We're going further in 👀

- Markets

- Stocks

- Hims & Hers

- Forum Discussion

Hims & Hers Stock Forum

StockStockDiscussion about HIMS

Posts

122$HIMS (+0.52%) further increased, now the largest single position in the portfolio.

Despite strong growth of 50% Y/Y and profitability, the company is still valued low with a P/E ratio of approx. 3.

Well positioned in the younger generation, exciting product range with shameful products that one would rather buy online.

Perhaps the positioning in the lower middle price segment of its generics could be useful here. When it comes to sensitive issues such as hair loss or love life, people are more likely to steer clear of the cheapest product and opt for a good price-performance ratio.

The recent decline is probably due to the end of the emergency situation for weight loss injections. It seems to have been priced in for the time being.

And even if they are no longer allowed to sell their own syringes, they can still be intermediaries.

But I won't be taking in many more shares, otherwise the lump will get too big.

What do you think?

$HIMS (+0.52%) Interesting analysis at Seeking Alpha... HOLD THE LINE!

https://seekingalpha.com/article/4724740-hims-hers-shortage-saga-stupendous-risk-reward

Summary/translation (ChatGPT) of the complete article:

Summary of Hims & Hers Investment Analysis

Hims & Hers Health, Inc (HIMS) represents a compelling investment opportunity despite concerns about marketing spend and a lack of GLP1 products. Here are the key points:

In summary, despite potential challenges, Hims & Hers' solid financial fundamentals and robust growth prospects make it an attractive investment.

- Valuation: The stock is considered undervalued at 25 times projected free cash flow and has significant growth potential and strong fundamentals.

- Financial health: Hims & Hers has more than 2 million paying subscribers, no debt and more than USD 230m in cash. EBITDA of USD 220 million and free cash flow of USD 170 million are expected for 2025.

- Growth potentialRevenue growth rates are expected to reach a CAGR of 35% in 2025, mainly driven by organic growth rather than GLP1 products.

- Market reaction: Recent FDA updates indicate that GLP1 products are no longer in short supply, which may impact pricing but will not diminish the underlying demand for Hims & Hers' services.

- Long-term outlookInvestors should focus on long-term fundamentals rather than short-term volatility. The analysis suggests that HIMS could reach a value of $30 per share by the summer of 2025.

The shares of Hims & Hers ($HIMS (+0.52%)) fell 14% on Wednesday after news that Novo Nordisk's (NVO) weight-loss drug Wegovy is no longer in short supply in the US. Certain doses of the drug, as well as its sibling Ozempic, had been on the FDA's drug shortage list for months. Both drugs are based on the active ingredient semaglutide. Hims & Hers (HIMS) marketed a compounded version of semaglutide during the shortage. As the FDA announced on its website on Wednesday, all doses of Wegovy and Ozempic are now available. Earlier this month, the FDA removed competing drugs Mounjaro and Zepbound from its shortage list. The drugs, manufactured by Eli Lilly (LLY), are based on the active ingredient tirzepatide. Meanwhile, manufacturers and marketers of compounded versions of the drugs have come under pressure. Generally, the FDA allows compounding manufacturers to make copies of certain drugs when they are considered to be in short supply, but not when they are more readily available. On Oct. 7, the Outsourcing Facilities Association, a trade group that represents compounding pharmacies and outsourcing facilities, filed a lawsuit against the FDA claiming the agency took Tizepatide off the list too soon and that the drug is still in short supply. The FDA has since said it is reviewing its decision.

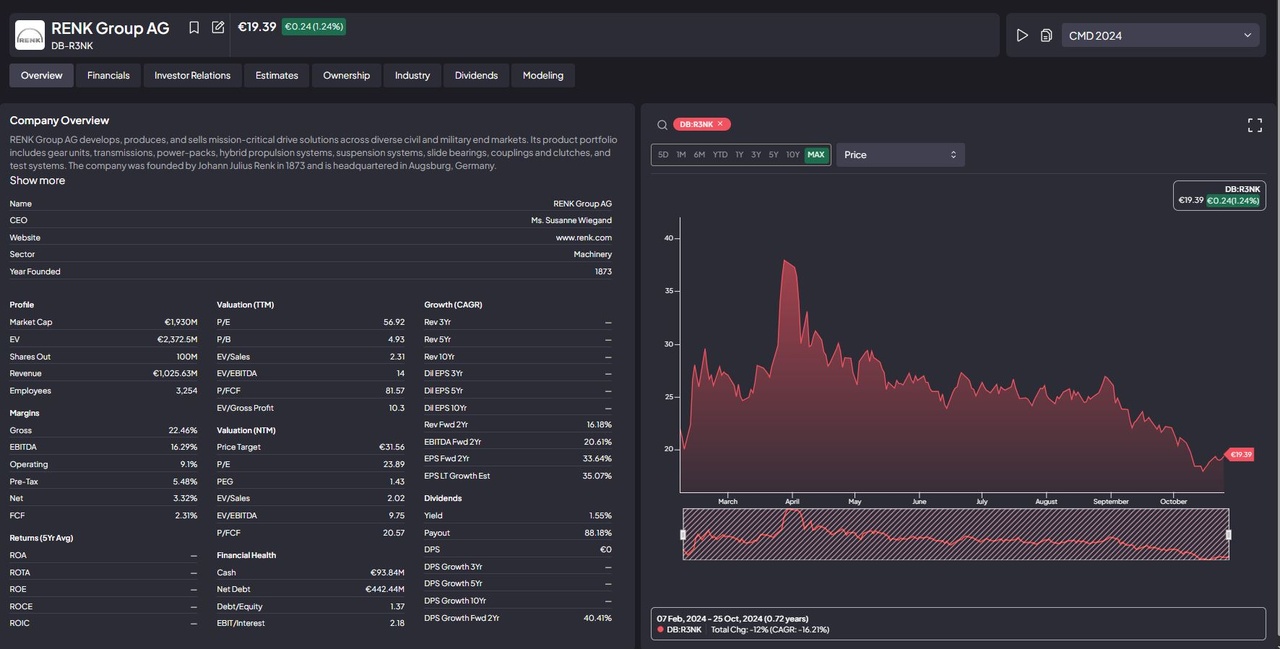

I played around a bit in finchat today. It has a very good screening function where you can filter by several parameters. Among other things, I noticed the share from DE $DE000RENK730 (-2.04%) caught my eye. The chart after the IPO actually looks completely like many other shares after the IPO. Either shares are sold off immediately after the IPO or you first see a parabolic rise followed by a sell-off. At some point, -30% to sometimes -70% below the listing price, they then usually form a bottom, similar to $PLTR (-2.46%)

$SOFI (+0.1%)

$NU (-4.07%)

$ENR (-0.15%)

$COIN (-9.83%)

$HIMS (+0.52%) . With the given growth prospects, the share could become quite interesting after another halving of the price. Does anyone here have them on their radar?

High-Risk-High-Growth Small Cap Update :)

At $RKLB (-3.44%) everything is going in the right direction at the moment. Up almost 200% since initial investment about half a year ago. And the future promises much more.

$QBTS (-6.67%) Although a leading provider of quantum computing is considerably riskier and very far from profitability, it has finally been posting share price gains for a month now and is recovering.

$AWE (-3.42%) has presented very good figures and is also well equipped for the future. It is a technological niche, but one that it is nevertheless occupying quite successfully.

For more inspiration:

$GRAB (-0.73%) ,$TMDX (+0.16%) ,$LNTH (+0.19%) ,$GRA (-1.1%) ,$6871 (-1.69%) ,$4480 (+0.91%) ,$ACMR (-5.96%) ,$HIMS (+0.52%) ,$IONQ ,$ASTS

I am up $HIMS (+0.52%) 33% in the plus

would you take profits or just hold long term ?

thanks for your opinions 👍🏼

The broad market is falling, but $HIMS (+0.52%) BOLD🛫🫦🫶

There was positive news from the FDA for the GLP-1 copycats.

Today is gonna be the day. Great Performance of my high growth stock currently.

Trending Securities

Top creators this week