Yesterday evening I increased my investment in $RSGN again, or rather doubled it (~47% remaining profit on total position, i.e. 50% margin of safety).

As the only one keeping an eye on the stock, I am happy to inform you about my reasons:

Block Trades:

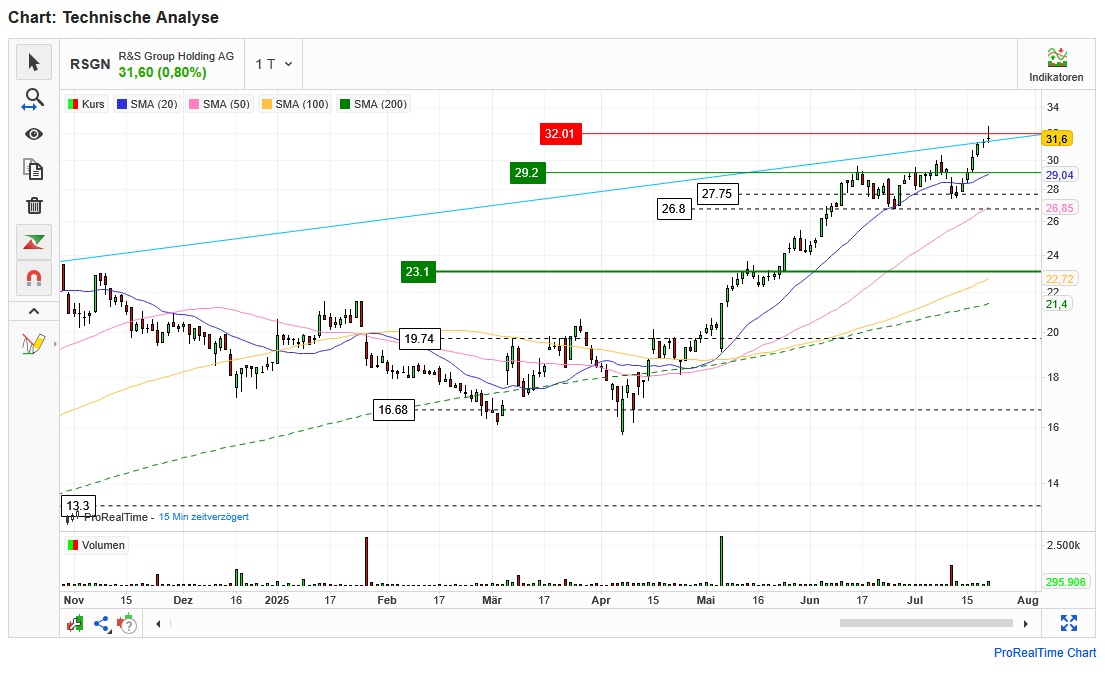

ABB's bookmakers placed a large number of shares at just under 20 in May and 1m shares at just under CHF 28 in July. These are probably (no public information available) placements by SPAC sponsors or early shareholders. This increases the free float and makes the company more attractive, as the co-determination rights are distributed. In addition, the CHF 28 mark should now prove to be a significant support.

New investors:

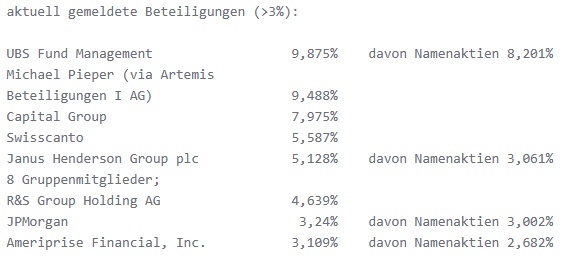

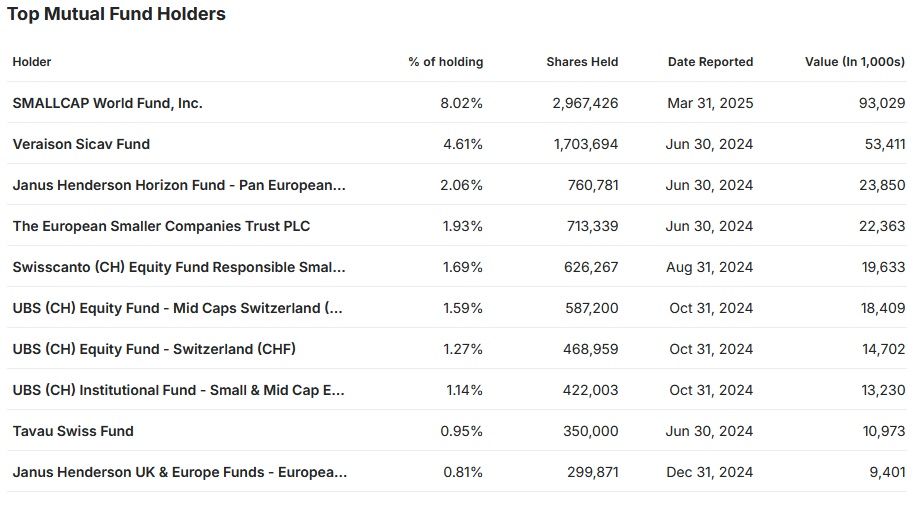

Existing and new investors in RSGN are regularly topping up:

Ameriprise is just the latest example of a relevant player. BUT: Some of these are also corresponding fund investments.

Article in FuW:

The financial magazine "Finanz und Wirtschaft" regularly (weekly?) presents its top picks. The track record of previous picks is impressive - for example $CRWV (-2.69%) was discovered early on and advised to invest. The attention will certainly help the "small player" to end up on watch lists or attract investments directly. The media attention also helps with private placements.

Negative - or risk:

The stock is currently heading for the top, but I had no patience for a limit order. The support at 29.- does not leave much room for maneuver.

Gameplan:

A sell order is set at CHF 45, over 180 shares. We will see if we see the run. I am convinced of the company in the long term. I may adjust both the number of shares and the trigger price.

The fact is that European equities are still undervalued compared to US equities. The drive towards small and mid-caps is also in tact. Fund inflows and direct investments should continue to help RSGN.