"Adobe Director, David A Ricks, purchased 2,250 shares of Adobe's common stock on January 28, 2025, at a price of $443.976 per share, totaling $998,946. Following this transaction, Ricks directly owns 4,984 shares and indirectly owns 3,913 shares through a trust. The shares were acquired as part of a planned annuity payment from the David A Ricks 12-2022 Grantor Retained Annuity Trust."

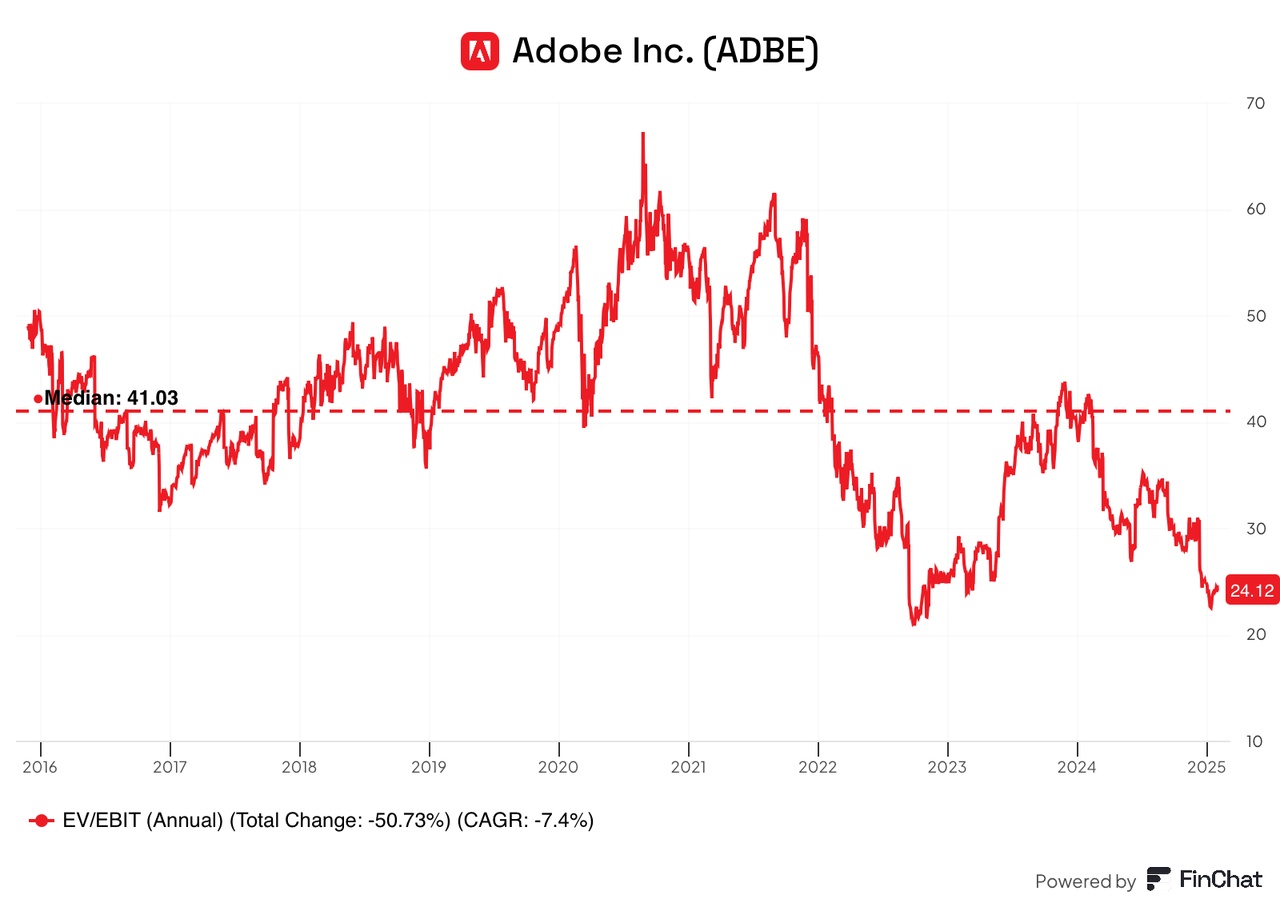

Adobe $ADBE (-2.14%) is 32% below its 52-week high and looks anything but pretty. At 24.1x, the stock is trading at the lowest EV/EBIT in over 10 years (with the exception of the end of 2022).

Director David A. Ricks has now acquired the company for approx. 1m $ shares, which is no small purchase for him considering his previous purchases.

Adobe has some competitive advantagesincluding switching costs, a dominant market position and a successful subscription model. The company continues to grow in the double digits per year and shows high, stable margins (gross margin: 89%, free cash flow margin: 37%). Last year saw the highest buybacks ever, an indicator of an undervalued share. They are also sitting on 7.8 bn $ cashwhich exceeds the long-term debt.

Artificial intelligence (AI) is both an opportunity and a threat for Adobe $ADBE (-2.14%) both an opportunity and a threat:

- Adobe $ADBE (-2.14%) is trying to integrate AI directly into its programs.

- At the same time, competing products such as Midjourney, Canva, etc. are increasingly calling classic creative software into question. This is depressing sentiment.

What do you think? Will Adobe $ADBE (-2.14%) successfully adapt and maintain its market leadership? Or will they lose market share in the long term?