Old Republic International Corporation- The stock for Opis? Part 1. here: https://getqu.in/HKAf7p/

Debt

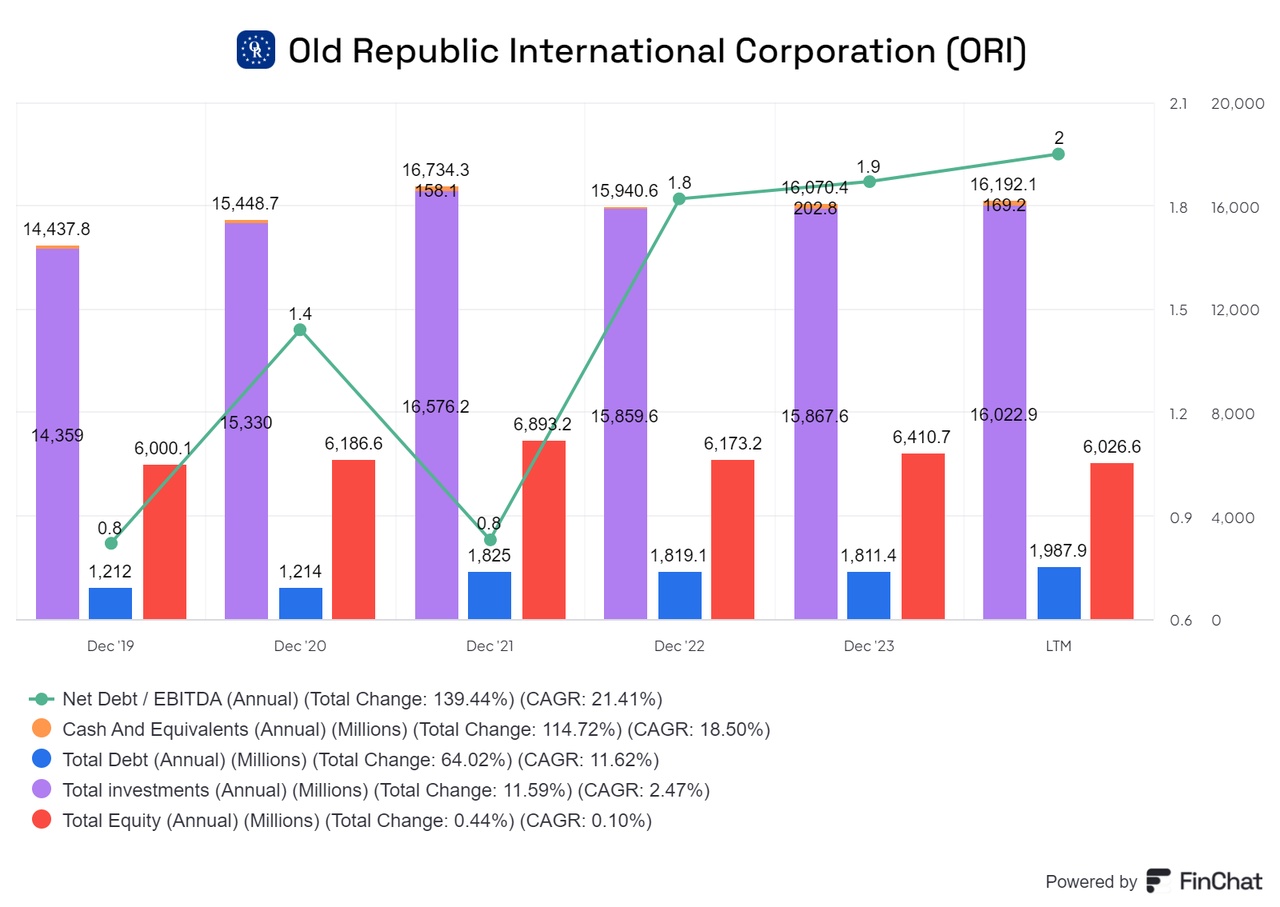

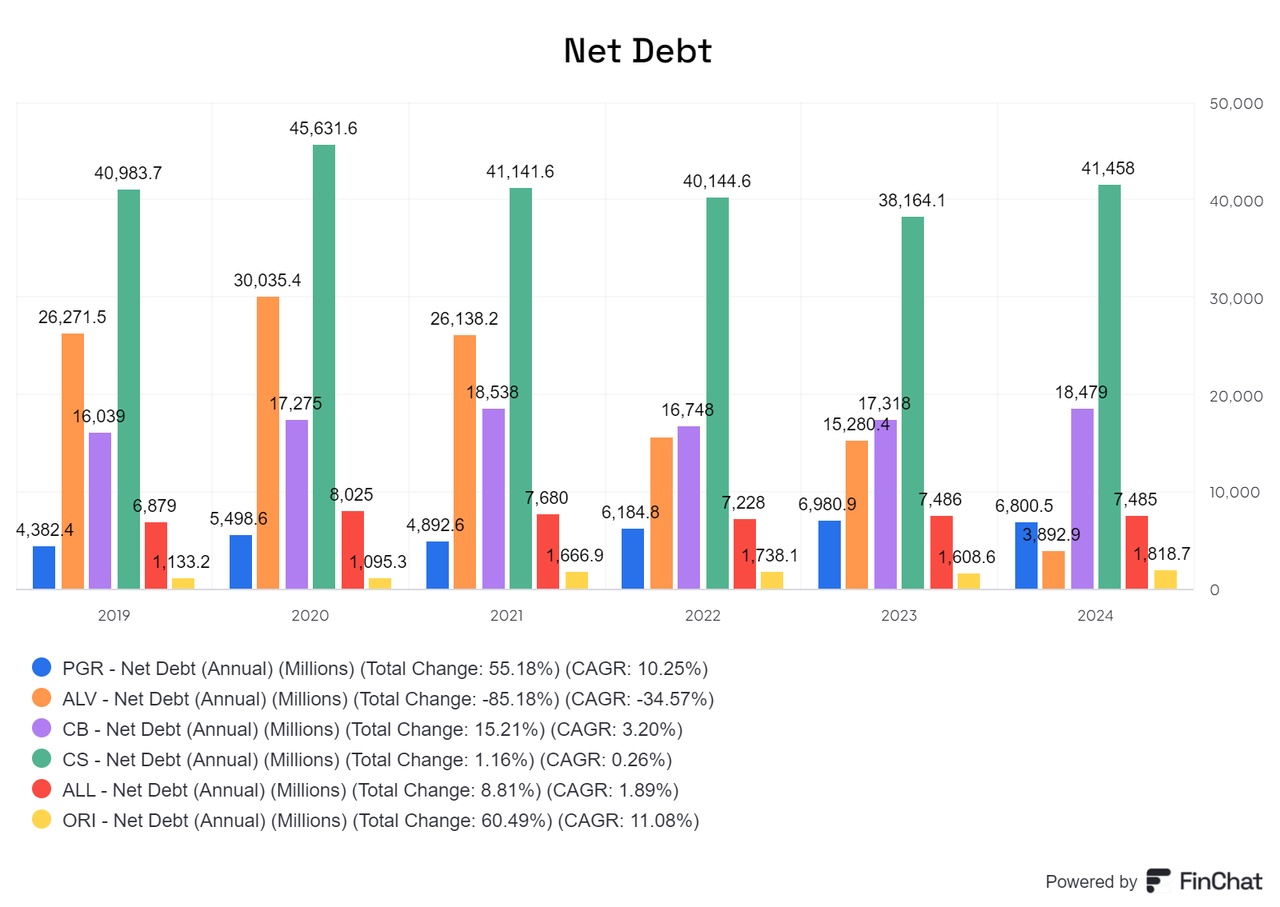

The Net Debt to EBITDA ratio of 2 is solid and shows that Old Republic International is financially well positioned. The available cash is immediately reinvested and can be found in the company's Total Investment. Compared to its competitors, ORI has the best net debt, which underlines the financial stability and efficient management of the capital structure.

ROIC & more

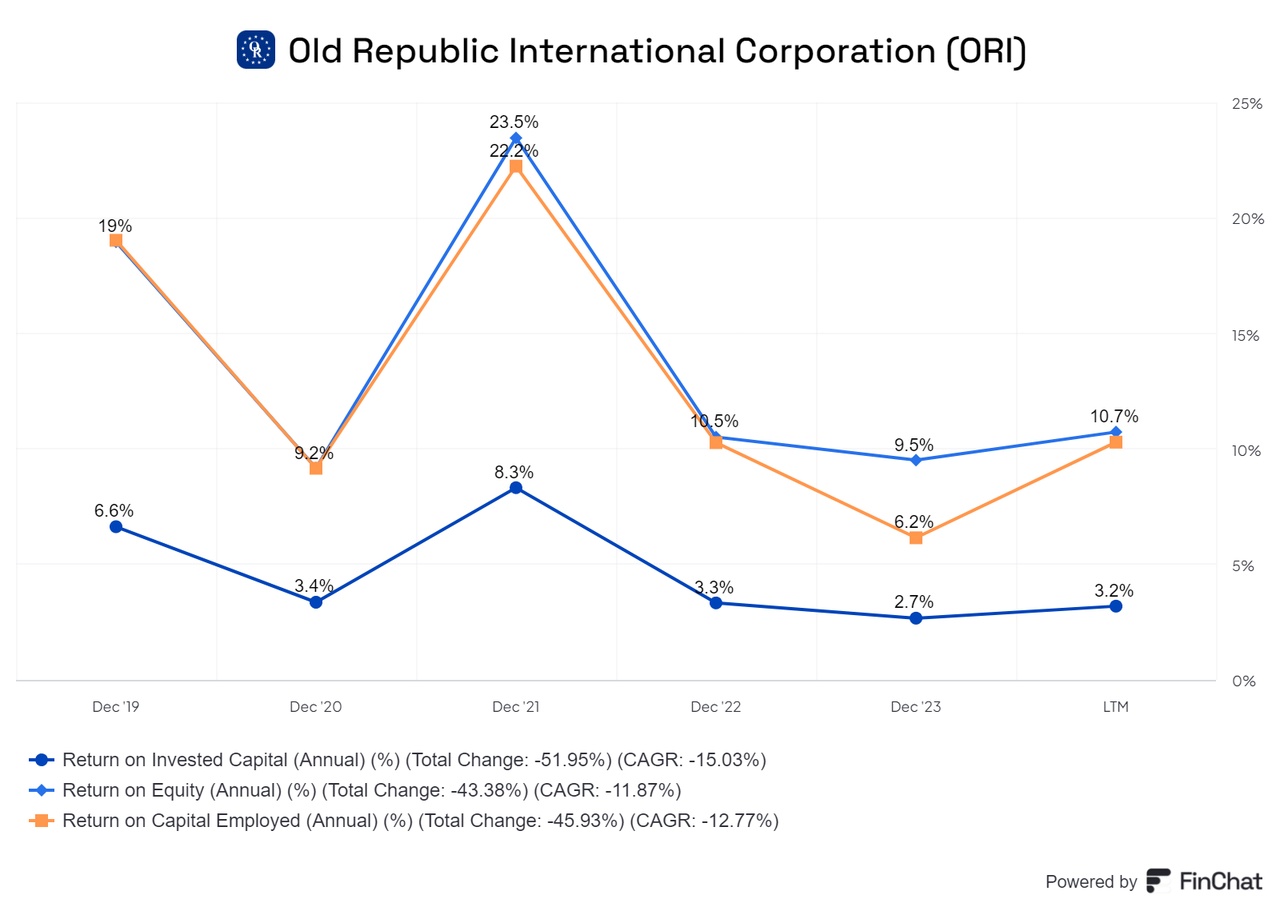

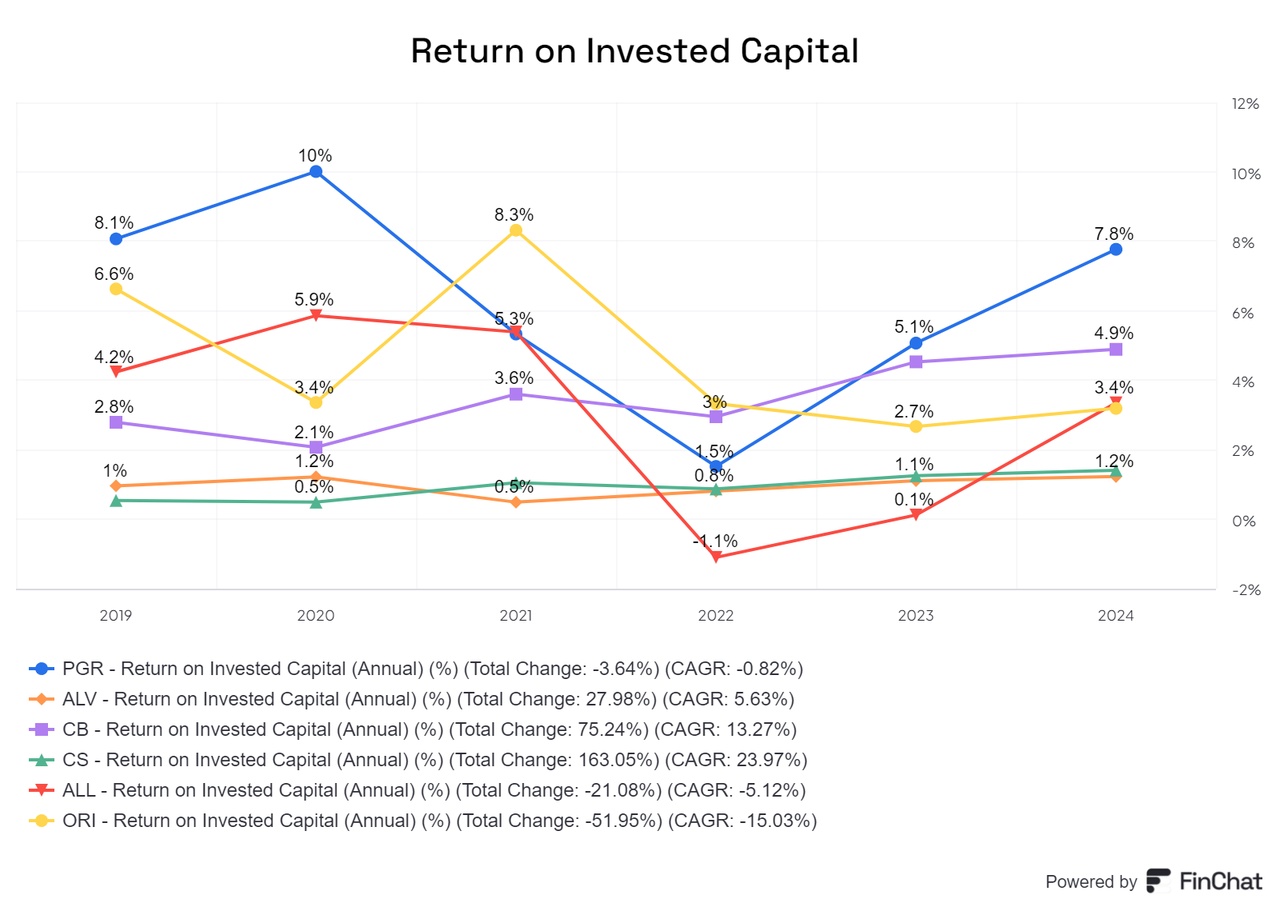

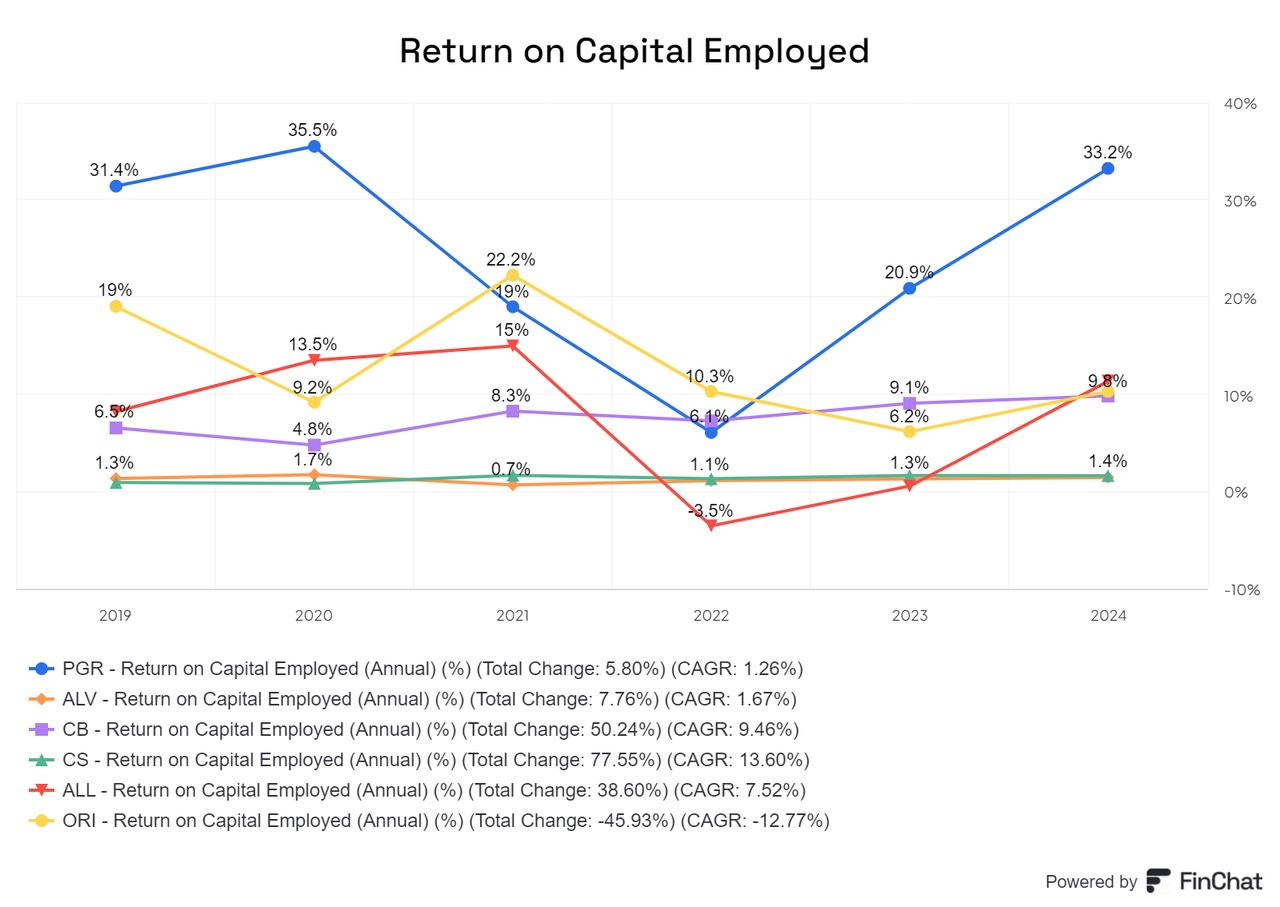

Compared to its competitors $ORI (+0.52%) Republic International also does not perform particularly well in terms of ROIC (Return on Invested Capital). This puts the company in the midfield, which is somewhat disappointing in view of its other key figures.

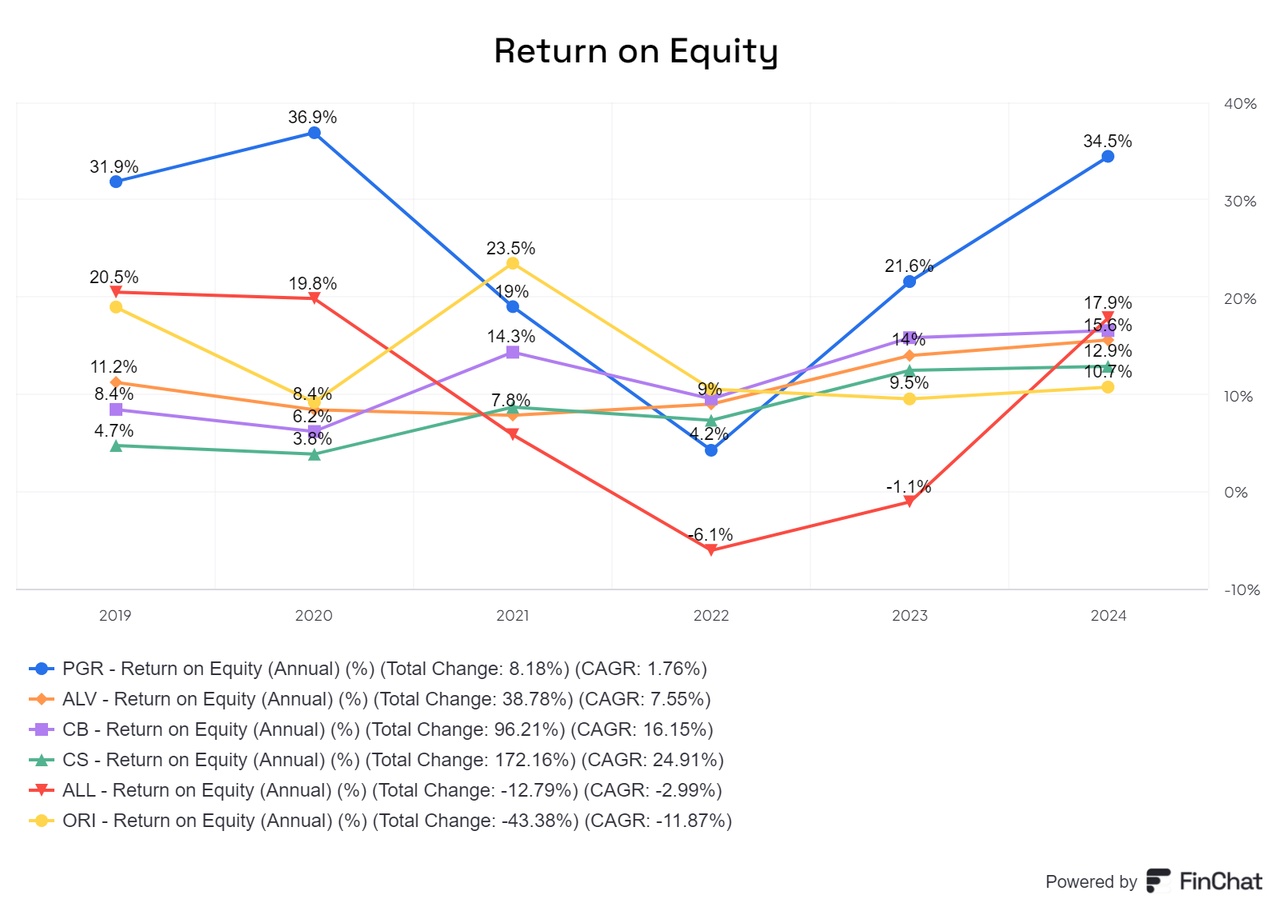

Old Republic International's ROE (return on equity) is acceptable, but is the weakest compared to its competitors.

The return on capital employed (ROCE) is average and not one of the top performers.

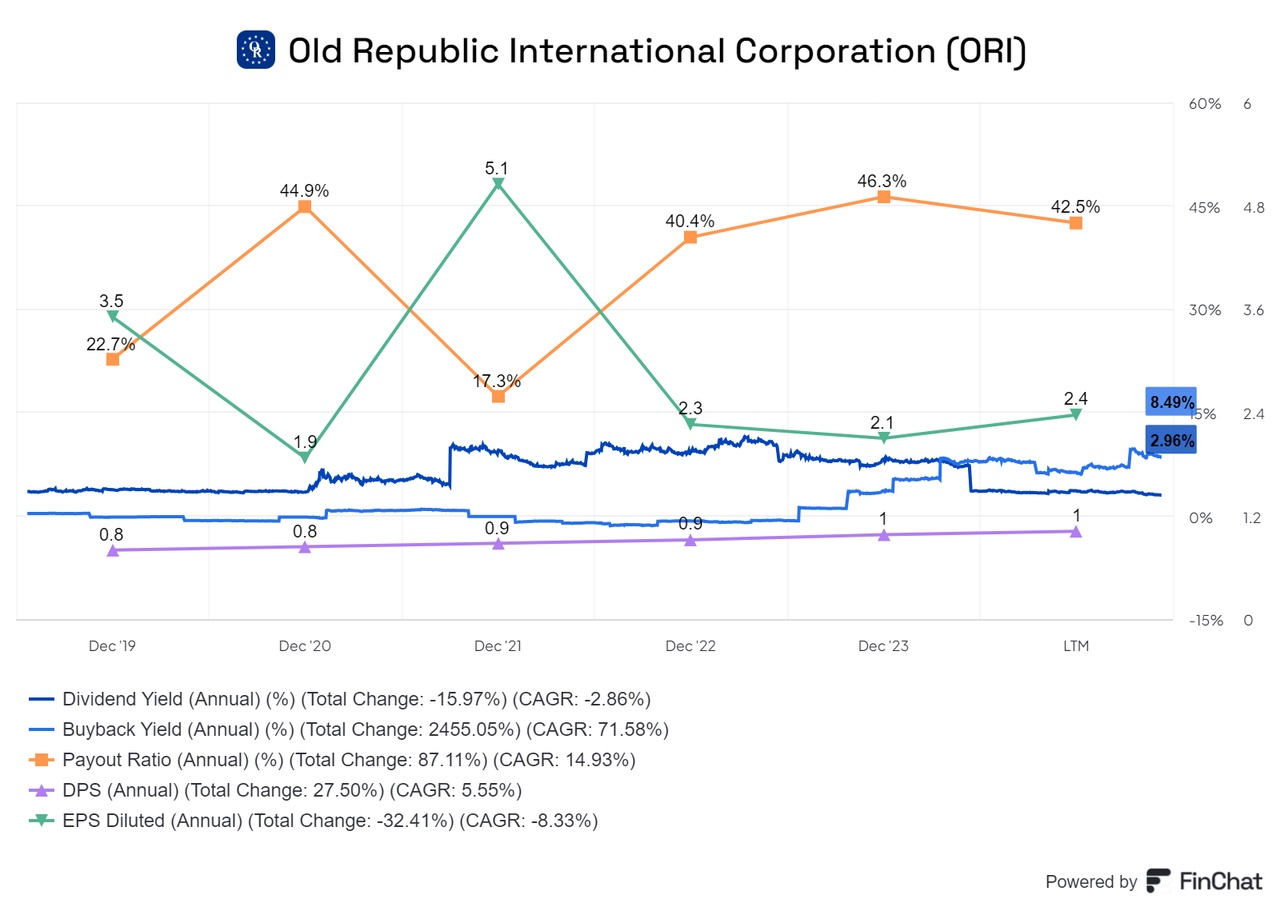

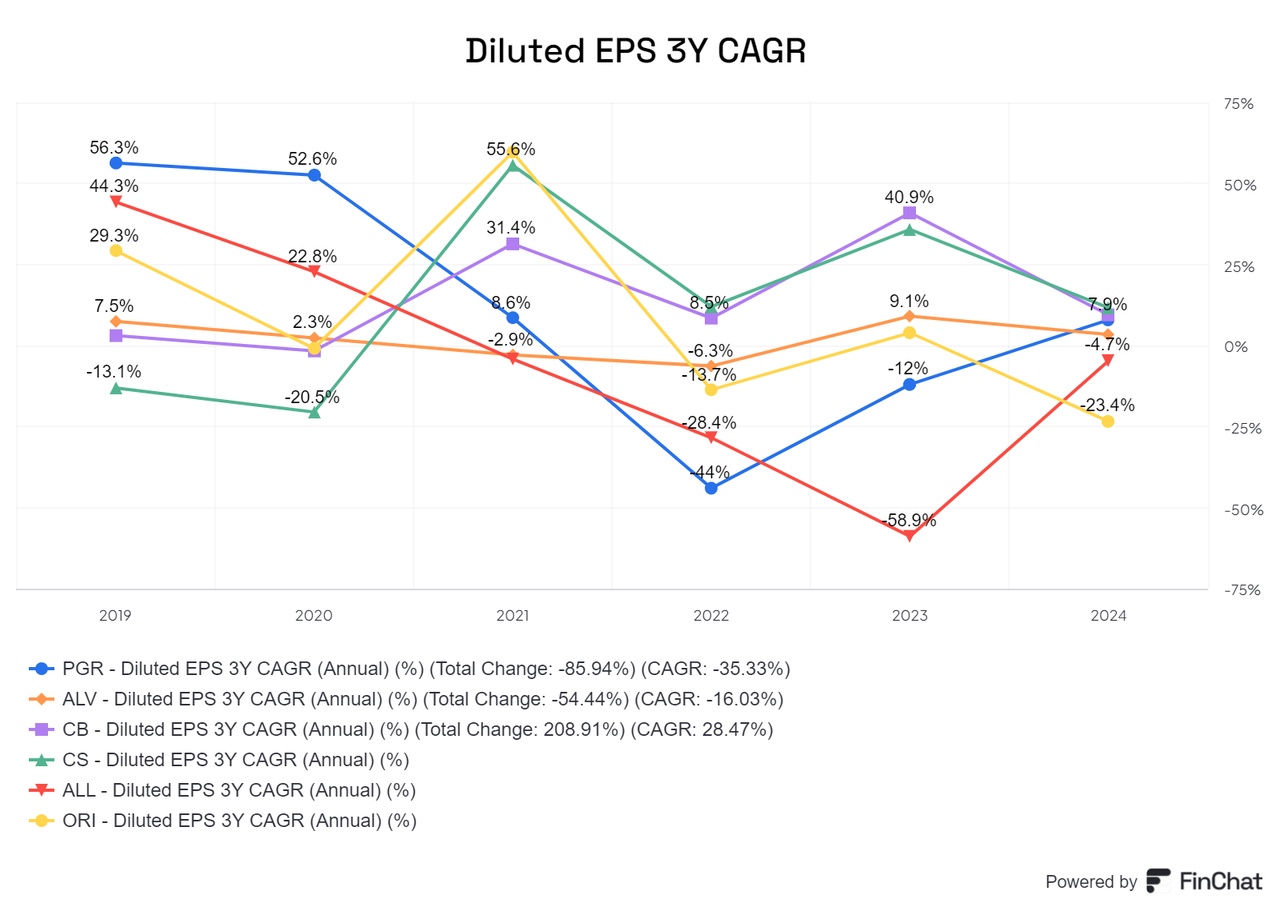

With a payout ratio of 42%, the company is within the fair range. However, earnings per share (EPS) fluctuate, which has already been explained in detail. In a good year, considerable profits can be made, while in a less successful year, earnings are correspondingly lower. The current dividend yield is just under 3% - a yield that is neither particularly outstanding nor disappointing. On a positive note, however, the dividend per share (DPS) has risen every two years in recent years.

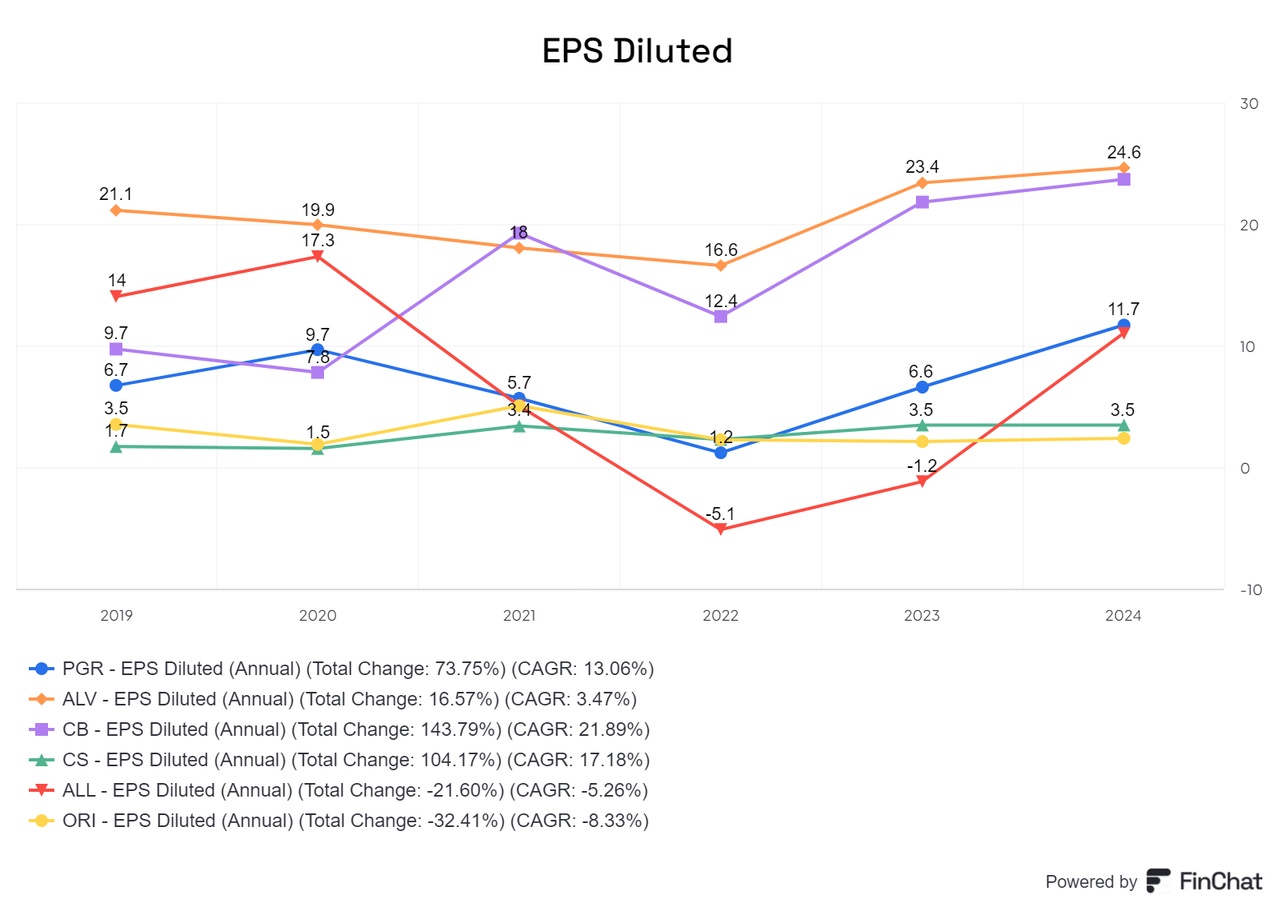

In comparison, earnings per share (EPS) are rather weak, as is the growth rate, which is also unimpressive.

Conclusion

The company is certainly interesting, but there are also some naja aspects. Securing investments through liquidity leaves a lot to be desired and raises numerous questions. One positive aspect is the outstanding gross profit, which indicates good customer relationships and generates immediate profits. However, sales are stagnating and show little growth, while KPIs are disappointing.

While the company is not a bad investment, I don't see a particularly compelling investment case for most people here. Revenue growth remains lacking and any increase would be problematic as it would likely reduce gross profit, which could leave you sitting on a limited customer base. It seems the company is focused on keeping profits high, reducing the number of shares in issue and keeping operations stable in order to pay an acceptable dividend.

Overall, one could say that the shares are suitable for investors who are looking for dividends and expect a normal market yield without having major growth ambitions. Anyone looking for above-average growth is in the wrong place here. A perfect share for @Simpson and @GoDividend those looking to get rich slowly Community.