Buffet invests with Heico in

Aerospace & Defense

Is this the new growth sector?

I think so, which is why there is a new buy

Into a long-term runner with a considerable margin.

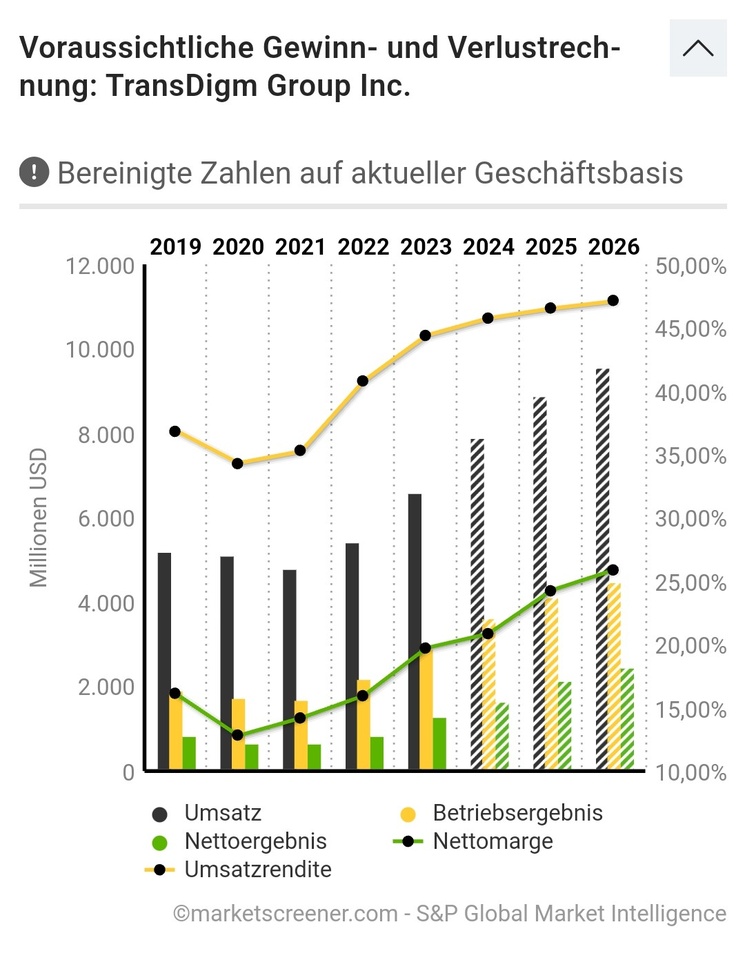

Profit growth of 23% is expected here by 2026.

There will be further increases:

Free cash flow: 2024: 1942

2025: 2366

2026: 2791

EbiT margin: 2024: 45.76

2025: 46,51

2026: 47,09

Earnings per share: 2024: 27.88

2025: 36,37

2026: 41,10

And thus, of course, the P/E ratio also falls

2024: 47,64. 2025: 36,09

2026: 31,49

TransDigm Group Inc (TDG - Free Report ) is a manufacturer, supplier and developer of advanced aerospace components, systems and subsystems for use in commercial and military aircraft. Rising earnings estimates, improved defense budget and strong liquidity offer a great investment opportunity in the Zacks Aerospace sector .Let's focus on the reasons that make this Zacks Rank #2 (Buy) stock an investment opportunity right now.

Growth Projections and Surprise Story

The Zacks Consensus Estimate for TDG's fiscal 2024 earnings per share (EPS) has risen 1.2% to $33.28 over the past 60 days. The Zacks Consensus Estimate for the company's total revenue in fiscal 2024 is $7.86 billion, representing year-over-year growth of 19.4%.

TransDigm Group's earnings growth (three to five years) is estimated at 20.7%. Over the last four quarters, the company delivered an average earnings surprise of 8.46%.

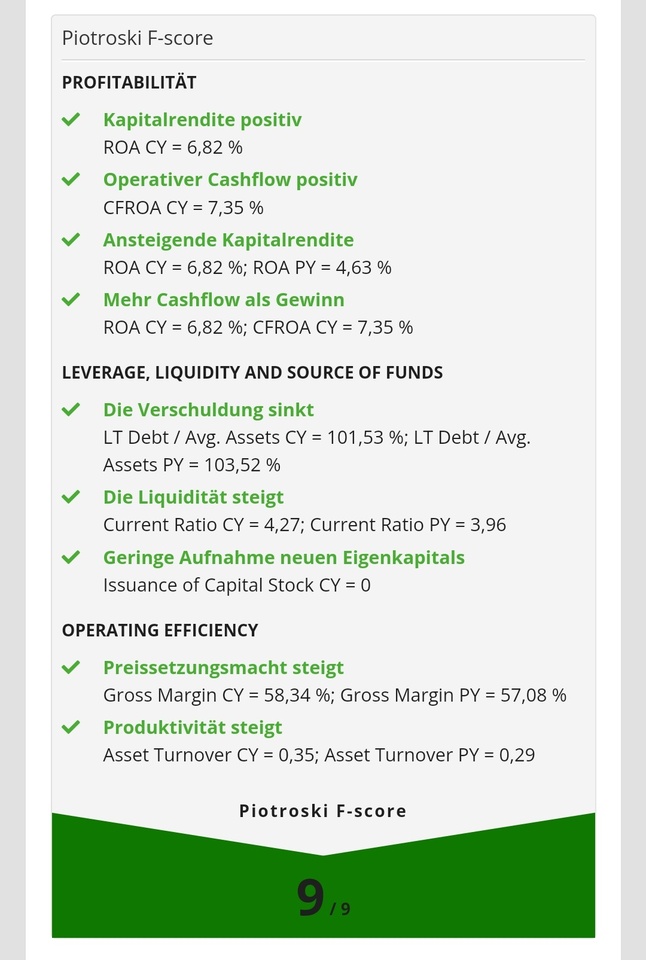

Solvency

TransDigm Group's net interest income (TIE) at the end of the third quarter of financial year 2024 was 2.7. The strong TIE ratio indicates that the company can easily meet its interest payment obligations in the near future.

Liquidity

The company's liquidity ratio was 3.82 at the end of the third quarter of financial year 2024, above the industry average of 1.55. The ratio, which is greater than one, shows that TransDigm is in a position to meet its future short-term liabilities without difficulty.

Rising defense budget

The Fiscal Year 2025 (FY25) budget proposal provides $850 billion in funding for the Pentagon, an increase of 1% over the amount appropriated for Fiscal Year 2024. TransDigm's products occupy a significant position in the US defense aviation market. The company has enjoyed significant growth opportunities in the defense sector in recent years due to the expansive budgetary policies of the US government and other developing countries.

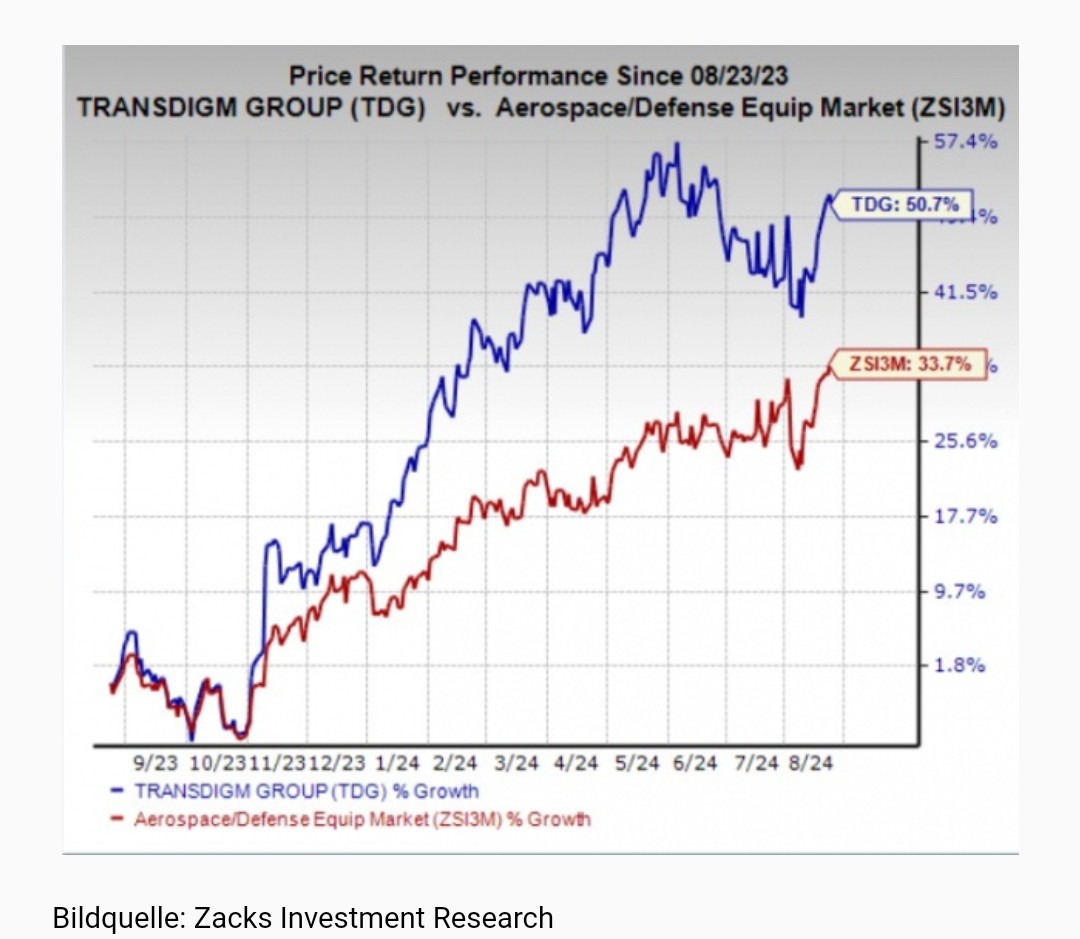

Price-performance

Over the past year, TDG's shares have gained 50.7% compared to an industry-wide average return of 33.7%.