Or: Volatility, dividends and why the tax office was my biggest cost factor

2025 is over and, looking back, it was a year that really had everything. Volatile markets, constant political bombardment, a portfolio with its own ideas and a private life that took very little interest in whether the market was red or green.

Nevertheless, at the end of the day, it was a year with which I am very satisfied overall.

Market and performance 2025

Looking at the major indices, 2025 was anything but boring:

- S&P500 fluctuated strongly and closed the year slightly negative or sideways (in EUR).

- MSCI World was able to catch up over the course of the year, but also remained without much euphoria.

- The DAX consistently outperformed and was up over 15 percent at times

As usual, my portfolio was more defensively positioned. In good market phases, I lost returns, but lost significantly less in weak phases. This is exactly what paid off, especially in the spring and summer.

The original target of 130,000 euros portfolio value (all portfolios together) was actually achieved by the end of the year. Not in a straight line, not without detours, but achieved is achieved.

Individual stocks and typical 2025 candidates

2025 had some clear winners, but also stocks that regularly demanded my patience.

Some of the stronger phases included

- Eli Lilly ($LLY (+0.39%) ) with several double-digit monthly gains

- Tesla ($TSLA (+0.31%) ) with typical +30 percent months, followed by equally typical setbacks

- UnitedHealth ($UNH (+0.01%) ) as an absolute rollercoaster with months between -20 percent and +15 percent

On the other side were

- Texas Instruments ($TXN (+0.01%) ), strongly influenced by tariffs and political uncertainties

- Ferrari ($RACE (-0.34%) ) with a rather disappointing performance despite a strong brand

- Classic consumer stocks such as Nestlé ($NESN (-1.6%) ) or Procter & Gamble ($PG (-0.14%) ), which were surprisingly weak at times

All in all, however, it has once again become clear why I focus on broad diversification and defensive stocks.

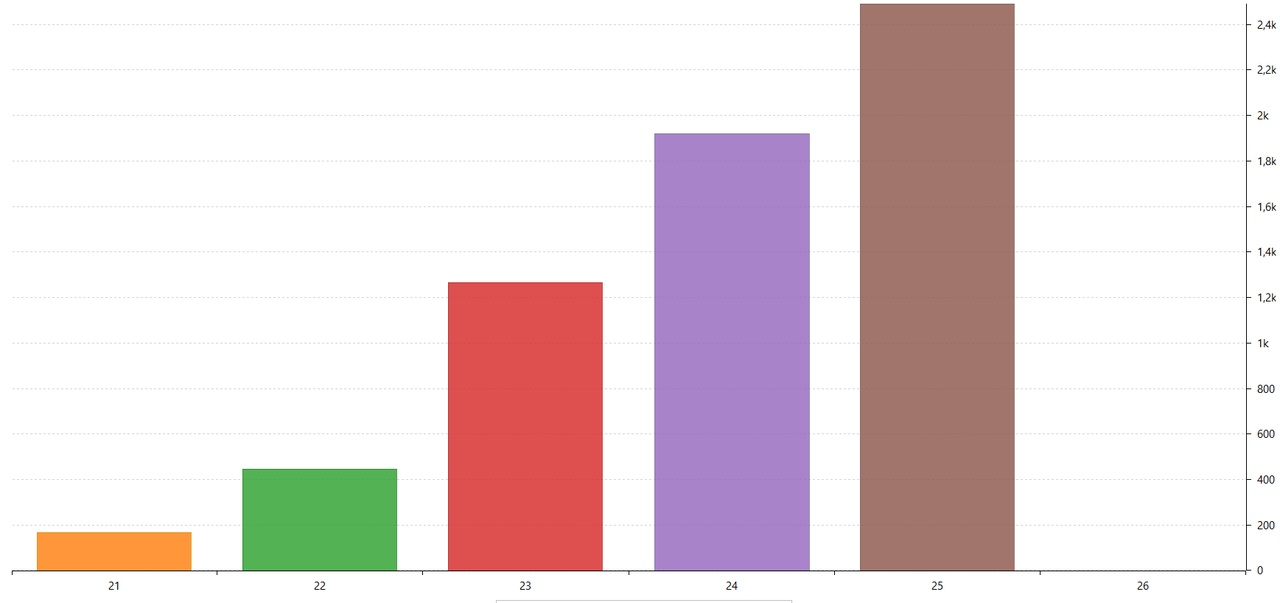

Dividends 2025, my personal highlight

The area that gave me the most pleasure in 2025 was clearly dividends.

Almost every month was up on the previous year. In some cases very significantly:

- February around +65%

- March around +29%

- April almost +50%

- June over +110%

- September around +45%

- December about +12%

July was weak, as expected, but that's part of it.

At the end of the year, I reached my personal target of of around 2,400 euros net dividends or even slightly exceeded it. In the end, the total net amount was €2491.38. This is an extremely important point for me because this figure is independent of market sentiment. The dividends also came in when share prices fell or the market was collectively in a bad mood.

My dividend ladder also looks good.

If things go well, I will even receive a net dividend of €3,000 in 2026. All I need is for the USD to get a little stronger.

Portfolio reorganization and better overview

I reorganized my portfolio in the summer.

- Share portfolio with individual stocks (and gold)

- Pension portfolio with ETFs

$XEON (-0%) as a separate building block for the later loan repayment

Nothing has changed in terms of strategy, but mentally it was a huge advantage. Since then, it has been clear what needs to be valued and what can simply be left to run. The view of the portfolio has become more relaxed and the reviews are much more structured.

The nest egg and the year of bills

2025 was also the year in which the topic of nest eggs caught up with me very clearly.

- Car repairs in the region of around 1,500 euros

- Tax arrears of over 4,000 euros

- In between, the charming idea of the tax office to make an additional advance payment of 6,500 euros

In the end, this was corrected, but the damage was done. At times, the nest egg had dwindled to less than 1,000 euros. And that's where you quickly realize why you build up such a cushion in the first place.

My personal resting point is now 5,000 euros. That lets me sleep peacefully. Nevertheless, I'm still consistently building up my nest egg to 10,000 euros, simply because 2025 has shown that unplanned expenses are always more creative than any planning.

Goals for 2025 and personal conclusion

Not everything went perfectly. I adjusted goals, reduced savings rates and questioned decisions several times. Nevertheless:

- Portfolio target of 130,000 euros achieved

- Around 20,000 euros invested in total including ETFs

- Net dividend target of approx. 2,400 euros achieved

- Structure and overview significantly improved

2025 was not a year for heroic stories or social media screenshots with all-time highs. It was a year for realism, learning and clean positioning.

And to be honest: if you can say at the end of the year that you achieved your goals, slept soundly and didn't permanently win the tax office, then the bottom line is that it was a good year on the stock market.

Is there anything else that interests you?

How did your 2025 go?

What did you take away from it?

If you liked the review, please follow me.

If you didn't, keep scrolling and hope that 2026 will be more spectacular.