The big world ETF guide

Reading time: approx. 12 min

1) INTRODUCTION

Anyone entering the world of investing and wanting to start investing often wants one thing above all else: Simplicity.

A globally diversified ETF offers just that: an uncomplicated way to participate in global economic growth at low cost without having to familiarize yourself with complex investment strategies. But when it comes to choosing the right global ETF, many beginners are faced with the question: Which is the right one for me? me?

In this article, I will introduce you to various options for building a diversified world ETF portfolio. We start in the first section with the "one ETF for everything" solution, which is particularly suitable for investors who prefer not to deal with the topic at all. These one-ETF solutions can be saved like a piggy bank and are probably the most passive form of investment.

For investors who find the single-ETF solution too boring or under-complex, we turn to so-called multi-ETF solutions - i.e. investment ideas that include several ETFs. In the final section, we will take a closer look at a special variant that can be considered complex and requires more activity.

If you are a beginner, you can safely stop reading after the first section on the one-ETF solution, as this section contains all the information you need for a simple but effective investment in ETFs. The interested and advanced reader will then get their money's worth in the last section.

2.) THE ONE-ETF SOLUTION

Let's start with the simplest of all conceivable options: one ETF for everything. But even with the simplest form of building a world portfolio, it's the small but fine details that count. Each variant includes specific ETF suggestions with which you can realize such a one-ETF solution.

2.1 MSCI World

Probably the best-known world index is the MSCI World Index. This focuses on the largest companies in the so-called developed markets. The index contains the 1500 largest companies from 23 industrialized countries and comprises around 85% of the market capitalization of the world's industrialized nations [1]. The USA has by far the highest weighting, accounting for around 70% of the entire MSCI World Index. The second-highest weighted country is Japan with around 6%, followed by the UK with around 4%. German equities account for just over 2% of the index. The largest 10 positions - with illustrious names such as Microsoft $MSFT (-0.8%) Apple $AAPL (-0.53%) or Nvidia $NVDA (-1.04%) - already make up 24% of the overall index.

The easiest way to invest in the MSCI World Index is via an ETF. The most cost-effective option is the Amundi $MWRD or SPDR $SPPW (-1.34%) which only incur annual costs (TER) of 0.12% [2]. These are accumulating ETFs that do not distribute the income from the individual shares but reinvest it at fund level. If you prefer regular distributions, you can also choose a distributing ETF such as $MWOE (-1.2%) or $HMWO (-1.38%) you can also choose a distributing ETF.

2.2 FTSE All World

Another classic in the field of world indices is the FTSE All World. In addition to the industrialized countries, it also includes so-called emerging markets (emerging markets). The index includes the 4000 largest companies from around 50 countries [1]. In addition to the industrialized nations, the index therefore also includes shares from China, India, Brazil and Taiwan, for example. The total weighting of the USA in the FTSE All World is around 60% and the 10 largest positions account for around 21%. About 90-95% of global market capitalization is covered by the FTSE All World.

The biggest difference to the MSCI World Index is that the FTSE All World also includes emerging markets and is therefore even more broadly diversified worldwide. According to [3], the cheapest accumulating ETF on the FTS All World Index with an expense ratio of 0.15% is the one from Invesco $FWRG (-1.45%) . However, the FTSE All World ETF from Vanguard $VWCE (-1.47%) enjoys enormous popularity here on Getquin (@Lorena). Distributing variants would be the $FTWG (-1.46%) from Invesco or the $VWRL (-1.36%) from Vanguard.

2.3. MSCI ACWI IMI

Probably the most broadly diversified index is the MSCI ACWI IMI. The somewhat unwieldy name stands for MSCI All Country World Index (ACWI) Investable Markets Index (IMI). This comprises over 9000 shares from industrialized and emerging countries.

The biggest difference to the FTSE All World apart from the fact that the number of shares in the index is more than twice as high, is that the MSCI ACWI IMI also includes small caps and thus achieves an even broader diversification. According to MSCI, the index covers approx. 99% of global market capitalization.

With an expense ratio of only 0.17% and at the same time the only accumulating ETF on the MSCI ACWI IMI is the $SPYI (-1.51%) from SPDR. The distributing variant has also been available since June 2024 $SPSA (-1.31%).

In my opinion, the MSCI ACWI IMI the all-in-one package when it comes to broadly diversified global investing. I therefore personally use the $SPYI (-1.51%) and the $SPSA (-1.31%) for my child's custody account.

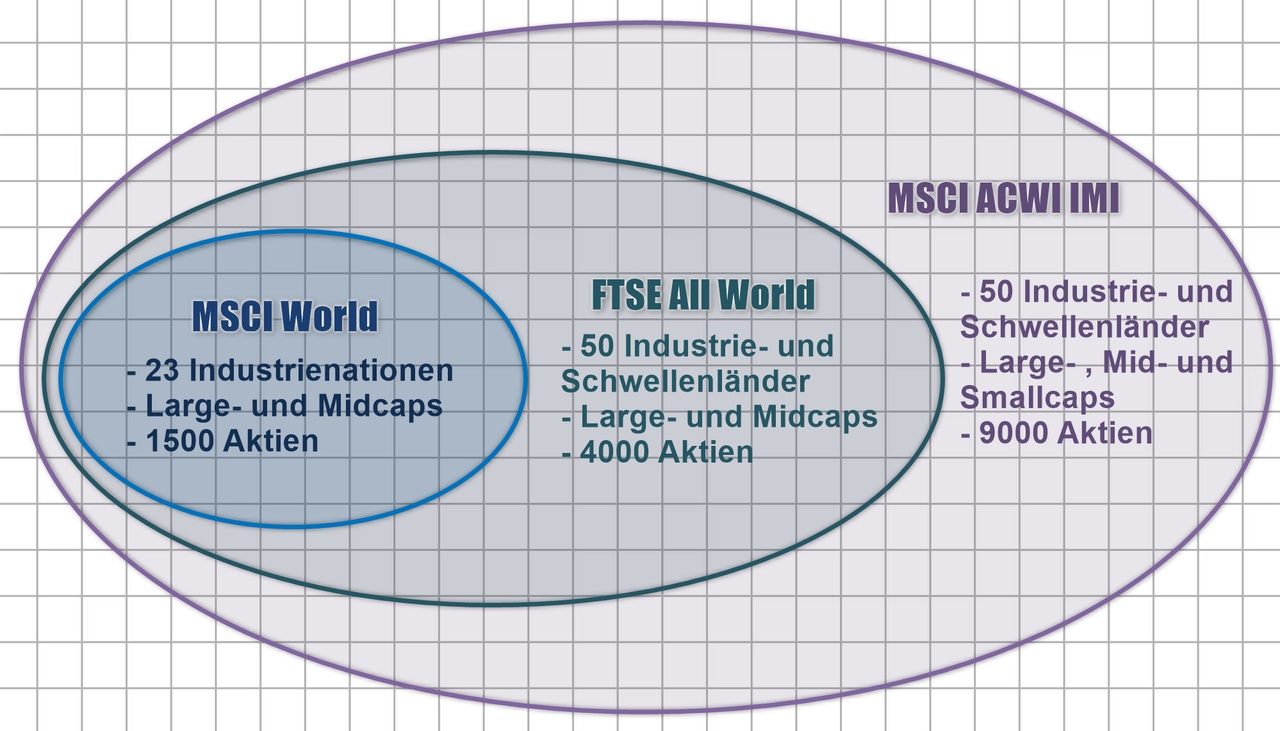

The following chart provides an overview to illustrate this:

To calculate the real performance, I have created sample portfolios with the corresponding ETFs. For the MSCI World I chose the $SC0J (-1.18%) as it has been tradable in Germany since June 2009. For the FTSE All World, I opted for the classic $VWCE (-1.47%) from Vanguard, which has been available in Germany since July 2019. For the MSCI ACWI IMI, I opted for the $SPYI (-1.51%) which has been available to buy in Germany since 2011.

As a result, the maximum comparison period is July 2019 to the present day. During this period of just over 5 years, the MSCI World ETF $SC0J (-1.18%) has performed best with a performance of around +102% (+13.6% CAGR). The FTSE All World $VWCE (-1.47%) follows with a performance of +90% (+12.4% CAGR) and in last place is the $SPYI (-1.51%) with +85% (+11.8% CAGR).

Unsurprisingly, the MSCI World is ahead in the selected comparison period. This is mainly due to the significantly higher weighting of the USA in the MSCI World and the absence of the emerging markets, which performed comparatively poorly in this period. Although the ACWI IMI is similar to the FTSE All World, it performs somewhat worse, as the small caps also lagged behind the broad market in the comparison period.

As past performance is no guarantee of future performance, this does not automatically mean that the MSCI World will perform better than the other two variants in the coming years. That is why I personally continue to prefer the MSCI ACWI IMI for long-term investment $SPYI (-1.51%).

3.) THE MULTI-ETF SOLUTION

Why keep it simple when you can make it complicated? That's what many investors think - myself included. There are several ways to construct a global portfolio with more than one ETF to allow a certain degree of flexibility. However, this is only necessary if you consciously over- or underweight certain countries, factors or sectors. This may be because you have a very positive view of emerging markets or because you consider the 70% US share in the MSCI World to be too high.

However, flexibility and personal views also entail more complexity and work than the one-ETF solution. As soon as we have more than one ETF in the portfolio, the question of weighting, rebalancing and when to rebalance at all automatically arises. This also increases transaction costs, and rebalancing can lead to early taxation and an interruption of the compound interest effect. To justify this, you should be very sure that the one-ETF solution is not the ideal solution for you personally after all.

A detailed performance comparison is provided after the presentation of the world portfolio solutions at the end of this section.

3.1. 70/30 Portfolio MSCI World & Emerging Markets

A classic variant to cover the emerging markets missing from the MSCI World is a portfolio consisting of an MSCI World ETF and an MSCI Emerging Markets ETF. A weighting consisting of 70% MSCI World and 30% emerging markets is established and often quoted.

Compared to the FTSE All World, this is a higher proportion of equities in the emerging markets, as this is only around 10%. You should therefore consider a 70/30 portfolio above all if you want to overweight the emerging markets compared to the FTSE All World.

The cheapest MSCI Emerging Markets ETF with a TER of 0.18% is the $AEME (-2.1%) from Amundi. China is the largest position with a weighting of 24%. It is followed by India with a good 20% and Taiwan with around 19%. In the 70/30 portfolio, the country weighting is currently 48% USA, 7.2% China, 6% India, 5.6% Taiwan and 4.1% Japan. Germany is represented with around 1.6%. The total expense ratio of the 70/30 portfolio is 0.187%.

3.2 FTSE All World & Smallcaps

As already described in the previous sections, the FTSE All-World already contains a 10% share in the emerging markets. Only the global small caps are missing. In order to still cover these, an MSCI World Small Cap ETF can be used. In so-called factor investingthe small-cap factor is one of the best-known factor premiums [4] - small-cap stocks should achieve higher average equity returns. However, the details of factor investing will not be discussed here. You are welcome to use the source cited [4].

A portfolio consisting of 85% FTSE All World and 15% small caps is an example of a possible world portfolio that takes small caps into account. The practical implementation could be realized with the FTSE All World ETF $VWCE (-1.47%) from Vanguard and the MSCI World Small Cap ETF $WSML (-1.4%) from iShares. However, the expense ratio for the $WSML is already comparatively high at 0.35%. The overall portfolio has a TER of 0.24%.

3.3 Modular portfolio

If you want even more leeway when creating a global portfolio with ETFs, you can take the next step and put together a portfolio based on the modular principle. Instead of using the traditional division into industrialized countries and emerging markets, you select the individual world regions separately and determine their weighting yourself. This approach offers great opportunities and freedom, but at the same time significantly increases complexity.

Such a modular world portfolio could look like this, for example:

- 50% USA via S&P500 ETF $SPXS (-1.31%)

- 20% Europe via MSCI Europe ETF $XMEU (-1.05%)

- 20% emerging markets via MSCI Emerging Markets ETF $AEME (-2.1%)

- 10% Japan via MSCI Japan ETF $LCUJ (-2.17%)

The selected weightings and regions are of course subjective and depend on the individual preferences of the investor. The world's strongest stock market in the USA is represented by the well-known S&P500 index. The entire European region, including non-EU countries, is covered by the corresponding ETF. The advanced industrial nation of Japan is represented by a special ETF, while China, India and Taiwan are included in the portfolio via the Emerging Markets ETF. The total expense ratio of this example portfolio is 0,097%.

3.4 Performance comparison

Due to the start dates of the ETFs used, a performance comparison is possible here from August 2019. For the performance comparison, I have created corresponding sample portfolios here on Getquin and rebalanced them at annual intervals. rebalancing at annual intervals.

The rebalancing proceeded as follows:

- the weighting of the portfolio is checked once a year

- if an individual weighting deviates by more than 30% from the target weighting, the entire portfolio is adjusted back to the original target allocation

Specifically, I have (arbitrarily) chosen June 15 as the cut-off date for rebalancing. The annual review of the weighting is a compromise between effort and cost. Rebalancing too frequently would cut profits too quickly; rebalancing too infrequently, on the other hand, would blur the intention behind the portfolio, as the weightings of the positions would move too far away from the original weighting.

Overall, the 70/30 portfolio was rebalanced once during the period mentioned, as the share of the MSCI Emerging Markets had fallen below 21% (30% below the target weighting of 30% in the portfolio). No rebalancing was necessary in the FTSE All World & Smallcap portfolio. By contrast, the modular portfolio had to be rebalanced twice. As you can see, more ETFs usually mean more work.

The performance of the individual world portfolios over 5 years was:

- 70/30 portfolio+80% (+11.7% CAGR)

- FTSE All World & Smallcaps: +86% (+12.3% CAGR)

- Building block portfolio: +87% (+12.5% CAGR)

No portfolio has outperformed the MSCI World (+102%) over the last 5 years, which is hardly surprising given the lower proportion of US stocks in the portfolios. In retrospect, the best performance over the last 10-15 years would probably have been achieved with a 100% US allocation. However, the aim of a global portfolio should not be to achieve the maximum possible return, but to achieve the return of the global equity market with the lowest possible risk.

4) CAN IT BE A LITTLE MORE EXCITING?

Some people may now be thinking: why always just these boring ETFs when Bitcoin $BTC (-2.19%) exists? Interest in Bitcoin has continued to grow worldwide in recent years and Bitcoin ETFs now offer easy ways for private and institutional investors to invest in Bitcoin. Just recently, Blackrock rated a Bitcoin allocation of 1-2% in a portfolio of 60% stocks and 40% bonds as risk neutral compared to investing in the Magnificant 7 Stocks [5].

Furthermore, the US share in the portfolio cannot only be represented by the supposed standard index S&P500. Many more risk-averse investors also like the NASDAQ 100, which primarily contains high-growth tech companies.

Example may-be-somewhat-more-exciting-world-portfolio:

- 25% NASDAQ 100 over $EQAC (-1.47%)

- 25% S&P500 Equal Weight over $XDEW (-1.27%)

- 20% Europe over $XMEU (-1.05%)

- 15% Emerging Markets over $AEME (-2.1%)

- 10% Japan over $LCUJ (-2.17%)

- 5% Bitcoin $BTC (-2.19%)

The total 50% US share in the portfolio is divided into the NASDAQ 100 and an equally weighted S&P500. The equally weighted variant was chosen to avoid too much overlap with the heavyweights in the NASDAQ 100 and to create a broader base. The 5% Bitcoin weighting corresponds to a more risk-averse approach than the 1-2% suggested by Blackrock and still keeps the volatility of the overall portfolio within a reasonable range.

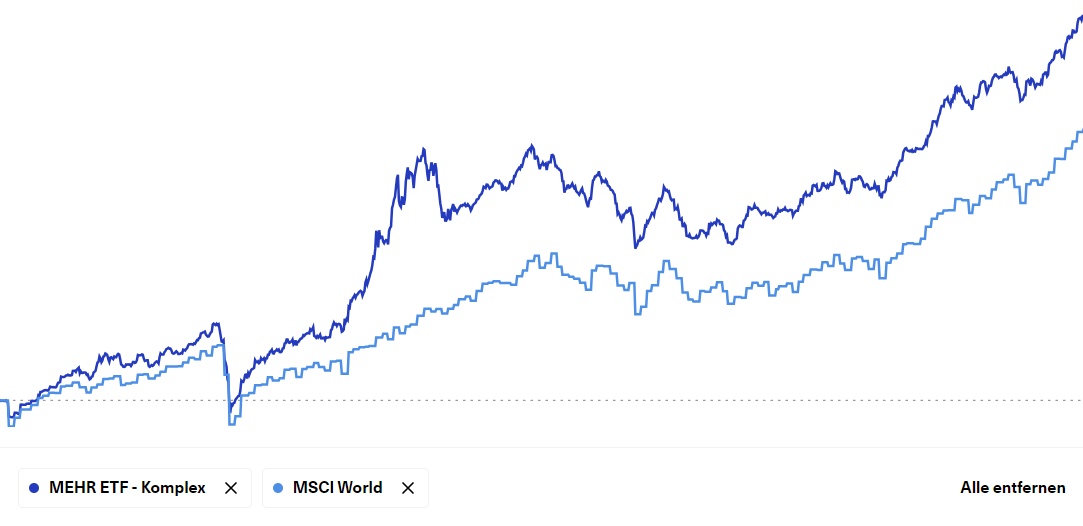

As in the previous examples, I have created a sample portfolio on Getquin and carried out an annual rebalancing check. As Bitcoin is generally somewhat more volatile, I set a wider range than the 30% deviation from the target weighting: the rebalancing was only triggered when Bitcoin accounted for either more than 10% or less than 2% of the total portfolio on the reporting date.

According to these rules, a rebalancing was triggered exactly twice in the period from December 2018 to date: 2021 and 2024. In June 2021, the Bitcoin share in the overall portfolio reached 20% and 75% of the BTC position was sold. The rebalancing also triggered the sale of a smaller share of the NASDAQ 100 ETF. The proceeds were then used to reallocate the remaining ETFs. In June 2024, Bitcoin also reached the upper limit and another rebalancing took place.

In the selected period from December 2018 to the present day, the may-yet-be-somewhat-more-exciting world portfolio achieved an overall performance of +176% (18.4% CAGR), clearly outperforming the MSCI World (+122%). The main drivers of this outperformance are firstly Bitcoin (which traded at around €3,700/BTC in December 2018) and secondly the NASDAQ 100, which clearly outperformed the MSCI World during this period.

The outperformance would of course have been much greater with a higher Bitcoin or NASDAQ100 share. In my opinion, however, the chosen overall weighting of 30% reflects a good compromise between opportunity and risk. The highest maximum drawdown of the overall portfolio in the period under review was around -20%.

5) CONCLUSION

Despite the wide range of investment options, I believe that for most investors the world ETF is the best solution for long-term wealth accumulation. Nowadays it is easier than ever to acquire a low-cost world portfolio based on an ETF.

For investors who want a little more spice, numerous options have been presented to build their own world portfolio - you don't have to build your own ETF like @Simpson 🙃

Which portfolio do you find most interesting? If you are interested, I would be happy to provide you with the (more complex) sample portfolios on Getquin for you to view.

Stay tuned,

Yours Nico Uhlig (aka RealMichaelScott)

Sources:

[2] justETF: https://www.justetf.com/de/search.html?search=ETFS&index=MSCI%2BWorld&sortOrder=asc&sortField=ter

[3] justETF: https://www.justetf.com/de/search.html?search=ETFS&index=FTSE%2BAll-World

[4] Gerd Kommer Website: https://gerd-kommer.de/factor-investing-die-basics/