So, I have now also registered with Trading 212 and received a free share. Unfortunately $HM B (-1.05%) but what the heck. It has made a good impression so far. In any case, transfers there arrived after 2 hours. Correction: transferred 5 minutes ago, just credited. Respect

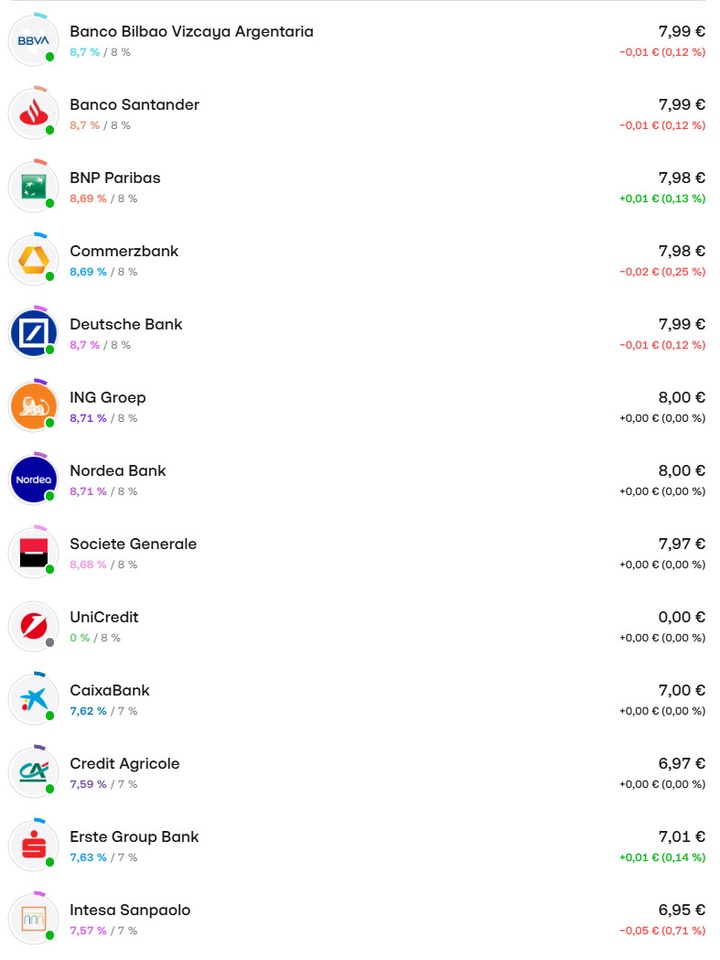

Now I've set up a pie with European banks, as my main custody account here is mainly in the USA.