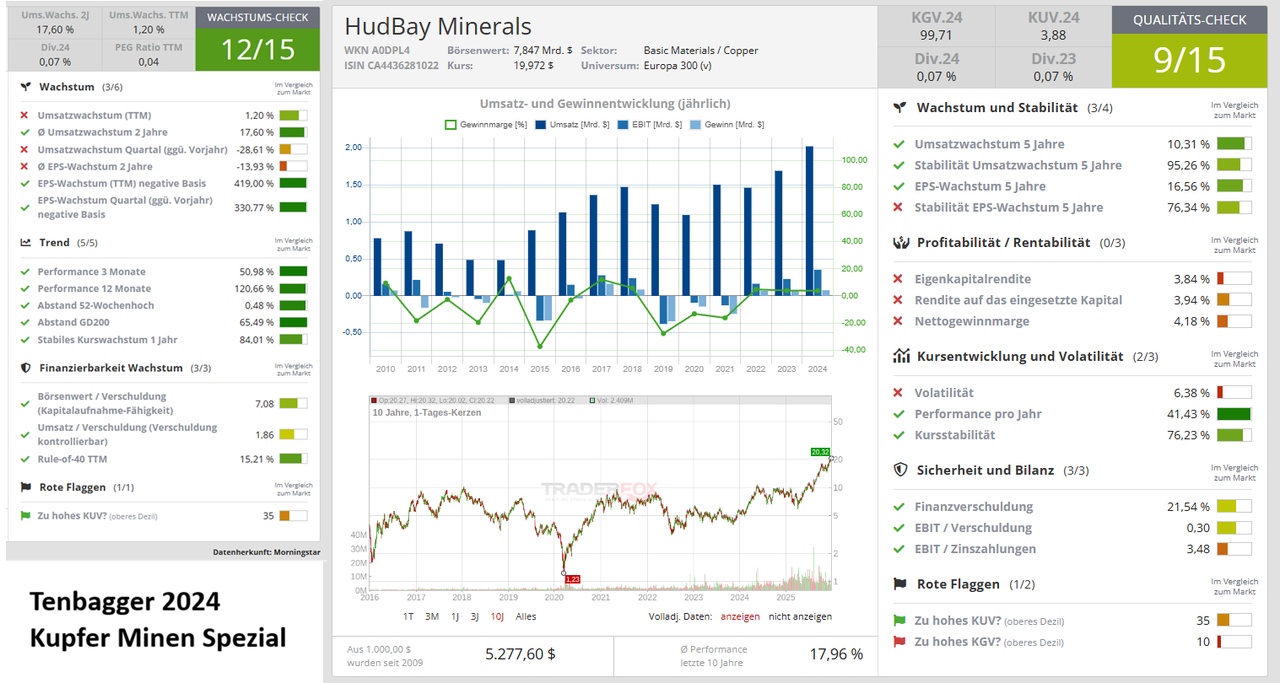

Hudbay is a copper-focused mining company with three long-life operations and a world-class pipeline of copper growth projects in the category mining regions of Canada, Peru and the United States.

Hudbay's operating portfolio includes the Constancia mine in Cusco, Peru, the Snow Lake operations in Manitoba, Canada and the Copper Mountain mine in British Columbia, Canada. Copper is the company's main metal, complemented by significant gold production. Hudbay's growth pipeline includes the Copper World project in Arizona, the Mason project in Nevada (USA), the Llaguen project in La Libertad (Peru) and several expansion and exploration opportunities close to existing operations.

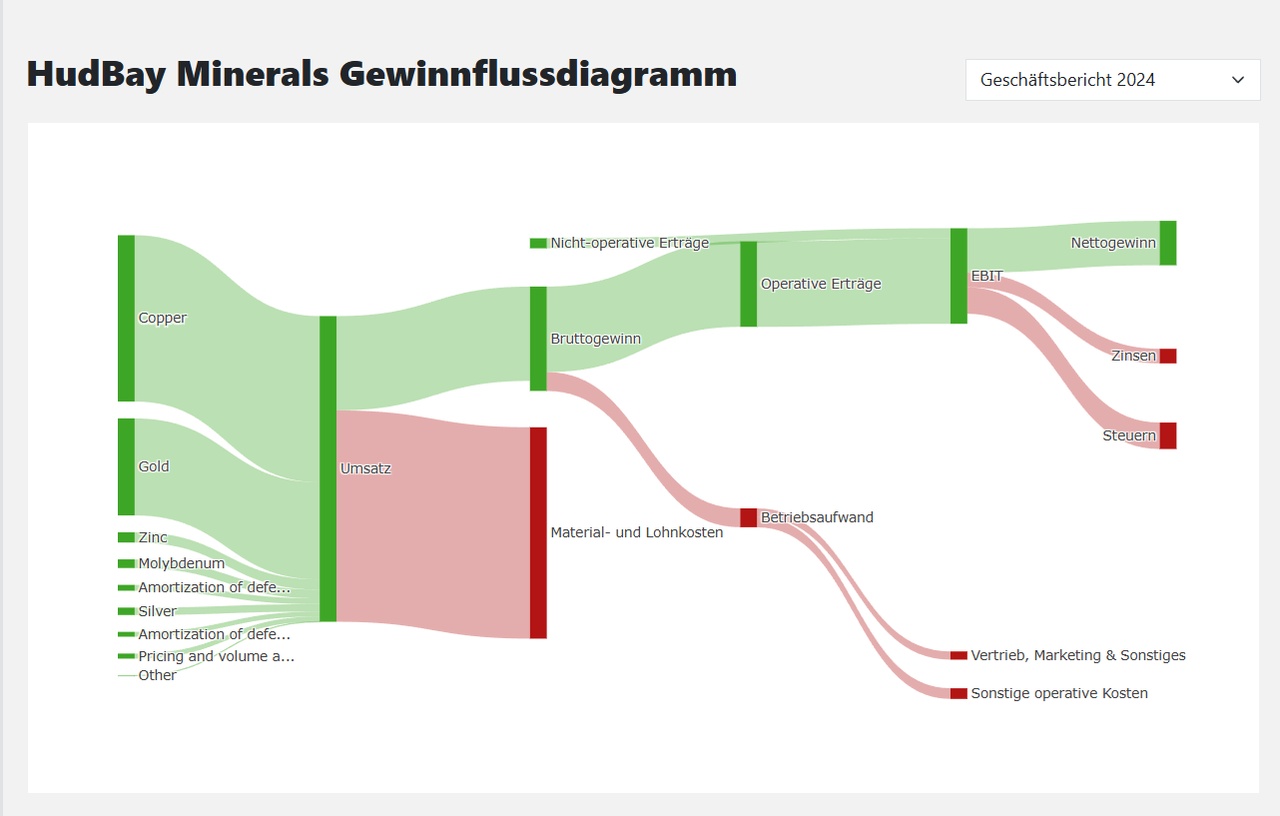

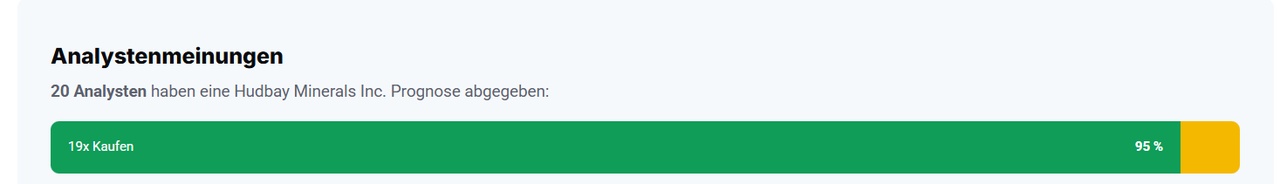

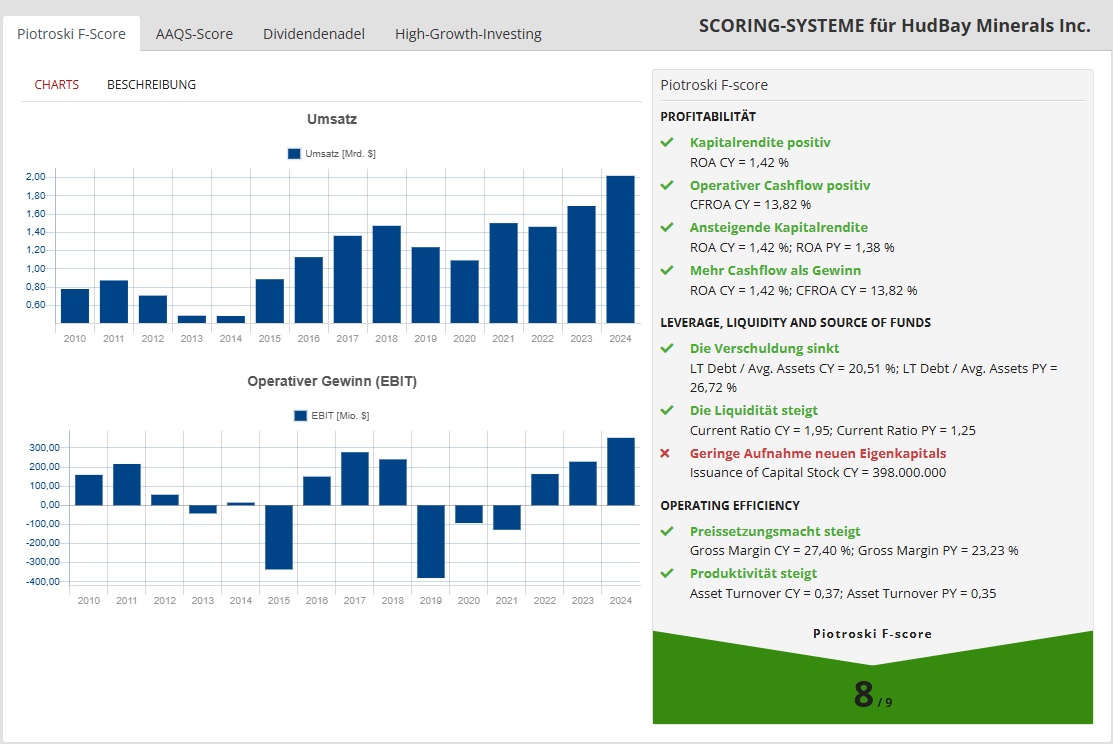

HudBay Minerals Inc. is a resource mining (metals/coal) and resource extraction (diamonds/precious metals) company headquartered in Canada. The HudBay Minerals share is traded under ISIN CA4436281022. In the past financial year, HudBay Minerals generated sales of CAD 2,720.74 million, which corresponds to growth of 19.69% compared to the previous year. Operating profit amounted to CAD 544.97 million, an improvement of 27.85%. Net income for the year amounted to CAD 105.08 million, an improvement of 17.31%. On the balance sheet date, the company had total assets of CAD 7,892.27 million. Reported equity amounted to CAD 3,807.49 million, which corresponds to an equity ratio of 48.24%. Total debt amounted to CAD 1,700.38 million, with a debt to asset ratio of 21.54%. HudBay Minerals employed 2,803 people at the end of the financial year, an increase of 3.51 % compared to the previous year. Revenue per employee amounted to CAD 0.97 million. The company paid a dividend of CAD 0.02 per share for the past financial year, which corresponds to a dividend yield of 0.17 %. The price/earnings ratio (P/E ratio) is 41.81 and the price/book ratio (P/B ratio) is 1.25.

Planning for the future

We have laid the foundations for a new phase of growth based on our long history and proven track record in project development. Our near-term growth profile includes the high-grade Pampacancha satellite camp at our Constancia mine in Peru and the expanded gold and copper-gold zone at our Lalor mine in Snow Lake, Manitoba. Our world-class pipeline includes the recent discovery of the Copper World Complex project in Arizona, as well as the Mason deposit in Nevada, and you will see significant, high-grade properties where we are already in the planning stages of how to unlock their value. Over time, we look forward to expanding our exploration program into Arizona and Nevada.

Is HBM's Copper World JV with Mitsubishi a potential breakthrough?

- HBM signs a $600 million deal with Mitsubishi for a 30% stake in the construction of the Copper World Project.

- HBM's Copper World is in line with Washington's mission to rebuild a domestic supply chain for critical minerals.

- The deal helps HBM defer its initial capital requirements until at least 2028 and increase the IRR owed to 90%.

Ist HBMs Copper World JV mit Mitsubishi ein potenzieller Durchbruch? - 18. November 2025 - Zacks.com

Year

Earnings per share

P/E RATIO

2025 0,84 23,98

2026 1,42 14,20

2027 1,63 12,40

2028 1,89 10,72

Market capitalization in EUR billion 6,69

year

Profit in million

2025 522,65

2026 562,29

2027 642,31

2028 638,73

2029 1.106,00

Year

Free cash flow in € million

2025 237,76

2026 523,46

2027 621,44

2028 416,93

2029 803,64

HBM_InvestorPresentation_November2025_final.pdf

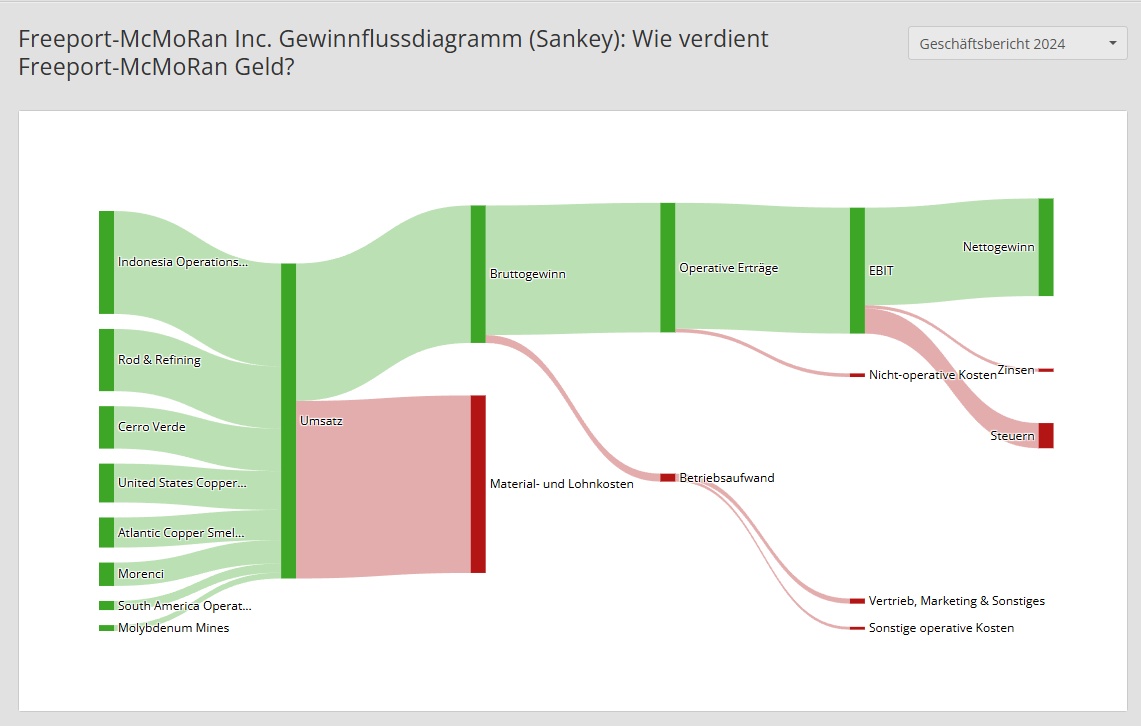

Freeport-McMoRan (FCX) is a leading international metals company dedicated to being a leader in copper. Our company was incorporated under the laws of the State of Delaware on November 10, 1987 and is headquartered in Phoenix, Arizona. We operate large, long-lived, geographically diverse assets with significant proven and probable copper, gold and molybdenum reserves. Our portfolio of assets includes the Grasberg mineral district in Indonesia, one of the largest copper and gold deposits in the world; and significant operations in the Americas, including the large-scale Morenci mineral district in North America and the Cerro Verde asset in South America.

Freeport-McMoRan Inc ("FCX"), formerly known as Freeport-McMoRan Copper & Gold Inc, was formed in 1988 following the discovery of the Grasberg copper and gold deposit in Papua, Indonesia, when FCX's former parent company, then known by the trading symbol "FTX", sold 20 percent of the company in an initial public offering. or IPO. Following the acquisition of Phelps Dodge in 2007, FCX emerged as a dynamic industry leader, combining the assets and technical teams of two great companies. FCX's unique portfolio of mining assets was developed and acquired from several predecessor companies, including Freeport Minerals, Phelps Dodge, Cyprus Minerals, American Metal Company (AMAX) and Climax Molybdenum, among others. The many important milestones that have occurred over the decades make FCX's portfolio of assets difficult to replicate today.

Freeport was named among the ten most transparent companies in the US.

Freeport wurde zu den zehn transparentesten Unternehmen in den USA gewählt | Freeport-McMoRan

Freeport named among leading companies using AI to achieve results

Baghdad autonomous train fleet retrofit fully implemented

Umbau der autonomen Zugflotte Bagdad vollständig umgesetzt | Freeport-McMoRan

Freeport-McMoRan is the quality commodity with comeback potential

Freeport-McMoRan Inc. (ISIN: US35671D8570) operates significant copper, gold and oil and gas reserves worldwide. It is the world's largest molybdenum producer. The foundations of the company were laid by the merger of Freeport Minerals and McMoRan Oil & Gas in 1981. The company was listed on the NYSE in 1988 and its shares have been freely tradable since 1955.

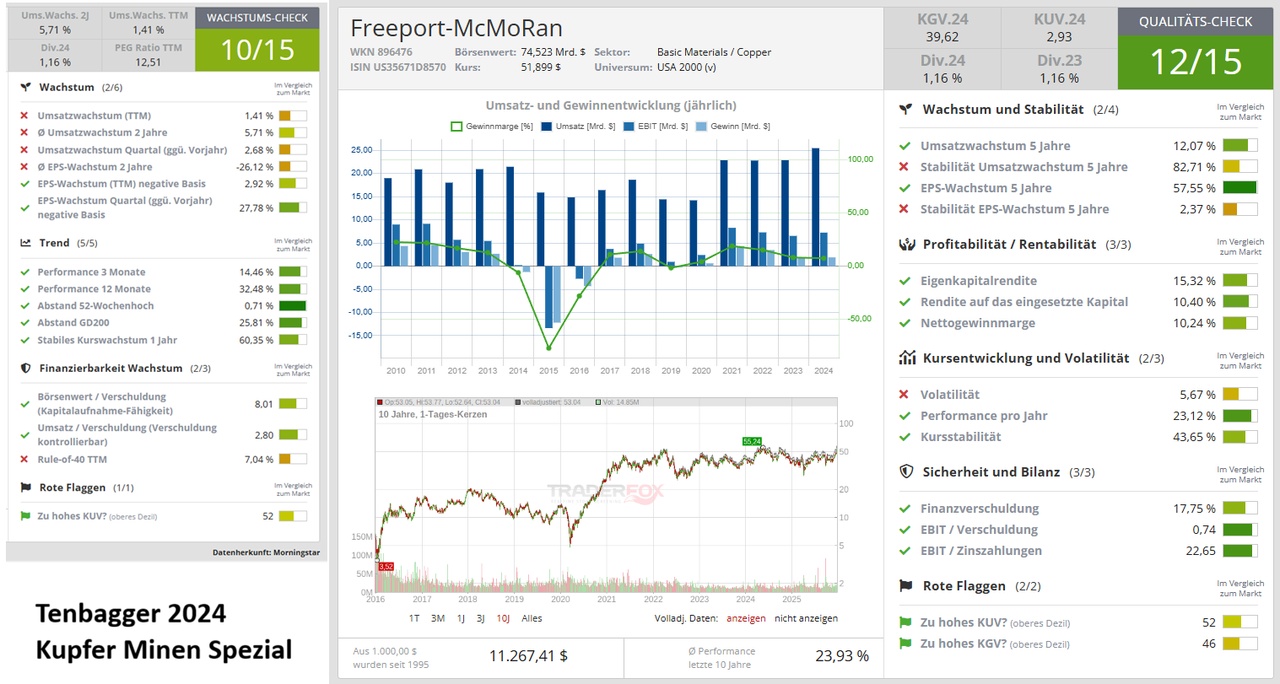

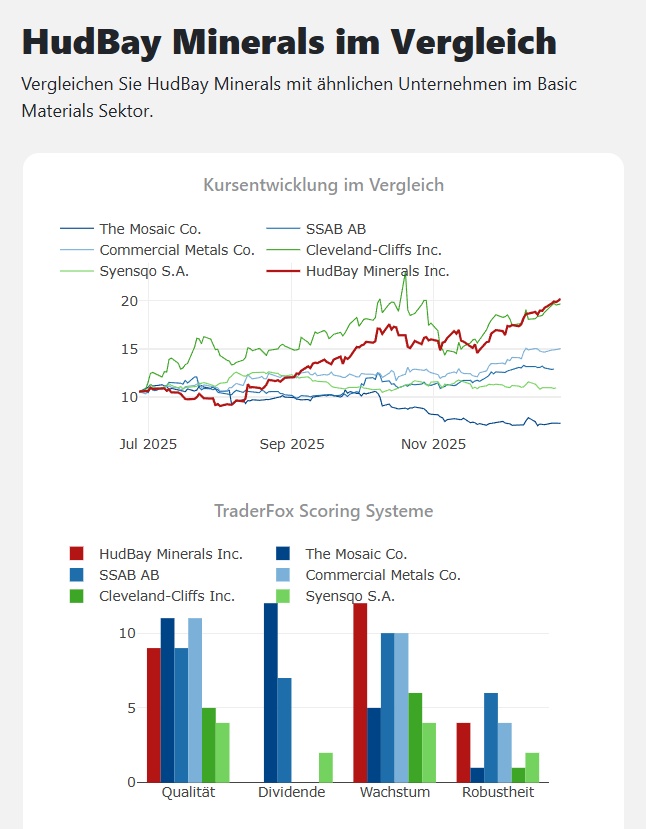

With a return on equity of 15 % and average double-digit growth rates over the last 5 years, Freeport-McMoRan has the qualities to be considered as a long-term investment. This is also illustrated by the good result of 12/15 points in the TraderFox quality check. In addition, the company regularly distributes dividends to shareholders, allowing investors to participate directly in the profits.

Rohstoffe im Rallye-Modus: Diese 3 Aktien gehören aktuell zu den größten Gewinnern

Pivotal-Point tracking Freeport McMoRan. (FCX): Copper giant benefits from strong quarterly figures and all-clear in Grasberg - UBS sees price target at USD 55!

15.12.2025 at 13:00

Freeport-McMoRan is a mining company with a focus on copper, molybdenum and gold. Freeport already reported impressive figures for the 3rd quarter on October 24. At USD 0.35, adjusted earnings per share were well above expectations of USD 0.27. Revenue reached USD 5.82 billion, which was also above the estimated USD 5.65 billion. On November 18, 2025, Freeport-McMoRan announced plans to resume large-scale production in the Grasberg mining district in Indonesia following a serious incident (sludge collapse) in September.

Year

Earnings per share USD

P/E RATIO

2025 1,51 35,20

2026 2,22 23,95

2027 2,93 18,14

2028 2,92 18,16

Year

Profit in € million

2025 2.138,37

2026 3.348,81

2027 4.575,53

2028 5.275,00

2029 4.057,00

Year

Free cash flow in € million

2025 1.907,36

2026 3.874,00

2027 6.249,36

2028 7.627,00

2029 8.992,00

Market capitalization in EUR billion 63,31

Analyst recommendations on Freeport-McMoRan

Buy 16

Overweight 3

Hold 5

Underweight 0

Sell 1