Store is taken off the stock exchange. Too bad actually. The title ran for several months with me in the savings plan. Now I have to look for something new, but the +20% is of course welcome.

What now? @Simpson

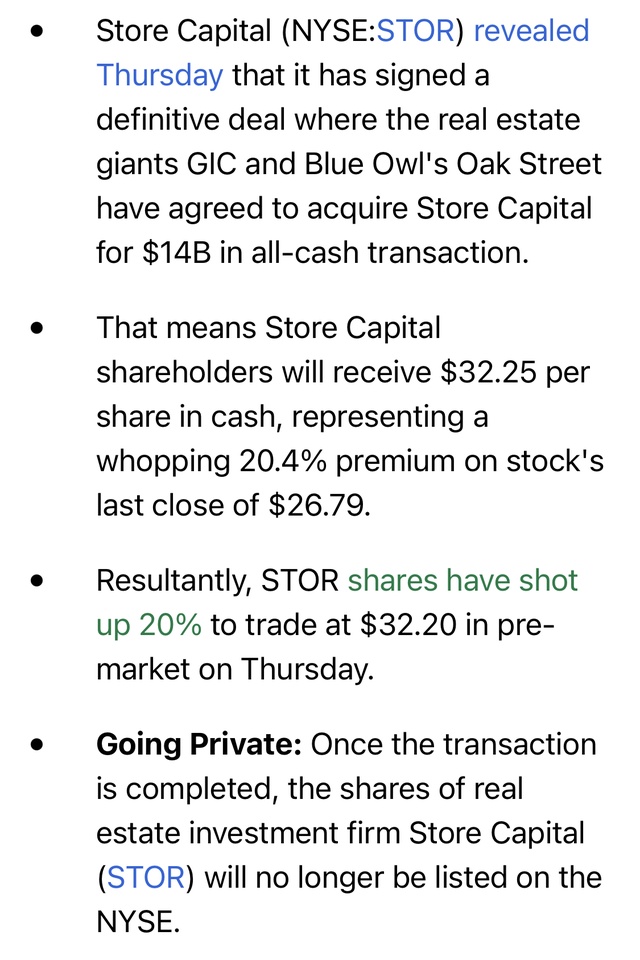

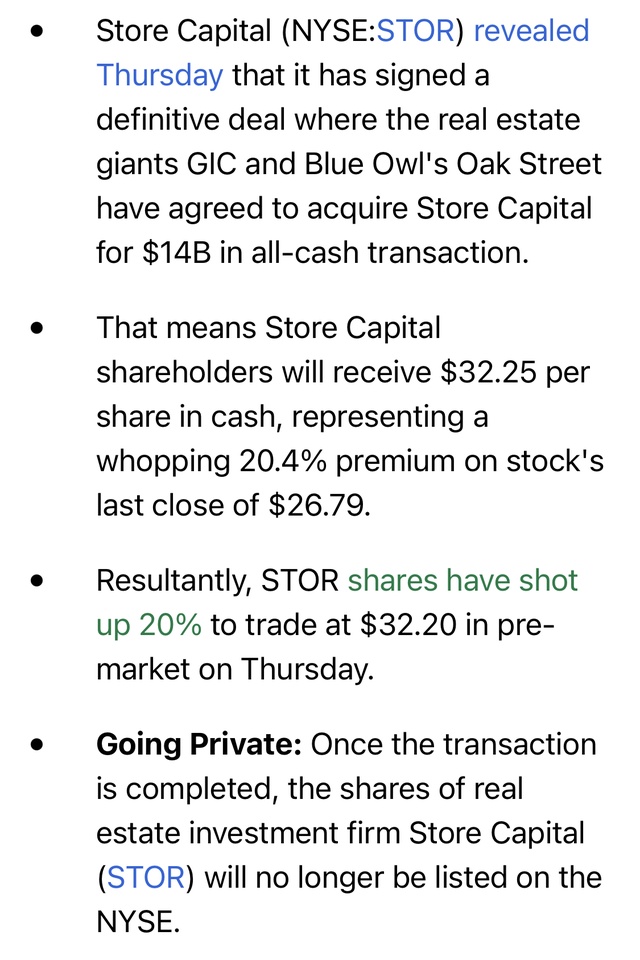

Screenshot: SeekingAlpha

Store is taken off the stock exchange. Too bad actually. The title ran for several months with me in the savings plan. Now I have to look for something new, but the +20% is of course welcome.

What now? @Simpson

Screenshot: SeekingAlpha