Hello my dears,

Yesterday I was reminded by dear @Dirty30 reminded me of a company from Bulgaria.

And that's why I'm introducing the company today.

Bulgaria launched on January 1, 2026 introduced the euro. "The euro will bring benefits to the Bulgarian people, making payments and travel easier. It will offer new opportunities to Bulgarian businesses and allow them to better take advantage of our single market," said European Commission President Ursula von der Leyen in a statement.

📈 Why joining the euro creates structural appreciation potential

1. elimination of the currency risk

The lev was a real obstacle for international investors. The euro eliminates this:

- Hedging effort

- Exchange rate risk

- Uncertainty about monetary policy

This alone often leads to higher multiples.

2. capital inflows from EU funds & institutional indices

With euro entry, Bulgarian equities slip into :

- more European small-cap indices

- Emerging Europe funds

- ETF universes that were previously excluded

This creates automatic demandregardless of fundamentals.

🔍 How much potential is realistic?

If Bulgaria experiences the same valuation adjustment as:

- Slovenia

- Slovakia

- Baltic states after the introduction of the euro

...then +50-100 % over several years is absolutely realistic

Tech (e.g. Shelly)

Export-oriented, high margins, capital inflows, scaling

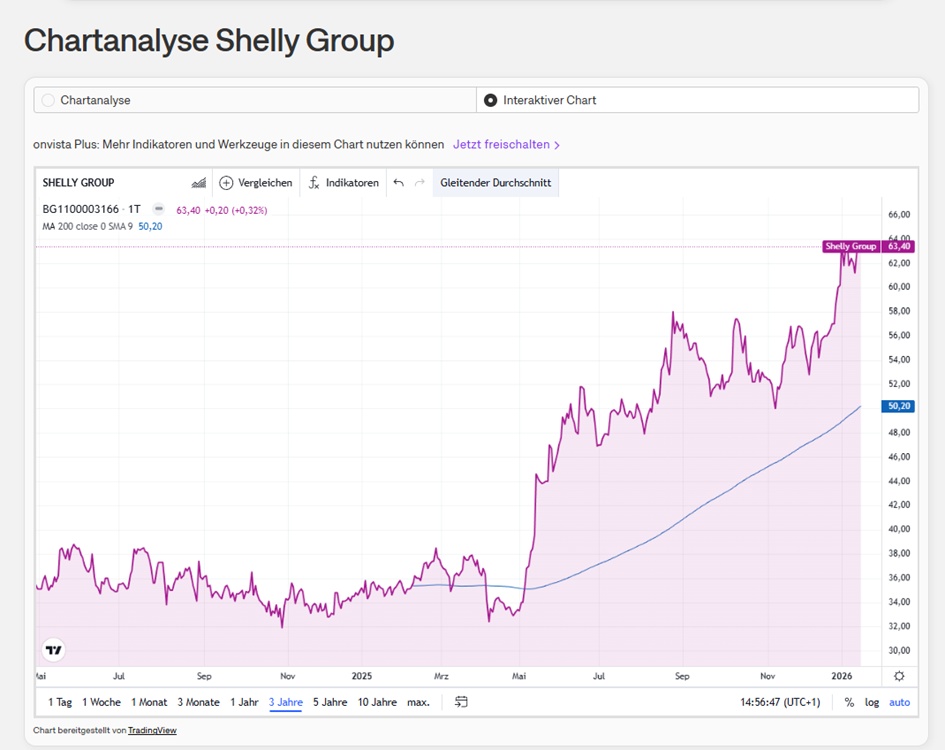

Shelly wins. $SLYG (-1.2%)

My dears, how exciting is the Bulgarian stock market for you? And what do you think of Shelly?

Feel free to let the tradesmen and electricians know in the comments.

150 million turnover & favorite of electricians, SHELLY

150 Millionen Umsatz & Liebling der Elektriker, SHELLY | Kassenzone

Shelly Group ADformerly Allterco AD, is a Bulgaria-based company primarily engaged in the acquisition, management, valuation and sale of investments in Bulgarian and foreign companies. Its activities include the acquisition, management and sale of bonds, the acquisition, valuation and sale of patents, the granting of licenses for the use of patents to companies in which the company has an interest and the financing of companies in which the company has an interest. The Group consists of 6 subsidiaries and has branches in Bulgaria, Germany and Slovenia as well as in China and the USA. Through its subsidiaries, the Group is active in the development, production and trade of smart devices for the Internet of Things (IoT) and in real estate management, and operates in the fields of information technology (IT) services and IT consulting.

Number of employees: 277

We transform innovative ideas and technologies into solutions for improved product efficiency and reliability.

Customers and their needs lead the development of our IoT solutions. Our focus is on helping customers make environmentally conscious decisions in their everyday and business lives by using data-based tools to track and manage energy consumption.

Global presence

The Shelly Group consists of 6 subsidiaries and has offices in Bulgaria, Germany, Slovenia, China and the USA. The company has already conquered over 100 markets, helping customers live a calmer and happier life while increasing the energy efficiency and comfort of any home or commercial building.

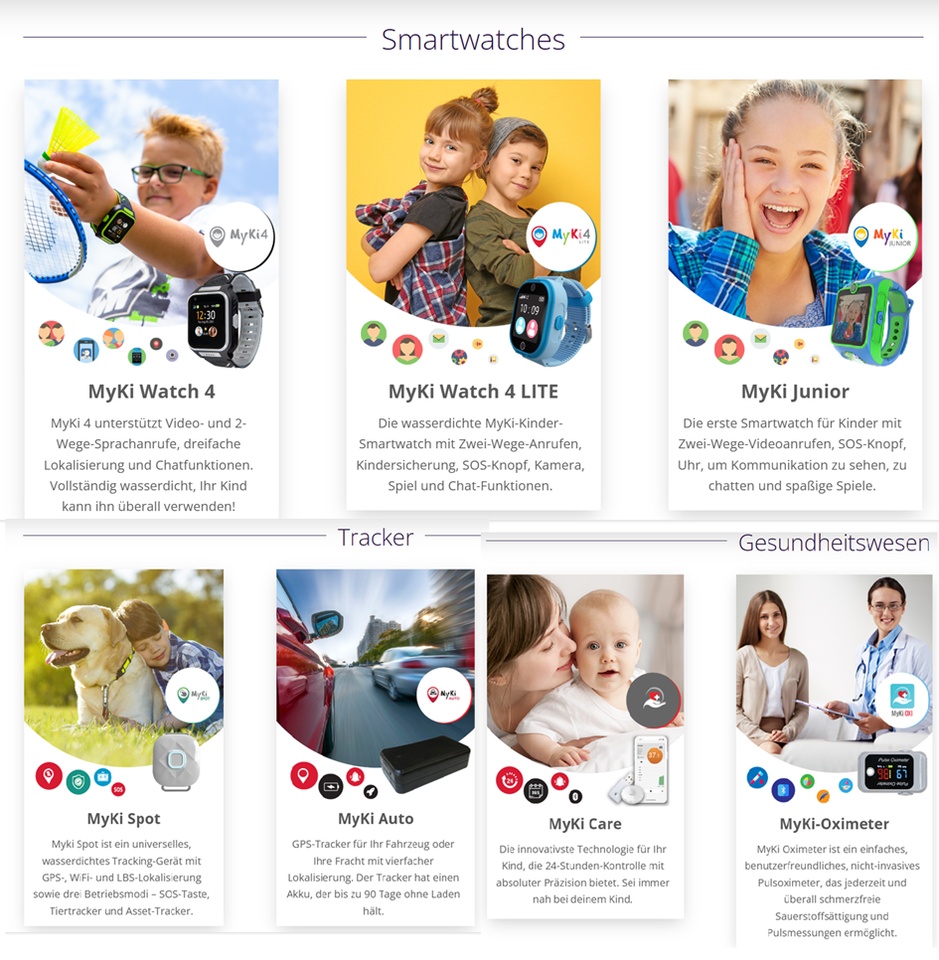

In December 2015, Shelly introduced the first GPS/GSM watch tracker for children, MyKi Watch. Since then, the MyKi family has expanded with MyKi Pet, a device that helps pet owners monitor their pets' whereabouts at all times via an app. In February 2017, MyKi Touch joined the marked side - a touchable watch tracker for children with more features.

Today, thousands of children in Bulgaria wear MyKi. Both MyKi Watch and Myki Touch are available for countries around the world.

Performance

1 year +83.72 %

Current year +4.98 %

Shelly Group publishes preliminary consolidated revenue for financial year 2025

Sofia / Munich, January 13, 2026 - Shelly Group SE (Ticker: SLYG / ISIN:

BG1100003166) ("Shelly Group" / "the Company") has achieved an increase in consolidated

2025 financial year, according to preliminary figures, an increase in revenue from the sale

of devices and related services by around 40% to approximately EUR

149.7 million (around BGN 292.8 million) compared to the same period of the previous year.

This figure is well within the forecast range of EUR 145 million

to EUR 155 million (BGN 284 million to BGN 303 million).

The EBIT forecast for the 2025 financial year is confirmed. The sales target

of around EUR 200 million for 2026 remains unchanged.

The company will officially announce the unaudited consolidated figures for the financial year

2025 financial year on February 23, 2026 after the close of trading.

Note: EUR/BGN exchange rate fixed at EUR 1 = BGN 1.95583.

Further information at corporate.shelly.com.

Contact Investor Relations

Shelly Group consistently aligns finance organization for further

international scaling of the next growth phase

08,01,2026

Shelly Group significantly increases revenue and profitability in 9M 2025 - New product lines provide additional impetus for 2026

12,11,2025

BGN in millions

Estimates

Year Turnover Change

2024 208,7 42,42 %

2025 290 38,95 %

2026 403,3 39,07 %

2027 538,4 % 33,5 %

Year EBIT Change

2024 50,27 34,47 %

2025 72,46 44,13 %

2026 97,91 35,13 %

2027 133,2 36 %

Year Net result Change

2024 45,29 34,95 %

2025 57,81 27,63 %

2026 80,56 39,37 %

2027 106,7 32,49 %

Great and steady increase in earnings

Year Net debt CAPEX

2024 -14,8 7,791

2025 -27,4 7,316

2026 -43,1 7,409

2027 -74,4 8,282

Year Free cash flow Change

2024 -2,364 -123,04 %

2025 20,38 962,27 %

2026 34,96 71,51 %

2027 51,31 46,76 %

Great increase in free cash flow

Year EBIT margin ROE

2024 24,09 % 34,85 %

2025 24,99 % 39,9 %

2026 24,28 % 42,5 %

2027 24,73 % 40,8 %

Year Earnings per share Change

2024 2,49 36,07 %

2025 3,192 28,19 %

2026 4,446 39,3 %

2027 5,886 32,39 %

Year Dividend Yield

2024 0,25 0,38 %

2025 0,369 0,3 %

2026 0,631 0,51 %

2027 0,845 0,69 %

Year P/E ratio PEG

2024 26.4x 0.7x

2025 38.6x 1.4x

2026 27.7x 0.7x

2027 20.9x 0.6x

Market value 2,237

Number of shares (in thousands) 18,158

Date of publication 24.02.2025