Hello dear Getquin community,

as there was a lot of interest in the Excel template for the article, here is the link to the template for you:

Cheers,

Michael Scott

Hello dear Getquin community,

as there was a lot of interest in the Excel template for the article, here is the link to the template for you:

Cheers,

Michael Scott

Reading time: approx. 12min

1. ) INTRODUCTION

I recently asked you on Getquin to vote on which topic I should focus on in one of my future posts. About 65% of you voted that the topic of "fair share price" should be addressed and therefore requested a contribution on this topic.

The question of what constitutes a fair price is indeed initially subjective. A common definition is that the fair price of a share is the sum of its discounted cash flows [1]. This definition is also the basis for the well-known discounted cash flow method (DCF method) [2], which assumes a growth phase and a terminal phase and discounts all future cash flows to determine the fair value of a share. What exactly "discounting" means and how it is applied will be explained later in the article.

Before I explain my method in detail, however, I would like to mention some limitations. My method is just one method among many and not the method with which you can determine the exact value of a share in 10 years to two decimal places. Every method makes assumptions and, in case of doubt, is only as good as the assumptions that are made. Such models also react very strongly to small changes in the input values, so that a change in the interest rate from 5% to 3% can already lead to considerable changes in the final result.

It is therefore always advisable to make rather pessimistic (or at least realistic) assumptions in all analyses and always deduct a margin of safety at the end.

2.) FREE CASH FLOW

The method is based on the estimate of the free cash flow of a company over the next few years. Free cash flow is a popular key figure among investors, as it indicates how much of the operating cash flow (= money generated through business activities) is actually available to investors. Free cash flow can be calculated from a company's cash flow statement, for example, in which the operating cash flow the so-called capital expenditures (capex) from the operating cash flow:

Free cash flow = operating cash flow - capex

Capex includes all capital expenditures "for longer-term assets, such as machinery, buildings, but also original equipment, spare parts, computer systems" [4]. Fortunately, we can read both operating cash flow and capex from a company's cash flow statement. I use free cash flow for my method because free cash flow is less influenced by accounting subtleties than EBITDA, for example.

For the method presented here, it will be important to estimate a company's free cash flow for the coming years. Like any estimate, a free cash flow estimate is of course not error-free and is subject to uncertainties. We also want to keep the estimate as simple as possible. I estimate the free cash flow as follows:

EBITDA

- Capex

- Taxes

+ Stock-based compensation

= Free cash flow

This is an estimate that can be used to get a pretty good idea of a company's free cash flow. Many small details that play a role in the cash flow statement have not been taken into account here, but in most cases these are not so important. As a reminder: we wanted a simple and robust estimate of the free cash flow.

Now that we have a way to estimate free cash flow from EBITDA, let's go one step further and get to the valuation of a company based on free cash flow. I personally like to use the so-called free cash flow yield. The free cash flow yield is obtained by putting the free cash flow generated in a year in relation to the market capitalization (=price):

FCF Yield = FCF / Marketcap = (FCF/share) / (price/share)

The FCF Yield indicates the percentage of market capitalization generated annually by the free cash flow. The higher the FCF Yield the lower the lower the valuation. Microsoft, for example, is valued at $MSFT (-0.3%) is valued at around 2% FCF Yield, Apple $AAPL (+1.51%) with 3.4%, Exxon Mobil $XOM (-2.45%) with 9% and British American Tobacco $BATS (+2.33%) with 19%. Microsoft's business model is seen as low-risk, secure and with recurring revenues, while British American Tobacco currently has so many risks and shrinkage scenarios priced in that it has such a high FCF yield.

The FCF yield with which a company is valued depends in particular on the security of the business model, the future growth prospects and the existing risks. This can of course change over time: at the beginning of the 2010s, Microsoft was still valued with an FCF yield of around 10%. In the case of a declining FCF yield, we speak of a multiple expansionas the company's cash flows are seen as increasingly secure. If you had bought Microsoft at a 10% FCF yield and Microsoft was still generating exactly the same cash flow today as it was at that time, at today's valuation level (2% FCF yield) you would still have quintupled the original investment quintupled.

3.) MY METHOD

The basis for any earnings or losses of a company is initially always the turnover: if this increases, there is a chance of earning more money in the future; if it decreases, it becomes more difficult to earn more money. How much profit a company makes can be measured by the so-called EBITDA (earnings before interest, taxes, depreciation and amortization). The ratio of EBITDA to sales is known as the EBITDA margin. If a company improves its EBITDA margin, it becomes more efficient, with proportionately more EBITDA remaining from every dollar earned. As mentioned in the free cash flow section, we can estimate free cash flow from EBITDA using capex, taxes and stock-based compensation.

Example: A company generates € 1,000 in sales and achieves an EBITDA of € 400. In addition, capex of € 100 and taxes of € 50 are incurred. The company spends €5 on stock-based compensation. The company then has an EBITDA margin of 40% and an approximate free cash flow of

FCF = € 400 - € 100 - € 50 + € 5 = € 255.

If the company's market capitalization is currently €10,000, it would have an FCF yield of €255/€10,000 = 2.55%.

If we now estimate the future sales growth, the future EBITDA margin, the future expenses for capex, taxes and stock-based compensation, we can estimate the future free cash flow. If we can then estimate the FCF yield with which a share can be sold in X years, we can estimate the future market capitalization of the company. If we also take into account the number of outstanding shares and any share buybacks by the company, we can also estimate the price per share in X years.

4.) EXAMPLE: PHILIP MORRIS $PM (-0.29%)

To better understand the method, it is advisable to look at a concrete example. I have specifically chosen Philip Morris $PM. Before we start, however, it is important to define the investment period. Since I want to invest for the long term, I set the investment period at 10 years. This is completely arbitrary at first, but in general, the shorter and longer the period, the higher the inaccuracies. With shorter periods, we are subject to excessive cyclical fluctuations in the free cash flow and with longer periods, the model becomes less accurate due to the high sensitivity.

Warning: there are a lot of figures and estimates to follow, which can only be put into a suitable format here on Getquin to a limited extent (to put it euphemistically). I have attached a screenshot of my personal Excel spreadsheet so that you can better understand a lot of things there. The following data is taken from [5]:

i. The inventory (TTM, all figures in millions):

Market capitalization = USD 145,040

Number of shares = 1.551,1

EBITDA = USD 13,449

Capex = USD 1,357

taxes = 2,428 USD

Stock-based compensation = 0 USD

ii. Calculation of free cash flow & margins:

Free cash flow = 13,449 - 1,357 - 2,428 + 0 = 9,664 USD

EBITDA margin = 39,2%

Capex / turnover = 4,0%

Taxes / turnover = 7,1%

We now have an overview of the actual state of Philip Morris. We now want to estimate what these figures will look like in about 10 years' time. We estimate this:

Sales growth (annually)

EBITDA margin (in 10 years)

Capex / sales (in 10 years)

Taxes / sales (in 10 years)

Share buybacks in % (annually)

Stock-based compensation / EBITDA (in 10 years)

As we can see, we have to make a number of estimates here which, depending on how they turn out, can have a massively influence the final result. If we are too optimistic, we can calculate almost any future price, no matter how high. If we are too pessimistic, almost any price today will be too expensive.

iii. The development of the company:

A real treatise on my assessment of Philip Morris' corporate development would be too extensive at this point and would be enough material for a separate post (feel free to comment if you wish). Therefore, here is the short version of my assessment:

Philip Morris is struggling with the declining volume of cigarettes. For years there has been a decline in volume of around 2% per year, which has so far been offset by price increases. In principle, I assume that sales of cigarettes will decline by around 1% per year over the next 10 years. In the area of risk reduced productshowever, i.e. IQOS and snus in particular, Philip Morris will grow by 15-20% annually and IQOS is set to enter the US market in 2024. The management itself expects overall Group sales growth of 7-9% per year.

The new risk-reduced products also have a higher margin than traditional cigarettes, meaning that the EBITDA margin can even be expected to increase slightly in future as their share of total sales grows.

The last few years have been characterized by high investments (=capex), especially in the new product categories. The products are now ready for the market and we are entering a phase in which there will be slightly less capex. I also assume that tax expenditure will be around the average of recent years and that share buy-backs will resume as cash flows increase and investments decrease.

Overall, my long-term estimates are

Sales growth = 7% annually

EBITDA margin = 42%

Capex / Turnover = 3%

Taxes / turnover = 7.5%

Share buybacks in % = 0.3%

Stock-based compensation / EBITDA = 0%

iv. possible price in 10 years:

Some percentage math and a few Excel formulas later, we see that Philip Morris is estimated to be worth 21,241.1 million USD in free cash flow in 10 years. In addition, the number of outstanding shares has increased to 1.505,8 shares outstanding.

Philip Morris is currently valued at an FCF yield of 6.9% is currently valued. If the valuation does not change in 10 years, the market capitalization in 10 years will be USD 307,842 million. If this is divided by the number of shares outstanding in 10 years, the price per share is approximately 204 USD. At the current price of around USD 90, this would correspond to an annual return of around 8.6% would correspond.

This does not take into account a possible multiple expansion/deflation, i.e. an increase/decrease in the FCF yield. Furthermore, we still have to discount the future share price in order to determine the fair value today.

5.) FAIR VALUE WITH MARGIN OF SAFETY

The last variable to be included in our estimates is the so-called risk free rate comes into play. This is the risk-free or low-risk interest rate that you receive, for example, for investments in government bonds, fixed-term deposit accounts or similar. For example, if you receive 5% per year for a 10-year investment in a fixed-term deposit account, you would have to invest around €614 today to receive €1,000 after 10 years: the money you receive in 10 years is discounted at 5% per year. discounted annually (614€ = 1.000€ / (1,05)^10).

In the same way, we must also discount the future share price, as we could also invest the money today at a fixed interest rate for 10 years. Of course, there is a lot of leeway in the valuation: if we assume a low risk-free rate, today's share prices will automatically increase; if we assume a high risk-free rate, today's share prices will decrease. Incidentally, this is also the reason why the stock market generally reacts sensitively to changes in interest rates.

If we assume (conservatively!) an average risk free rate of 6% we obtain the current fair value of Philip Morris:

204 USD / (1.06)^10 = 114 USD

After all the estimates, calculations and discounting, we have now arrived at a fair value of 114 USD per share. However, as already mentioned several times, this is a model that makes many assumptions, estimates and idealizations. It is therefore always advisable to use a margin of safety should always be deducted. I deduct a flat rate of 20% from my calculated fair value, resulting in a total value:

Fair value w/ MoS = 91 USD

This value is fairly close to the current share price of around USD 90 / share, so that our estimates and assumptions should not be too far off the mark.

To conclude this section, here are a few examples that show how sensitively our model reacts to changes in certain estimates. All examples assume that the other estimates/parameters remain the same:

6.) SUMMARY & OUTLOOK

Based on the current company balance sheet and our estimates for the company's development, we can use this method to determine a fair value for a share. A possible multiple expansion/deflationi.e. a change in FCF yield in 10 years. In the screenshot attached to the article, you can get an overview of how this parameter influences the valuation today (return distribution).

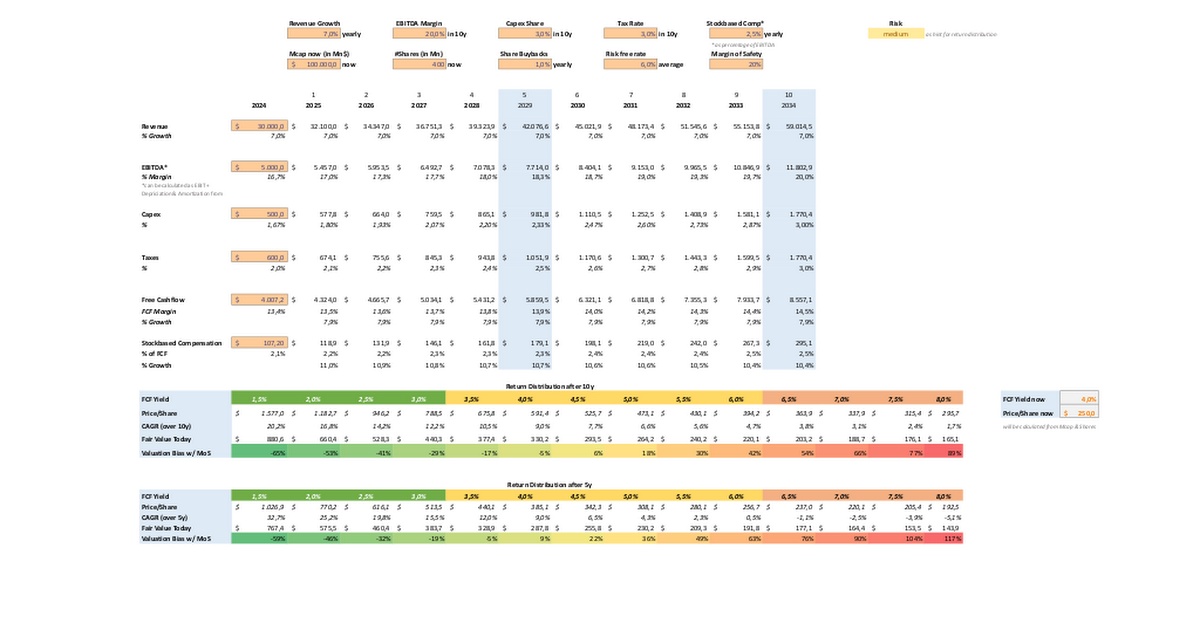

If you are interested, I can provide you with a corresponding Excel template. Just comment below the post. Then I will think of a suitable solution to provide you with the template.

Finally, I would like to mention again: take the final result with a good portion of caution to you. There is no guarantee that my model describes reality even approximately correctly, as there are many subjective assessment by me. As a small consolation, there will soon be an article that will show you that in many cases the price of a share is not as important as you might think.

As always, I am open to questions, suggestions and criticism.

Stay tuned,

Your Michael Scott

Sources:

[1] Wikipedia: https://de.wikipedia.org/wiki/Abzinsung_und_Aufzinsung

[2] Wikipedia: https://de.wikipedia.org/wiki/Discounted_Cash-Flow

[3] BWL-Lexikon: https://www.bwl-lexikon.de/wiki/free-cash-flow/#berechnung-direkte-methode

[4] Business lexicon: https://wirtschaftslexikon.gabler.de/definition/capex-52700

[5] SeekingAlpha: https://seekingalpha.com/