And they don’t even know it.

This year I watched a coworker cut his IRPEF by THOUSANDS…

while everyone else kept complaining and doing NOTHING.

Here’s EXACTLY what he did 👇

(and why 99% of workers are leaving money on the table)

🟡 1️⃣ The Most BROKEN Move in Italy

Previdenza Complementare

He put money into an Italian pension fund.

Not because he’s old.

But because every euro is fully deductible.

It’s basically a legal tax glitch.

And almost nobody uses it.

🟢 2️⃣ The IRPEF-KILLER

Invest in Innovation (Startup / PMI)

Italy will literally give you back:

30%

or even 65%

of what you invest in innovative companies.

He put money into a few platforms…

Boom: thousands shaved off IRPEF instantly.

Meanwhile people prefer paying taxes.

Wild.

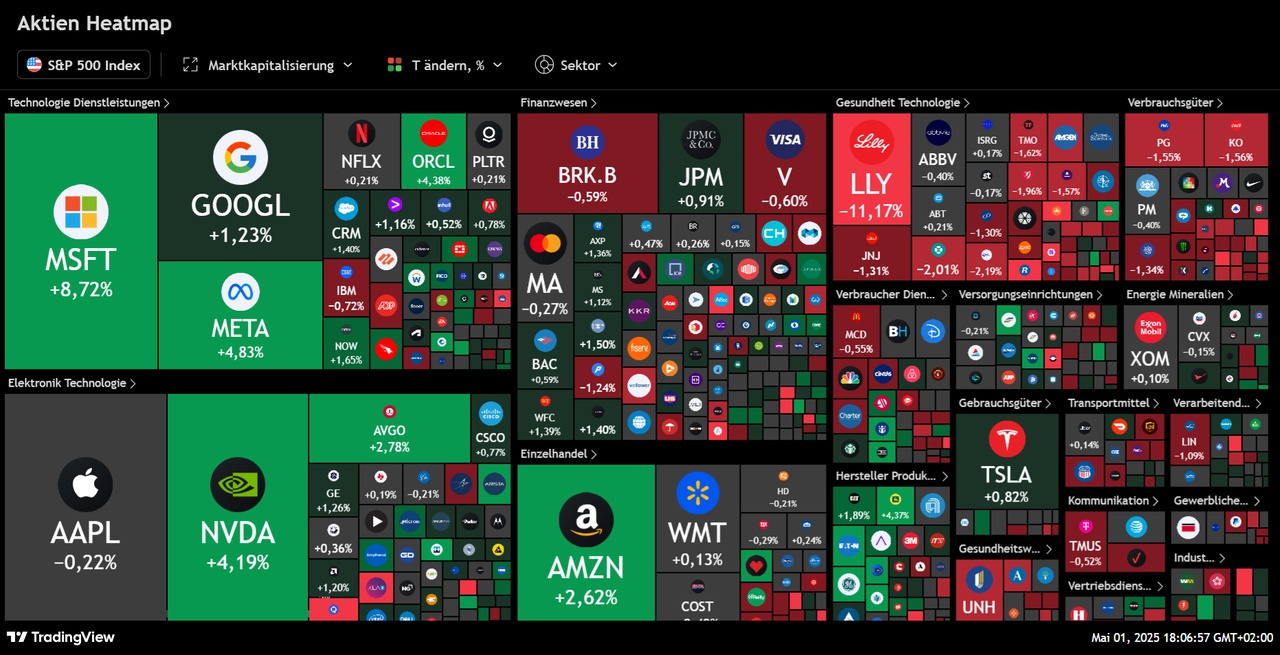

💹 3️⃣ The Silent Wealth Hack

Switch to ACCUMULATING ETFs or Low dividend ETF $VWCE (-0.74%)

$WEBG (-0.76%)

No dividends → no dividend tax → MAX compounding.

It’s the long-term cheat code.

Simple. Clean. Efficient.

🧨 The Result?

Lower IRPEF.

Higher net worth.

Zero wasted money.

All 100% legal.

⚡ Want to STOP overpaying and START optimizing?

I share the exact strategies Italian workers can use to:

reduce IRPEF

invest smarter

build wealth faster

👉 Follow me on Getquin

#irpef

#tasseitalia

#etfs

#etfaccumulo

#startup

#previdenzacomplementare