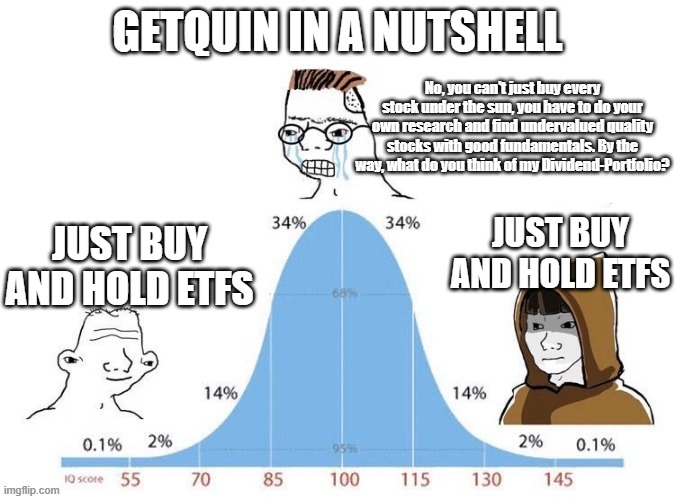

Not the content you want, but the content you deserve!

How do share returns relate to economic growth?

The USA belongs in every portfolio! BUT: Country diversification is important!

A different perspective on gold and BTC - What can possibly go wrong?

There is nothing magical about dividend growth!

At what point is my portfolio diversified? - Are 30 stocks enough?

--------------------------------------------------------------------

Crypto share

between 10-30 % of all assets

50 % $BTC (+0.15%)

45 % $ETH (+0.55%)

5 % $SOL

--------------------------------------------------------------------

Equity / bond share

Multifactor portfolio with cash / bond reserve for countercyclical purchases.

--------------------------------------------------------------------

Target allocation bonds / cash:

20% - 0% of the total portfolio, depending on the distance from the last ATH

75% EUR

------> 50% cash + overnight ETF $CSH2 (-0.02%)

------> 12.5% Inflation Linked Govt Bonds $IBCI (+0.41%)

------> 12.5 % Germany Gov Bond $X03G (+0.56%)

25 % USD

------> 12.5 % TIPS US Inflation-Linked Bonds $XTIP (+0.66%)

------> 12.5 US Treasury Bond 3-7 Year $TR7G (+0.64%)

--------------------------------------------------------------------

Target allocation equities:

80-100% of total portfolio, depending on distance from last ATH

35.0% World AllCaps Market capitalization weighted

-> 35 % Developed + Emerging Markets $SPYI (+0.51%)

48.0 % Developed Markets Factors

-> 12.0 % Value Factor $XDEV (-0.27%)

-> 12.0 % Quality Factor $XDEQ (+0.88%)

-> 12.0 % Momentum Factor $XDEM (+1.27%)

-> 12.0 % Size factor

----> 2.75 % US Small Cap Value weighted $ZPRV (+0.99%)

----> 2.75 % US Small Cap Quality $RTWO (+0.9%)

----> 5.5 % EU Small Cap Value weighted $ZPRX (-0.98%)

----> 1.0 % Japan Small Caps $ISJP (-0.29%)

17.0 % Emerging Markets

-> 2.0 % EM AllCaps $EIMI (-1.88%)

-> 5.0 % EM Value Factor $5MVL (-2.19%)

-> 5.0 % EM Quality $PEH (-3.12%)

-> 5.0 % EM Size Factor $SPYX (-1.87%)

Performance porn 2023: