19,07 Euro

What is it today?

Posts

33$BBBY Is now insolvent and the stock has fallen to about 16 cents

$BBBY is currently preparing for insolvency.

Not so long ago, Bed, Bath & Beyond was the target of speculators.

Now it is in talks with advisors and lenders about a possible bankruptcy filing. (1)

Actually, they wanted to raise $300 million from capital investors, but then failed.

Most recently, sales were down 33%, while gross margins were down 22.8%.

There were fears for insolvency as early as January. (2)

I assume that insolvency is coming and the company will be broken up. The locations and brands are supposedly not bad, but the cost pressure in the company is immense. The current economic situation does the rest.

$BBBY Should one here possibly again with some play money purely or is the Bude too risky? The short interest rate should be over 70%...

Must me times bissel make clear how just the stand is.

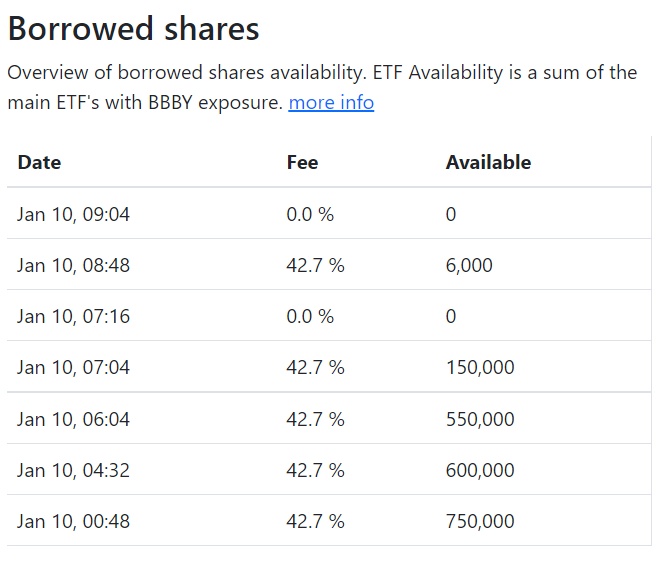

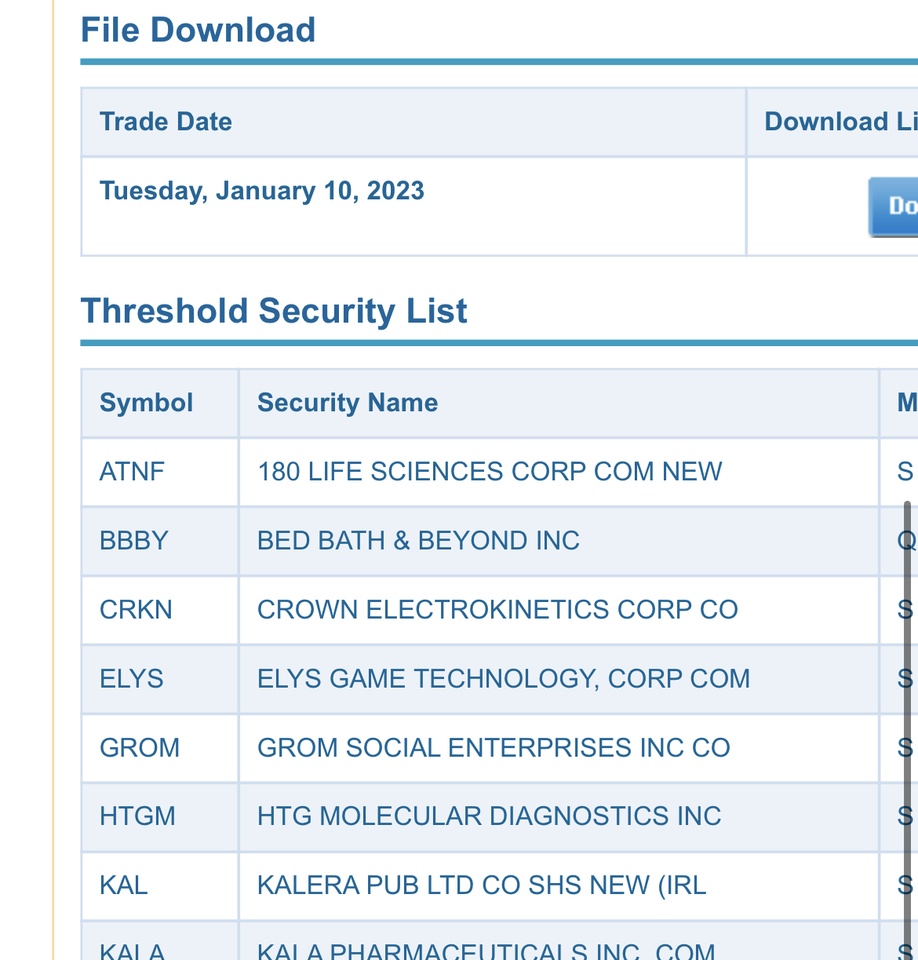

$BBBY is back on REGSHO 🚀🤡

CTB is 67%

750K shares were borrowed yesterday in 9hours.

Yesterday the whole float was traded!

MC of sub 200mil for a company with 600+ Stores, 30K+ employees, 1080 open positions

earnings Q3 yesterday aren’t good

townhall meeting today

🚀

Since I am @jamo1966 has nominated me for the #bestworst challenge, I now have to follow suit and make my posts.

My best investment apart from everything was of course my Audi R8 - simply because of the driving fun (ROI > 1000%).

In terms of stocks, the following were my best investments:

best:

Bought in Corona before the big hype was $GME (+7.23%) definitely by far my best investment. Whopping 2.796,71% I have to date 🚀

worst:

Recently I wanted to take the next train towards Renditetown with $BBBY but that has not yet really departed. Until today, unfortunately, 25.05% loss. Let's see what still comes.

Since I was nominated I now also nominate two. Once @Andreas1991 and the other @Anna11

Best v.s. Worst Investment 📈📉

Evening all @markusnowak Was wondering what my best v.s. worst investing was, so I thought I'd share.

Worst:

$VOW3 (-2.26%) Volkswagen: I got into VW at 179 and managed to get out at 230. I then had them on the watchlist until 175 and then invested. At the moment I have a total performance of -25%. Learning - "Never catch a falling knife

Best:

$XPEV (+2.66%) Xpeng: In Summer 2021, Tesla had super gains and I thought to myself, what else is there. Then I came to Xpeng where I sold with 63%.

I still hope for a 100% return, but may it also be safe to be, let's see what happens the next few years so.

What about you @oliverplass ? Do you have other investments besides bitcoin? And with you @_Gonzo

$BBBY?

getquin Daily Summary 31.08.2022

Hello getquin,

Today we have again exciting topics for you from the search at J.P. Morgan in Frankfurt to layoffs and crazy market movements at Snapchat.

Europe🌍:

1. investigators search US major bank J.P. Morgan in Frankfurt

JP Morgan wants to cooperate. The background is the Cum-Ex scandal. There are said to be more than 20 defendants, including managers and employees from the compliance department. The term Cum-Ex stands for trading in large blocks of shares with (cum) and without (ex) dividends, which comes from Latin. Those involved had capital gains taxes refunded to them that they had not paid at all. JP Morgan is said to have been involved in classic cum-ex transactions and later also used corresponding models for tax evasion.

Read more: https://bit.ly/3CHK2oj

🟥 $JEDT €114.16 (🔽 -0.24%)

Americas🌏:

2nd Snapchat announces 20% employee layoffs

Snapchat will lay off 20% of its more than 6,000 employees and discontinue several projects, including its Pixy photo drone and Snap Originals premium shows. The company promoted Jerry Hunter, senior vice president of engineering, to chief operating officer. Snapchat recently reported disappointing second-quarter results and said it would not provide guidance for the current quarter.

Read more: https://cnb.cx/3pWFaDY

🟩 $SNAP (-1.92%) €11.14 (🔼 +11.14%)

Asia🌏:

3rd top Softbank executive resigns

Rajeev Misra, a top SoftBank executive and a key ally of CEO Masayoshi Son, has stepped down from his roles as corporate officer and executive vice president of SoftBank Group. He remains CEO of SoftBank Investment Advisers, the company responsible for the $100 billion Vision Fund, which has made high-profile bets on companies such as Uber. SoftBank's investment strategy has come under fire after a series of bad investments such as WeWork, and the recent slide in tech stocks has hurt the fund's performance. SoftBank's Vision Fund posted a record loss of 3.5 trillion Japanese yen for the fiscal year ended March 31.

Read more: https://cnb.cx/3AE1yH9

🟩 $SFTBY (-1.39%) €20,01 (🔼 +1,65 %)

Welt🗺️:

4th BYD plunges after Buffett reduces his stake

Hong Kong-listed shares of BYD plunged Wednesday after Warren Buffett's Berkshire Hathaway cut its stake in the Chinese electric carmaker. One fund manager said this could be a warning sign of further developments.

The conglomerate slightly reduced its stake to 19.92% from 20.04%, according to a filing on the Hong Kong Stock Exchange. Berkshire sold 1.33 million BYD shares for about $47 million - the group now owns 218.7 million shares, according to the report. EV maker BYD falls more than 12%, dragging down the Hang Seng Index on Wednesday.

Read more: https://cnb.cx/3KynUym

🟥 $BYDDY (-3.66%) €30,90(🔼 +3,89 %)

Special:🎤

5. Bed Bath & Beyond shares plummet after memestock submits share offer for undisclosed amount

Shares of Bed Bath & Beyond fell after the meme-stock-turned-retailer said in a filing that it would sell shares for an undisclosed amount. The company also announced $500 million in new financing and plans for layoffs. The stock fell 24% when the market opened Wednesday. The announcement came just hours before Bed Bath & Beyond unveiled a turnaround plan Wednesday to regain the trust of customers, investors and suppliers. Some investors had called for the retailer to capitalize on its meme status by issuing stock to raise much-needed cash.

Read more: https://cnb.cx/3dYe3Wr

🟥 $BBBY €9,51 (🔼 -23,35%)

Quarterly figures:

🚖 Crowdstrike $CRWD (+0.55%)

EPS: 🟩 $28 cents expected vs $36 cents published

Revenue: 🟩 $516 million expected vs $516 million published

🚖 Hewlett Packard $HPQ (-0.4%)

EPS: 🟥 $1.05 cents expected vs $0.94 cents published

Revenue: 🟥 $14.9 billion million expected vs $14.7 billion million published

🟥 $EUNL (+0.72%) €73.62 (🔽 -0.25%)

🟥 $TSLA (+9.97%) €274.83 (🔽 -1.26%)

🟥 $SP500TR 3.985,56 (🔽 -0,010 %)

🟥 $GDAXI 12.929,62 (🔽 -0,23 %)

🟩 $BTC (+0.31%) ₿, €19.986,32 (🔼 +0,63%)

Time: 17:30 CEST

Joke of the day:

'I won $3 million on the lottery this weekend so I decided to donate a quarter of it to charity. Now I have $2,999,999.75.'

getquin Daily Summary 30.08.2022

Hello getquin,

here is again your daily collection of news, useless and sometimes useful facts and everything that could be related to stocks. Today the market was not so positive. In addition to news on European stocks, today we have an all-round view with Asia and America. Write in the comments, how it was today so about your portfolio.

Europe🌍:

1. German inflation rate reaches 7.9%, the highest level in 50 years

Sharp price increases for energy and food have pushed the inflation rate in Germany to its highest level in almost 50 years. According to calculations by the Federal Statistical Office, consumer prices in May were 7.9 percent higher than in the same month last year.

This meant that the inflation rate in Europe's largest economy remained above the seven percent mark for the third month in a row. From April to May 2022, prices rose by 0.9 percent. The Wiesbaden-based statisticians confirmed their preliminary data from the end of May on Tuesday.

Read more: https://bit.ly/3wG6jz7

🟩 $GDAXI 12.957,92 (🔼 +0,50 %)

America🌏:

2nd Elon Musk invokes whistleblower claims in latest attempt to kill Twitter deal

Elon Musk filed another notice Tuesday to end the Twitter acquisition, citing more reasons. Twitter shares fell more than 1% in premarket trading.The latest filings come after Twitter's former security chief Peiter "Mudge" Zatko earlier this month alleged "extreme, egregious deficiencies" by the social media company in privacy, security and content moderation. Twitter said Musk's latest termination attempt was "invalid and unlawful" under the acquisition agreement.

Read more: https://cnb.cx/3cr3M4Y

🟥 $TWTR €39,62 (🔽 -2,05 %)

Asia🌏:

3. concern about the impact of covid restrictions in China's major business centers.

Concern is growing over the tightening of covid restrictions in several major Chinese cities as authorities lock out millions of citizens in Shenzhen and Dalian.

The measures have added to uncertainty and concern about China's shaky economy. Analysts believe that tightening restrictions in major economic centers such as Shenzhen, Dalian and Chengdu in the southwest could have a far more serious impact than the lockdowns in smaller centers.

The new measures, planned for only a few days for now, reflect China's insistence on its "dynamic zero covid" policy of suppressing any outbreak as soon as it occurs.

"Markets could come under renewed pressure in the coming weeks, which would likely trigger another round of cuts by economists on the street," Nomura warned in a note Tuesday, highlighting the importance of cities such as the southern tech hub of Shenzhen.

Read more: https://bit.ly/3AXbMUw

🟥 $XCH $18,48 (🔽 -2,17%)

Welt🗺️:

4th Battle of the Chip Giants

An exciting day for all owners of chip and graphics card stocks. It seems like one company is trying to top the other with announcements.

AMD's CEO Lisa SU announced today that AMD will introduce four new architectures in the next few quarters, the first of which will launch as early as next month and is expected to surpass even Intel's powerhouse Core I9 in terms of gaming speed.

Shortly after, Nvidia announced a new data center solution in partnership with Dell. The data center is said to work at the forefront of AI innovation. The announcement said the two companies will provide "cutting-edge AI training, AI inference, data processing, data science and zero-trust security capabilities to enterprises around the world."

Nonetheless, the news was not reflected in stock performance, and both stocks slumped more than 3%.

🟥 $AMD (-0.12%) €86,10 (🔽 -3,13 %)

🟥 $NVDA (-0.03%) €154,02 (🔽 -3,07%)

Special:🎤

Today is the 92nd birthday of Warren Buffet.

🟥 $BRK.A (+1.48%) €432,500.00 (🔽 -1,14%)

Stocks of the day:

🟩 $PAH3 €72,74 (🔼 +4,06%)

👍 The planned IPO of VW's sports car subsidiary Porsche AG continues to drive the share price and puts investors in a positive mood. In particular, the securities of Volkswagen Group holding Porsche SE continued their price rally, following the new speculation that had arisen on Friday about the valuation of Porsche AG.

🟥 $BYDDY (-3.66%) €63,93 (🔽 -8,33%)

👎 In addition to increasing lockdown concerns, a report by the U.S. news agency Bloomberg massively weighs on the price of the papers of the Chinese e-car manufacturer and Tesla rival. According to rumors, star investor Warren Buffett could sell his shares in BYD.

🟥 Most searched

$ALV (-0.71%) €170,08 (🔽 -0,15%)

🟥 Most traded

$BBBY €12,86 (🔽 -5,3%)

🟥 $SP500TR 2.987,96 (🔽 -1,06%)

🟩 $GDAXI 12.937,49 (🔼 +0,35%)

🟥 $BTC (+0.31%) ₿, €19.758,54 (🔽 -2,48%)

Time: 17:00 CEST

Lesson of the day:

Lucid $LCID (-3.72%) today filed for a "mixed shelf offering" of up to $8 billion. But what is that anyway?

A shelf offering is a Securities and Exchange Commission (SEC) provision that allows a stock issuer (such as a company) to register a new issue of securities without having to sell the entire issue at once. Instead, the issuer can sell portions of the issue over a three-year period without having to re-register the security or pay penalties.

Best performance vs. worst performance

On the occasion of the hype and fall of $BBBY I thought I would make a post about my best and my worst investment.

Worst: Was with me unfortunately $NFLX (+0.37%). I did not buy at the ATH but still at just under 500€. In total stand at $NFLX (+0.37%) just -54,4%see screenshot

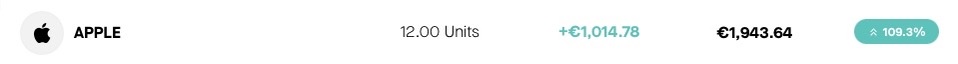

Best: My best investment was in $AAPL (+0.65%). I bought APPLE back in the Corona Crash and haven't regretted it to this day 😁 Total. +109,3%

Btw $BBBY currently down 35% haha

Top creators this week